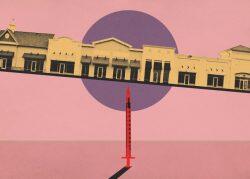

A second lease involving Sterling Bay’s sprawling River North office building at 600 West Chicago Avenue has become the subject of a lawsuit.

The food services company that operates the building’s retail tenant Farehouse Market — which sells meals, coffee, cocktails and take-home foods and liquor — has requested a payment of more than $515,000 from Sterling Bay for leaving its lease seven years early.

Farehouse, operated by Nicholas Saccaro’s Lombard-based Quest Food Management Services, decided to make an early exit due to lackluster sales at the property that the tenant blamed on the “vast reduction” of office workers at the building since the pandemic began, it said in its lawsuit filed in Cook County court earlier this month.

The fight is emblematic of difficult discussions between downtown Chicago retailers dependent on foot traffic brought by large crowds of office workers and commercial building owners whose tenants are downsizing their real estate footprints and continuing to allow many employees to work from home.

“This story is one being experienced throughout areas of Chicago that relied on office density,” said John Vance, a retail broker with Stone Real Estate who’s not involved in the lawsuit or the lease in dispute. “What retailers need are people to return to the office in a significant and consistent manner so they can project how much revenue they can generate.”

That hasn’t happened in downtown Chicago. Only between 20 and 50 percent of pre-pandemic worker attendance has been restored at the 1.7-million-square-foot Sterling Bay property, depending on the day of the week, and it hasn’t increased since last summer, the suit claims. Quest is asking to be reimbursed for tenant improvement costs it put toward building out its space that it says it’s entitled to for exercising an early lease termination.

The termination is allowed in the third year of the 10-year lease that was originally scheduled to end in 2030 if the tenant didn’t achieve $2.5 million of average annual sales in the deal’s first three years.

Sterling Bay CEO Andy Gloor disputed that his company is on the hook for such a payout to Farehouse in a February 27 letter to the tenant, claiming Quest doesn’t have a right to pull Farehouse out of the building until 2024 and that the parties can’t know if average yearly gross sales will hit the $2.5 million mark until then. He also pointed out Sterling Bay paid the retailer $430,000 between June 2020 and September to contribute to its operating costs and abated $142,000 in rent the landlord could have collected.

“Since tenant opened for business in the premises, the only revenues the landlord has received are less than $30,000 in the aggregate since January 2020,” Gloor said. He also said Sterling Bay would need more evidence of how the tenant calculated the fee it’s owed from the landlord in the event of an early lease termination, should Farehouse still decide to leave next year.

Quest said it calculated the money it says it’s owed using the formula provided in the lease that says it will be given a portion of the costs it put into tenant improvement construction for its space in the building.

Even with Sterling Bay’s help through the pandemic, Quest claims the Farehouse venture has lost $500,000 since it opened. It tried to renegotiate a new arrangement for Sterling Bay for five months, but Sterling Bay refused to agree to a new deal, the suit says.

Saccaro, Quest’s president, declined to comment, and his company’s attorney didn’t return a request for comment. Sterling Bay declined to comment. The landlord bought the building for $510 million in 2018.

It’s at least the second legal dispute involving the building — which is the home of Groupon’s headquarters — getting hashed out in court right now. In January, Groupon sued Uptake Technologies, claiming Uptake owes it $1.5 million in rent. Uptake subleased space in the building that Groupon had shed by putting it on the secondary market.

Litigation over that clash is still moving through Cook County court.

Read more