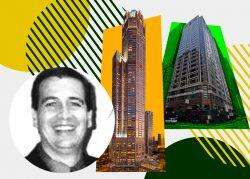

Howard Hughes Corp., had a profitable first quarter, thanks to the sale of its stake in Chicago’s 110 N Wacker Dr., the second-most-valuable skyscraper in the city.

Chicago real estate investor Tim Callahan and New York’s Oak Hill Advisors paid $210 million to Howard Hughes for a controlling stake in the 55-story tower. That values it at more than $1 billion.

It was among the largest transactions for an office building in Chicago, with Willis Tower as the only Chicago skyscraper with a higher valuation, at $1.3 billion when it was sold to Blackstone in 2015.

Before the sale, which closed in March, the tower was a $1.6 million loss for Howard Hughes in 2021, according to its first-quarter earnings call.

Howard Hughes CEO David O’Reilly said in a release that the tower was one of the last non-core assets the company had in its portfolio. The sale brought in $169 million — the company’s initial investment in the property was $13 million, according to Bisnow.

The 1.5 million-square-foot tower opened in 2020. It’s more than 82 percent leased to long-term tenants, according to Crain’s. Its anchor tenant is Bank of America, which leases more than 500,000 square feet and it has a 45-foot lobby, dining options and a secondary air-filtration system that was added after the pandemic. CBRE will oversee leasing and management of the property.

The sale comes at a precarious time for Chicago’s office market, a sector still slow to recover from the pandemic and a shift to remote work. It underscores demand for office properties with views and amenities, even as the pandemic turns longtime work practices topsy-turvy. Chicago office buildings that have updated amenities in popular locations like Fulton Market are finding new tenants relatively quickly, while older buildings are struggling.

[Bisnow] — Miranda Davis

Read more