Trending

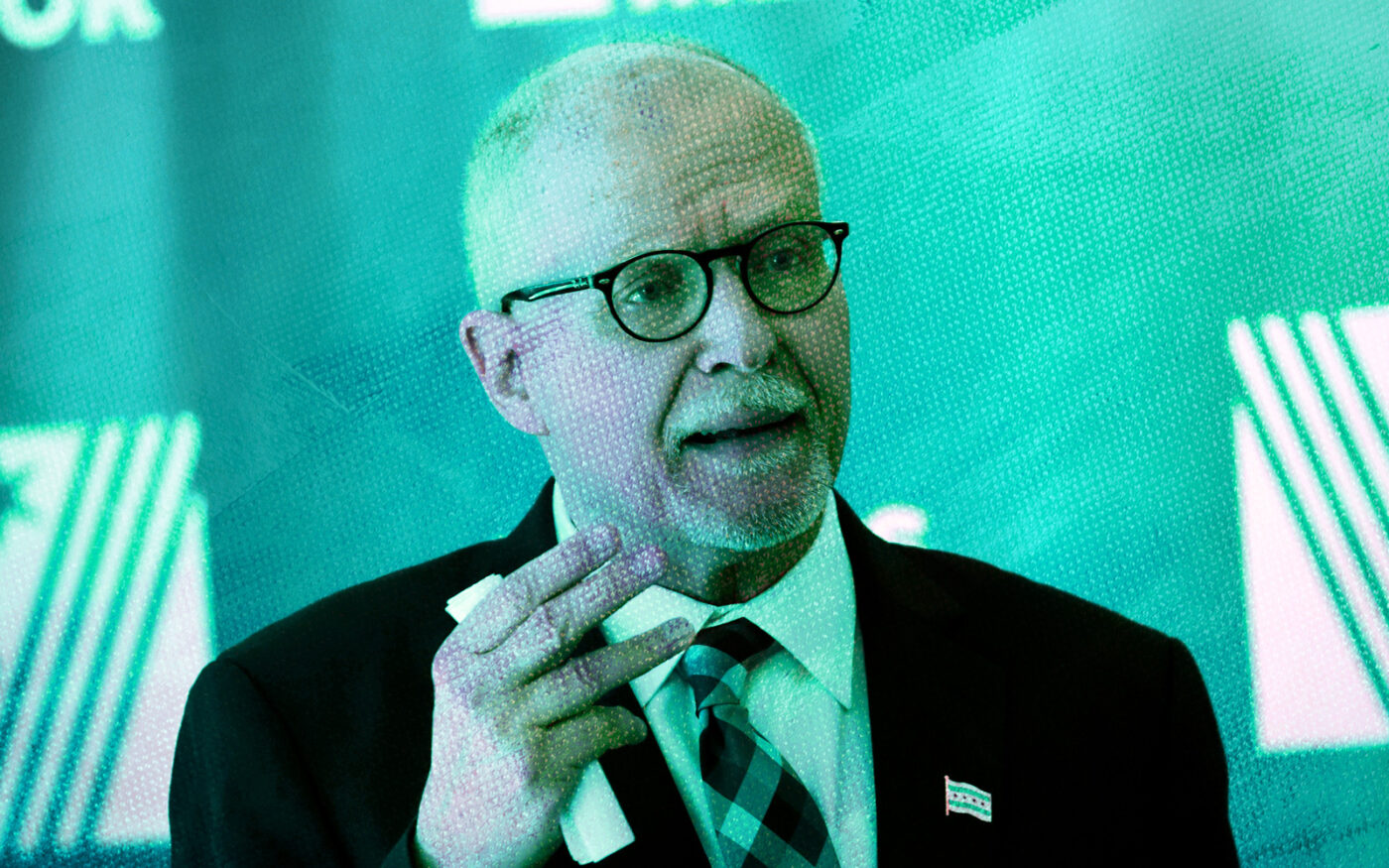

Vallas nets more CRE industry support

Landlord, hotel industry groups criticize Johnson in Chicago runoff

Real estate trade groups spoke up Monday as early voting started in Chicago’s April 4 mayoral runoff to throw their support behind Paul Vallas — and the industry piled on a fresh helping of criticism for his opponent Brandon Johnson.

The Chicagoland Apartment Association and the Illinois Hotel & Lodging Association endorsed Vallas, as did the Chicagoland Chamber of Commerce, the Illinois Manufacturer’s Association and the Illinois Retail Merchants Association. They also attacked Johnson’s plans, claiming the Cook County Commissioner’s proposals to fund additional social services with tax increases would drive business out of Chicago and deter real estate investment.

“He would increase taxes on hotels and motels that are still struggling to get through the pandemic, reinstate the employee head tax which charges businesses for each job their create within the city, increase taxes on real estate transactions, which would stifle affordable housing development and much more,” the groups said of Johnson in a joint statement.

The endorsement adds to the support Vallas, a former Chicago Public Schools CEO, has already received from the real estate industry, including from the developers and brokers who have contributed to his campaign and from players who see him as more sympathetic to the needs of the real estate industry.

Johnson’s campaign did not respond to a request for comment on the endorsement, though in recent days has gained the support of the Rev. Jesse Jackson and U.S. Sen. Bernie Sanders, whose political action organization, Our Revolution, sent emails over the weekend to the former presidential contender’s donor list soliciting campaign funding for Johnson’s run.

Johnson’s $800 million tax plan includes a “mansion tax” that would raise the amount of real estate transfer tax paid on sales of commercial or residential property for $1 million or more to 2.65 percent from 0.75 percent. It also includes a so-called “head tax” on businesses whose employees commute from the suburbs, and increasing the Chicago Hotel Accommodations Tax to raise an additional $30 million for the city, up from $116 million taxes on hotels raised last year, a figure that includes state and county taxes, as well, according to the hotel industry group.

Vallas’ policies on the development of affordable and market rate housing are also more in line with the Chicagoland Apartment Association’s stances, group executive Michael Mini said.

“We think the city council should view development of housing and trying to make it easier to develop and build housing as opposed to making it more difficult by enacting tax increases and other regulations that are going to impede development of building more housing, which we believe is the only way that we’re going to work our way out of the affordable housing challenge,” he said.

Vallas’ opposition to and Johnson’s support of rent control measures is also a key issue for the group.

“Rent control is a very, very serious concern of ours. There are efforts in the Illinois General Assembly to overturn the Illinois Rent Control Preemption Act and we are fighting that effort and have been for the last several years,” Mini said of the rule that prohibits municipal governments from enacting rent control.

Mini also flagged Johnson’s support of the Just Housing ordinance in Cook County, which restricts property owners from doing background checks on residents.

“While we certainly support housing past offenders and working with them, those kinds of restrictions just make it more difficult for housing providers to do their jobs,” he said.

Chicago’s 17.4 percent hotel tax — which includes state and other taxes that wouldn’t be impacted by Johnson’s proposal — is already one of the highest in the country, and increasing it would discourage meeting planners from holding conventions in the city, Illinois Hotel & Lodging Association CEO Michael Jacobson said.

“It would just put us at a greater competitive disadvantage with other cities for our convention business,” he said.

The state organization and the American Hotel & Lodging Association have supported Vallas’ campaign with donations of $25,000 apiece, Jacobson said.

Chicagoland Chamber of Commerce CEO Jack Lavin said all aspects of Johnson’s tax plan add up to an “unwelcome” sign for businesses, especially when the city already has high property taxes and is recovering from a pandemic.

Lavin added that he views Vallas’ policies as more effective in encouraging employees to return to offices, particularly his safety plan for Chicago Transit Authority trains and buses.