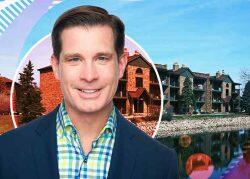

Sam “Simcha” Applegrad picked up an apartment complex in the northwest Chicago suburbs for $80 million, adding to the streak of multifamily trades in the area as deal volume for other commercial real estate assets dives while rising interest rates wedge pricing gaps between buyers and sellers.

It marks a big cash out for Friedkin Property Group, which paid $47 million for the property nearly a decade ago and in the meantime took more cash out of the property through a loan it obtained against it during ownership.

Several LLCs affiliated with Applegrad’s New York-based firm YMY Acquisitions are listed as the buyer of the 396-unit, three-story Fieldpointe of Schaumburg apartments at 1708 Arbor Square in a deal executed Dec. 16 and documented late last month in Cook County records.

Friedkin, which is helmed by Morton Friedkin, bought the 12-building complex in 2014, part of the firm’s Chicago-area shopping spree that was under way at the time.

Its sale also included a creative financing arrangement. Friedkin took out a $49 million mortgage on the property in 2020, and the buyer took over the loan for the remaining balance. YMY declined to comment on the sale. Friedkin did not respond to requests for comment.

Losses on apartment plays in the Chicago area have been rare, however, in the last several years, even as occupancy at suburban multifamily properties dipped a bit in the past year. They were still nearly fully leased, though, at 97.5 percent occupied in the third quarter last year, down from a rate of 98 percent and higher in the past year, according to the most recent data from Integra Realty Resources. The average suburban net effective rent was steady throughout last year, ending the third quarter at $1.92 per square foot, Integra said.

The complex includes studio, one-bedroom and two-bedroom apartments. One bedroom apartments lease starting at $1,557 a month, with the price going up to $1,910 a month for a two-bedroom unit. The property was built in the 1970s and renovated in 2008.

Friedkin still owns several Chicago-area residential and mixed-use properties in the city and in the suburbs of Naperville, Elk Grove Village, Aurora and Evanston, according to the firm’s website.

Other large multifamily assets that have traded hands in the Chicago suburbs in recent months are the 586-unit Stonebridge Village Apartments in Arlington Heights for a price that came to about $224,000 per unit in January and a 236-unit complex in Buffalo Grove that DRA Advisors bought for $53 million in December.

This story has been updated to correct the price of Applegrad’s purchase after it was confirmed the buyer assumed an existing mortgage.

Read more