Acadia Realty Trust is on the verge of feeling more pain on Chicago’s Magnificent Mile.

Swedish retailer H&M is hunting for a smaller space to move into from its four-story, 60,000-square-foot store at 840 North Michigan Avenue, an Acadia-owned building that the tenant has occupied for almost two decades, Crain’s reported.

If the apparel company goes through with the downsizing and relocation, the city’s most famous shopping strip will add more empty storefronts to a retail vacancy rate that stands at almost a quarter of its total space. H&M is seeking about half the square footage it rents from Acadia.

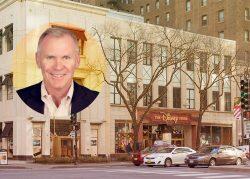

The landlord’s trouble on the Mag Mile extends beyond H&M’s potential exit from the 87,100-square-foot property in which Acadia bought an 88 percent stake for $144 million in 2014. Last year, Acadia faced a completely empty building after the departure of the Disney Store from a 61,600-square-foot building at 717 North Michigan Ave. for which Acadia paid $104 million in 2017.

Acadia isn’t the only Mag Mile property facing distress. Water Tower Place was handed back to its lender by Brookfield. Macerich sold its 50 percent stake in The Shops at North Bridge building this year for $21 million, a fraction of the $515 million that it and partner Alaska Permanent Fund paid in 2008. Another landlord, Irish investment firm ECA Capital, is working to avoid default on a $55.5 million mortgage against two adjacent storefronts after Gap left one last year and their combined vacancy rate spiked to 74 percent.

Aside from the pandemic cutting downtown foot traffic, a string of brazen smash-and-grab robberies of luxury retail businesses and a rise in crimes visible from sidewalks and storefronts in Chicago has contributed to the softening market.

Signs of a bounceback on the Mag Mile have started to emerge. The space vacated by the Disney Store has been filled by a 11,400-square-foot lease to candy store chain It’Sugar. And the fact that H&M doesn’t plan to leave the Mag Mile altogether – as Gap and Macy’s did during the pandemic – is a consolation.

There’s still demand to own property on the strip, as evidenced by last month’s Silvestri Investments purchase of the flagship Neiman Marcus store for $94 million, a deal that retail broker Greg Kirsch of Cushman & Wakefield said showed the market where stability lies as landlords face disparate debt situations with their buildings.

That’s been cited as an obstacle to implementing a cohesive strategy on the Mag Mile by a panel of experts convened by the Urban Land Institute. They’ve suggested that boutique-type stores and brands unique to Chicago could become tenants beside small-scale luxury stores between the Drake Hotel and 875 North Michigan Ave., formerly the John Hancock Center, which is across the street from Acadia’s H&M building.

[Crain’s] — Sam Lounsberry

Read more