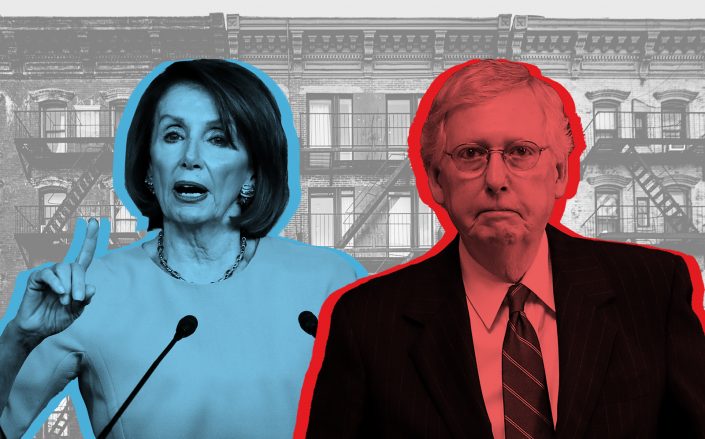

Speaker of the House Nancy Pelosi and Senate Majority Leader Mitch McConnell (Getty; iStock)

The proposed $900 billion federal relief package hands affordable housing developers a key win in the form of changes to a popular financing program.

The bill includes reforms to the Low-Income Housing Tax Credit program, which has financed more than 3 million housing units since its inception in 1986. Lawmakers proposed a floor rate of 4 percent, divorcing the program from borrowing rates set by the Treasury Department. The new floor rate would apply to projects that receive tax credits after Dec. 31.

As a result, the credits will be worth more, and potentially become more attractive to corporate investors, who receive a reduction on federal income taxes for 10 years based on the rate. Developers, who sell the tax credits to raise equity on projects have long called for changes to the program and were hopeful that Congress would adopt the floor rate.

“It means in New York City that a lot of projects are going to be made feasible,” said Rick Gropper, principal at Camber Property Group. “We’re talking about millions of dollars in additional funding.”

With interest rates low, and state and local governments short on cash, the LIHTC change could free up subsidies for projects as developers are able to raise more equity through tax credit sales.

An analysis by accounting firm Novogradac estimates that the change could finance 126,000 affordable apartments nationally by 2029. In New York alone, the change could generate 23,000 apartments in the next decade, according to the New York Housing Conference.

“Establishing a floor on the LIHTC 4 percent credit will encourage investment in affordable housing during economic downturns and increase production by making more developments financially feasible,” Jolie Milstein, president and CEO of the New York State Association for Affordable Housing, said in a statement. “In the coming months, we need every level of government to build upon this positive step and enact smart policies that stimulate the long-term production of affordable housing and keep struggling renters in their homes right now.”

Congressional leaders announced Sunday night that they had reached a stimulus deal, which also includes $25 billion in rent relief and extends federal eviction protections through Jan. 31. Lawmakers are expected to vote on the measure Monday night.