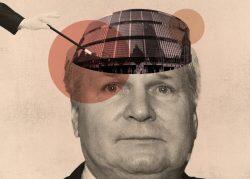

Chicago developer Michael Reschke is nearing a deal to buy a $191 million loan for two Loop towers at a discount, doubling down on his bet on a LaSalle Street revival.

Reschke, who earned the moniker “Harry Houdini” from Crain’s in 1999 for his ability to survive precarious financial situations in the city’s commercial real estate market, is trying to pull off another amazing escape. He’s eyeing more distressed Loop property after paying the state $70 million for the Thompson Center, the outlet reported. Reschke is leading what is likely to be an expensive makeover of the property.

His company Prime Group’s next purchase looks like it will be the loan attached to office buildings at 115 South LaSalle and 111 West Monroe Street, Crain’s reported, citing unidentified people familiar with the discussions. The buildings were longtime Chicago offices for BMO Harris Bank and law firm Chapman & Cutler, which lease about 900,000 square feet in the towers but are moving to the newly completed BMO Tower by Union Station.

Buying the loan, which has been marketed for sale for months, would give Reschke the chance to take over ownership of the 37-story LaSalle Street and 23-story Monroe Street building. If he follows through on the gamble, the move would mark another vote of confidence in the Loop and more specifically South LaSalle Street, which has been riddled with vacancies and was losing big-name tenants even before the pandemic slashed downtown office demand.

The sale of the two properties, totaling more than 1.5 million square feet combined, would probably amount to a financial haircut for Union Bank and the owner of the real estate, an affiliate of South Korea-based Samsung Life Insurance. The Samsung venture borrowed from Union to finance its 2015 acquisition of the BMO buildings for $314 million. Then in 2018, BMO announced it would leave for its new namesake tower, and Chapman & Cutler followed, pressuring Samsung into selling the loan or facing a likely foreclosure.

Purchasing the loan would probably lead to another pricey renovation project for Reschke, who would have lots of influence over the attempt to revive the struggling LaSalle corridor through the Central Loop. The former BMO property is not the only distressed building on the street. Next door, at 135 South LaSalle, building owner AmTrust Realty is negotiating a handoff of its deed to its lender after the property was vacated by Bank of America for its own namesake tower on Wacker Drive.

Investments into upgrading the amenities in LaSalle Street workplaces are likely on tap for Reschke, Crain’s reported, citing an unidentified person. To help foster the corridor’s rebound, urban planning experts have argued that officials should consider turning some of the offices into housing for students, offering tax incentives in the area, and closing down vehicle traffic on LaSalle to make a more retail and pedestrian-friendly environment.

CoStar News reported on Reschke’s interest in the $191 million loan earlier.

[Crain’s] – Sam Lounsberry

Read more