Call it real estate gymnastics: Sellers of Chicago-area industrial assets are flipping properties and stretching their money as the sector’s strong performance rolls into the fall.

Some of the most notable industrial deals this year involved sellers who more than doubled their investments compared to prices they paid in the last decade for the warehouses, truck yards, data centers and vacant land soon to be developed. Values of these asset classes have soared, fueled by consumers’ growing reliance on e-commerce and a short supply leading to competition for space among tenants.

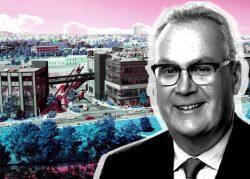

“The one thing that the pandemic did was transition the U.S. economy from a services economy to a goods and services economy,” said Jack Brennan, a CBRE broker and relative of Michael Brennan, whose firm tops the list with deals that quadrupled its investment in an Elk Grove business park. “The need to store all these products in warehouse space grew substantially.”

Here are four sellers whose properties more than doubled in value with a sale this year from the time they were last bought, plus a fifth that was the Chicago-area’s largest industrial deal so far this year. All the reports come from public property records.

Windows of opportunity

Software giant Microsoft played a big role in quadrupling a $39 million bet that Brennan Investment Group made in 2017 on 85 acres of land in Elk Grove. Brennan developed a new industrial park and subsequently sold the land in deals totaling $180 million. In 2020, Brennan sold 36 acres to Microsoft for $52.5 million and the tech giant built a big data center. Around the same time, T5 Data Centers paid $29 million for property in the park that held a building shell that Brennan developed that was turned into a separate data center. Then this spring, LBA Realty paid Brennan $99 million for three parcels on Innovation Drive that held three fully leased industrial buildings Brennan had built, accounting for $180 million. It’s unclear what Brennan spent to build T5’s building shell and warehouses bought by LBA.

Top of the market

Top-Line Furniture’s transition from an owner to a renter of its Itasca warehouse this month also more than quadrupled its value. The firm bought the property holding a 252,000-square-foot warehouse for $8.1 million in 2012, then sold it this month to Massachusetts’ High Street Logistics Properties for $36 million. Top-Line entered a long-term lease with High Street as part of the deal, which was stuck even as buyers and sellers realign pricing expectations that had been disjointed by this year’s interest rate hikes.

Truckloads of money

Timber Hill’s Cary Goldman opted to stop developing buildings to instead focus on industrial service facilities such as truck yards — vacant land with some truck refueling infrastructure meant to store heavy-duty vehicles. It’s paying off: Goldman’s Chicago-based firm this month sold a mostly vacant site near O’Hare International Airport at 2050 North Mannheim Road to the trucking company Penske for $15.4 million. Timber Hill bought the property for $3.2 million in 2017, almost quintupling its investment with the deal.

Scouting deals

Dominic Sergi’s local firm Clear Height Properties has flipped multiple properties this year for more than twice what it paid for them just before and in the early months of the health crisis. One of its largest such sales was to Miami’s Scout Capital Partners for $28 million, when the buyer picked up a 100,000-square-foot Elk Grove Village building fully leased to Brett Anthony Foods. Clear Height bought the property from Brett Anthony for a little more than $6 million in 2020 and then completed an 18-month improvement project adding a connector building between what had been two separate structures at 1250 and 1350 Greenleaf Avenue.

Whirlpools of profit

Chicago industrial investor Nuveen cashed out of a massive warehouse used by Whirlpool as a distribution center this month in Joliet, selling it to a Bank of America venture for more than $104 million. The deal amounted to a 46 percent increase from the $71.5 million Nuveen spent on the 1 million-square-foot facility at 3851 Youngs Road in 2018.

Read more