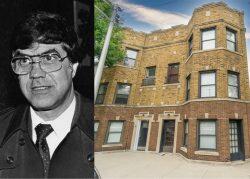

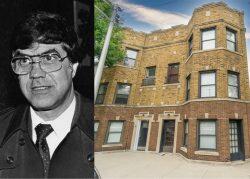

No clowning around: Joey Lombardo's Chicago home under contract

No clowning around: Joey Lombardo's Chicago home under contract

Trending

Developer 601W lands $830M refinancing for Old Post Office building

Mortgage loan is among largest ever for Chicago office building

A New York developer has landed one of Chicago’s largest-ever loans for a commercial office building.

A venture led by New York-based 601W took out a $830 million mortgage loan from JPMorgan Chase for the Old Post Office building at 433 W. Van Buren St., just west of the Loop, according to CoStar News and Crain’s. The loan is also tied to a 250,000-square-foot annex next door at 358 W. Harrison St. and a parking lot at 527 W. Clinton St.

The deal could be a sign of health for the commercial office market, which has been undercut by remote work throughout the pandemic. Chicago’s office vacancy rate stood at 17.9 percent at the end of the third quarter, the highest since 2013 yet slightly below the 20 percent peak in the aftermath of the 2008 financial crisis, JLL said. The city had 31,000 square feet of net absorption during the third quarter, ending a four-quarter streak of negative net absorption — periods where vacancies outpaced new leases.

The Old Post Office refinancing replaces $611 million in debt from 2019. 601W, which owns and manages some 45 million square feet of commercial property across the U.S., primarily office space, bought the 2.8 million-square-foot Old Post Office building for $130 million in 2016. The firm took out a $500 million construction loan from JPMorgan Chase and Blackstone in 2017, and put up about $250 million in equity to reposition the property and lease it.

Tenants include Cisco Systems, PepsiCo and Milwaukee Tool. The property, which was appraised in October 2020 at $914 million, is now valued at more than $2 billion, 601W says on its website.

601W didn’t respond to a request for comment.

Read more

No clowning around: Joey Lombardo's Chicago home under contract

No clowning around: Joey Lombardo's Chicago home under contract

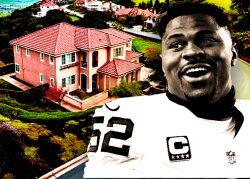

Chicago Bears star linebacker Khalil Mack’s East Bay home goes into contract

Chicago Bears star linebacker Khalil Mack’s East Bay home goes into contract