Mars Wrigley plans $40M research and development hub for Goose Island

Mars Wrigley plans $40M research and development hub for Goose Island

Trending

Chicago firm’s Goose Island purchase is biggest in $90M spending spree

Four-year-old company landed $74 million of loans for three suburban industrial projects, and is planning Chicago’s first multi-story warehouse on West Division site

A four-year-old local firm closed its biggest purchase of a $90 million spending spree in Chicago and its suburbs, among the nation’s hottest industrial real estate markets.

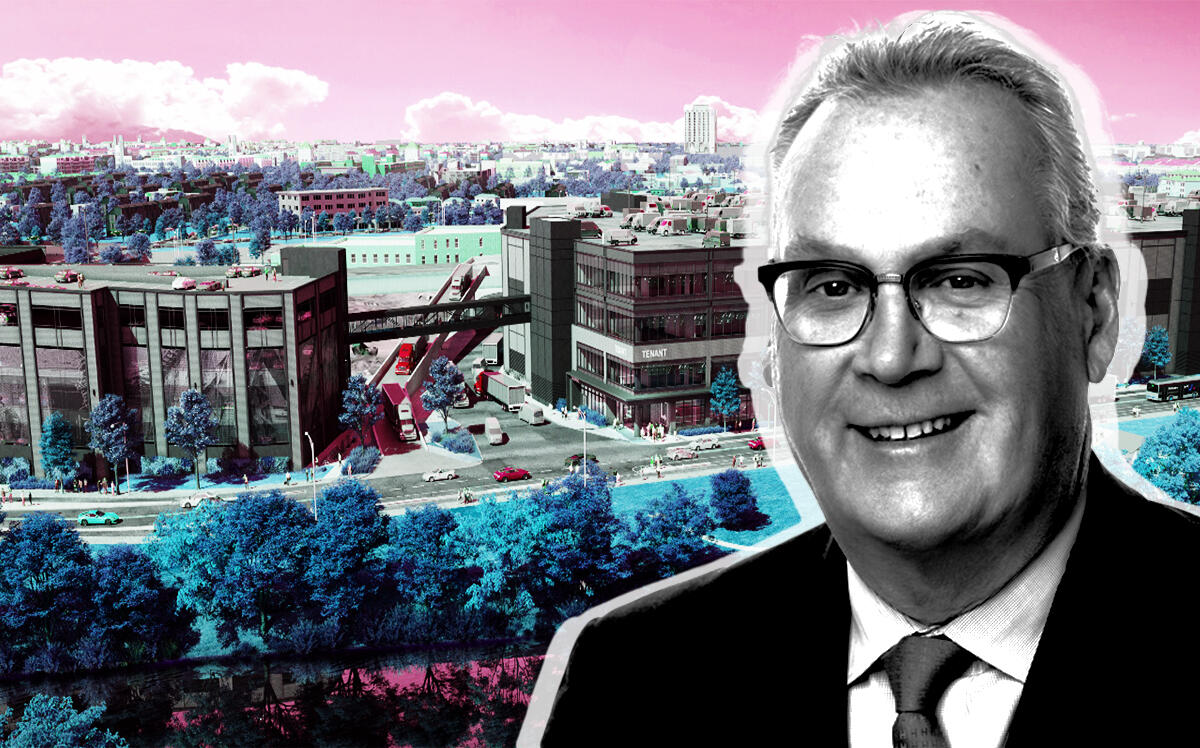

Logistics Property, founded by veteran warehouse developer James Martell and other former Ridge Development leaders, paid $55 million for a site at 1237 West Division Street on Goose Island, adding to three previous purchases that cost it $35 million in five months.

“We’ve had some good luck recently with our land acquisitions, and it’s a reflection of having a strong capital source and expertise so that brokers believe in our ability to execute,” Aaron Martell, the founder’s son, said in an interview.

The company plans to build the city’s first two-story warehouse, totaling 600,000 square feet, on the Goose Island property. Logistics bought it from People’s Gas Light & Coke, which had a production facility on the site.

As demand for warehouses outweighs supply, the four purchases add almost 1.7 million square feet of sorely needed space to the local development pipeline.

Chicago had a record pace of leasing activity in spec industrial properties in the first quarter. Some 9.3 million square feet was absorbed, breaking the previous quarter’s record 7 million square feet and pushing up rents, according to Collier’s.

While 53 projects totaling 18.1 million square feet were under construction at the end of the first quarter, demand is still outpacing the rate of construction, meaning new developments are likely to lease quickly. “No one with industrial experience over the last 30 years would have predicted this environment for demand,” Martell said.

Rising material costs and interest rates pose a threat to the advanage new developments hold over existing parcels, he said. Amazon, a major consumer of industrial real estate, has also pulled back on real estate spending after doubling its space across the nation during the pandemic.

Yet vacancies are still near record lows, stoking potential demand, Martell said.

Construction is about to start on his company’s three suburban Chicago parcels. Logistics paid the Catholic Church $17 million for a 29-acre site at Algonquin Road and College Drive in Palatine, where a 368,000-square-foot facility will be built. In March, it bought two properties in DuPage County near the Interstate 88 and Route 59 interchange for $10.5 million and $7 million.

In the last month, the firm obtained $74 million in three separate loans to finance construction on those three properties. It hasn’t yet acquired a loan for the Goose Island site.

Goose Island has attracted several other big investments lately for development sites and commercial buildings. Hines this year paid $47 million for a fully occupied office building and Mars Wrigley is planning a $40 million research and development facility. Residential developer Onni Group has eyed the neighborhood for multifamily projects, as well.

Read more

Mars Wrigley plans $40M research and development hub for Goose Island

Mars Wrigley plans $40M research and development hub for Goose Island

Hines under contract to buy Goose Island office building

Hines under contract to buy Goose Island office building

Amazon binge ends in hangover, halt on warehouse deals amid $4B loss

Amazon binge ends in hangover, halt on warehouse deals amid $4B loss