Trending

Lichtenstein’s Lightstone drops $64M on pair of deals

Firm buys up a combined 550,000 square feet

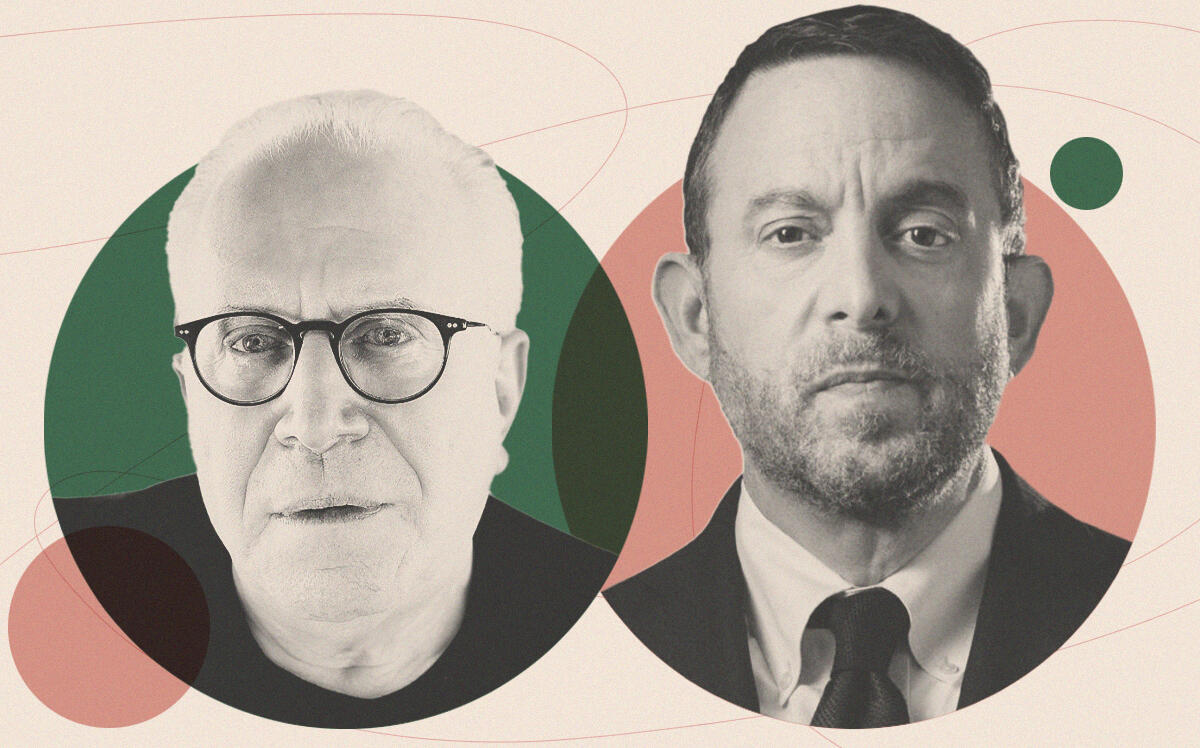

Billionaire investor David Lichtenstein’s firm Lightstone Group dropped $64 million on two Chicago-area lab and distribution facilities totaling 550,000 square feet as the company expands its industrial holdings with a focus on the Midwest.

In the pricier of the two deals, Lightstone paid about $35 million for the 226,000-square-foot lab and warehouse center at 990 and 1000 Deerfield Parkway, according to a source familiar with the deal. It’s fully leased to technology firm Siemens, which has occupied the site since 1987 and employs more than 800 engineers and manufacturing workers, Lightstone said in a statement.

The sellers were LLCs affiliated with Chicago-based firms that each held an interest in the property, Clark Street Real Estate and HSA Commercial Real Estate. Clark first acquired the property in 2003, but the price it paid at the time was unclear from public records. The property’s location in Lake County puts it alongside Fortune 500 companies and others in the healthcare, insurance and financial services industries.

New York-based Lightstone’s most recent Chicago-area purchase and the larger property of its two was in Broadview, about 12 miles west of downtown, for about $29 million. The deal for the 332,000-square-foot warehouse more than doubled the site’s value from the $13 million the seller, suburban Chicago-based TradeLane Properties, paid three years ago, public records show.

TradeLane didn’t return a request for comment.

Lightstone isn’t done buying in Chicago’s supply-constrained industrial sector. With the vacancy rate for area industrial buildings of 200,000 square feet or larger under 3 percent as of last quarter, and rent prices trending upward with such a short supply, the company will “continue to aggressively pursue strategic investment opportunities in Chicago and our other target Midwest markets,” Lightstone President Mitchell Hochberg said in a statement.

Developers have reacted to the tight market, though, putting a record amount of projects in the pipeline earlier this year. As a result, tenants were able to slow down and consider more options as they competed for the little available real estate.

The vacancy rate in large Chicago-area industrial buildings rose for the first time in nearly two years last quarter, and Amazon canceled plans for multiple large warehouses after admitting it overextended during the pandemic.

Still, even with the slight rise in vacancy from the market’s all-time-low of 2.6 percent earlier this year, the market remains in favor of landlords for now, brokers have said.

“The supply side is starting to catch up,” Colliers broker Matthew Stauber said last month. “Instead of having five bidders for every space, now it’s down to two or three.”

With the acquisitions, Lightstone’s industrial portfolio has grown to more than 6.5 million

square feet of space in 15 markets across the country, including Chicago and Dallas.

Read more