Trending

US hotel market had worst year since the Great Depression

NYC, Boston, Chicago and Hawaii saw biggest drops in revenue per available room

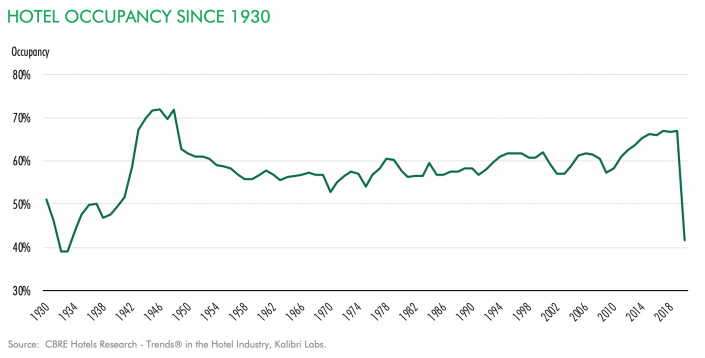

The coronavirus pandemic made 2020 the worst year for the U.S. hotel market since the Great Depression, when occupancy rates dipped below 40 percent. In 2020, the overall occupancy rate was 41.6 percent.

However, the impact varied significantly by geographic location and the type of hotel, according to a new report from CBRE Research.

New York City was the hardest-hit market of all, with revenue per available room (RevPAR) dropping 77 percent year-over-year. Other gateway cities like Boston, Chicago, San Francisco and Seattle, as well as air travel-dependent Hawaii, saw RevPAR declines of more than 70 percent.

A drastic drop in group demand, including business and convention-related travel, contributed to the decline, as did an 80 percent drop in inbound international travel to the U.S. amid ongoing travel restrictions.

“Demand cannot return to pre-Covid-19 levels without group demand returning,” the CBRE report notes.

Meanwhile, secondary markets like San Bernardino, CA and Jacksonville, FL saw more modest year-over-year declines, at around 26 percent and 38 percent, respectively.

“These less-dense markets benefited from their ability to better maintain social distancing and from their drive-to destination appeal,” CBRE analysts wrote.

In terms of hotel chain scale, the overall tendency was for higher-priced chains to see larger declines in room rates. But “luxury” properties, at the very top end of the market, were somewhat less impacted than “upper upscale” ones, according to CBRE data.

The type of hotel also played a role, with convention hotels unsurprisingly the hardest hit of all.

In terms of EBITDA, most hotels saw year-over-year declines of more than 100 percent — in other words, they lost money. But there were two exceptions.

“Only resort and extended-stay hotels generated earnings from operations in 2020, benefiting from their leisure orientation, likelihood for longer stays and individual kitchen facilities,” the report notes.

While hotel occupancy is now at a historic low, occupancy rates just before the pandemic had risen to a historic high of more than 65 percent — a level not seen since the 1940s, as the graph below shows.