An affiliate of Chicago’s Belgravia Group cashed out of a suburban retail parcel it flipped for $19 million, almost double what it spent for the property during the darkest days of the pandemic.

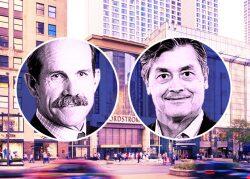

The 130,000-square-foot retail building leased to the PGA Superstore golf merchandiser, which has more than half the space, and the gym XSport Fitness was bought by a local investor registered to a Naperville home who made an unsolicited offer, according to the sellers. They consisted of entities controlled by Savas Er of North American Real Estate and Lakeview Inc., an affiliate of Belgravia.

They formed a venture that bought the building for $11 million in December 2020 when neither tenant was operating, keeping the doors shut as the pandemic built toward a midwinter peak. An attempt to reach the buyer wasn’t successful.

“Both tenant spaces were dark when we bought,” Er said. “The tenants had short-term leases, and it was in the middle of the pandemic. We believed the location was prime and perfect. We extended the leases with both tenants and created the value.”

The lease extensions and 72 percent profit margin for the property’s sellers demonstrate the faster pace of the suburban retail market’s recovery from the pandemic than some high-profile inner-city corridors.

Shopping strips in Chicago such as the Magnificent Mile and storefronts on State Street are suffering from high vacancies, and Michigan Avenue retail parcels have traded this year at big losses from valuations achieved last decade.

Yet demand for retail real estate in the Chicago area remains strong, as shown by the highest volume of retail deals for $1 million or more in any year since at least 2000 for the 12 month period ending in March, at about 830, according to brokerage Marcus & Millichap.

“Major suburbs are doing really well,” Savas said. “Chicago in the Mag Mile and State Street are unfortunately not there yet.”

Investors are unlikely to best that this year as rising interest rates slow economic activity.

“There will be some kind of a pause for a little bit,” Savas said. “But any smart investor I think would have known that.”

Read more