California’s Tides Equities seems to have its eye – and its money – set on a Texas takeover.

The L.A.-based investment firm added another multifamily property to its cache Friday, sealing a deal on the Clover on Park Lane apartments at 8780 Park Lane in Dallas’ VIckery Meadow neighborhood.

The seller was Travertine North Park Investors. Tides paid around $40 million for the apartment complex, according to a person familiar with the deal. Texas is one of 12 U.S. states where real estate sale prices are not made available to the public.

The property will be rebranded and renamed Tides on Park Lane. Tides specializes in renovating older multifamily residential complexes, upgrading and branding them in the process, and repositioning them as properties aimed at a middle-income market. Improvements include a number of identical elements—upgraded fixtures and finishes, slatted wooden fences and trim, white exterior walls, bocce courts and other common amenities—that make them recognizable as Tides properties.

Tides plans to spend about $8 million on renovating Tides on Park Lane. The 209,380-square-foot complex is on seven acres of land. It has 343 units: 17 studios, 244 one-bedrooms and 82 two-bedrooms. Tides worked with another company on the acquisition, according to the person familiar with the deal. That company financed 75 percent of the purchase with a debt fund execution loan. Tides paid the other 25 percent with cash.

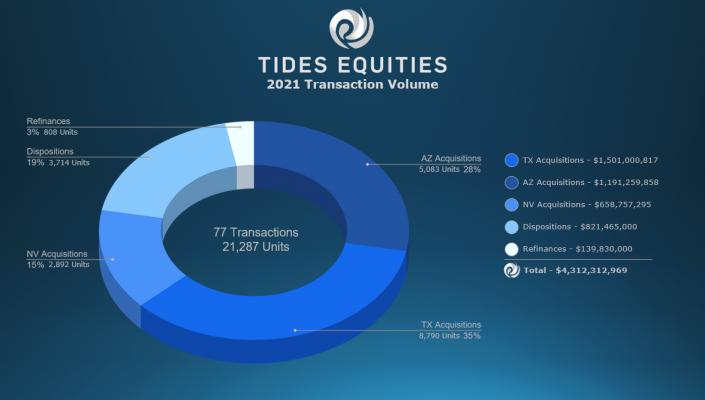

The sale signals the inroads Tides has made in Texas—particularly in Dallas, where it made 28 acquisitions with a total of 8,790 units, or $1.5 billion in acquisitions, in 2021. Over the past several years, Tides has been expanding a multifamily portfolio across the Western United States, mainly in Arizona, Texas, California and Nevada. Last year, it completed 77 transactions for more than $4.3 billion and 21,000 units in transaction volume across those markets, with $1.2 billion dollars worth of acquisitions in Phoenix, Arizona, and $650 million dollars worth of acquisitions in Las Vegas, Nevada.

Read more