New York investment firm Brixmor Property Group raised its bet on Chicago-area shopping centers, picking one up for $75 million and another right next to a mall that faced foreclosure last year.

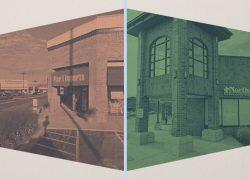

Brixmor bought the Elmhurst Crossing and North Riverside Plaza shopping centers from Montreal-based Federal Construction, the longtime owner of both properties.

Brixmor spent $75.1 million on Elmhurst Crossing, or about $216 per square foot for the Whole Foods-anchored property at the northwest corner of Route 83 and St. Charles Road, DuPage County records show.

The North Riverside property’s sale price hasn’t been posted in public records yet. Assuming the REIT paid an identical price per square foot as it did on Elmhurst, the North Riverside property would have cost $83 million, though it had more vacant space than the Elmhurst property at the time of the sale. Also potentially depressing the value is the property’s neighbor, the North Riverside Park Mall, which has been on the verge of foreclosure since last year. Brixmor’s recently purchased North Riverside property was mortgaged for $52 million in 2014, public records show.

The deals represent a move deeper into the Chicago market for Brixmor, which just purchased another Whole Foods-anchored retail strip called Ravinia Plaza in Orland Park, paying $26 million at $257 per square foot in February. It also is in the midst of a $21 million overhaul of Tinley Park Plaza in the southern suburb of Tinley Park that includes demolition of 87,000 square feet and building 66,000 square feet of new space.

The firm is leaning further into the market while grocery-anchored retail across the country is performing well. The asset class has been given a boost despite e-commerce making inroads during the pandemic.

In Chicago’s North Mayfair neighborhood, the Sterling Organization paid $18.2 million, or $208 per square feet in March to buy the Jewel Osco-anchored North Mayfair Commons from Canada’s Sun Life Assurance. Prices have moved up since December, when North American Real Estate paid $30 million, or $180 per square foot, for a suburban strip mall anchored by Jewel in suburban Glen Ellyn.

In addition to Whole Foods, Elmhurst Crossing is anchored by Kohl’s, At Home and Petco, with leases to restaurants Portillo’s and Chick-Fil-A as well as Bath & Body Works, Wells Fargo and Pure Hockey. It is fully leased except for a single vacant 2,400-square-foot unit, Brixmor said.

The North Riverside property is anchored by Kohl’s, Burlington, Best Buy, Petco, Michael’s and a new grocery under construction, with retail and dining leases to Chick-Fil-A, Chili’s and T-Mobile, as well. It has three vacant spaces totaling 25,000 square feet, Brixmor said.

Mid-America Real Estate brokers Ben Wineman and Kathryn Sugrue represented the seller.

Read more