Impact of “mansion tax” magnified as Chicago hits polls

While advertised as tax on a limited pool of wealthy homeowners, CRE sales would fund substantial portion of Johnson-backed proposal

A proposal to more than triple Chicago’s real estate transfer tax backed by Brandon Johnson is often referred to as the mansion tax — but it would hit much more than just high-end homes.

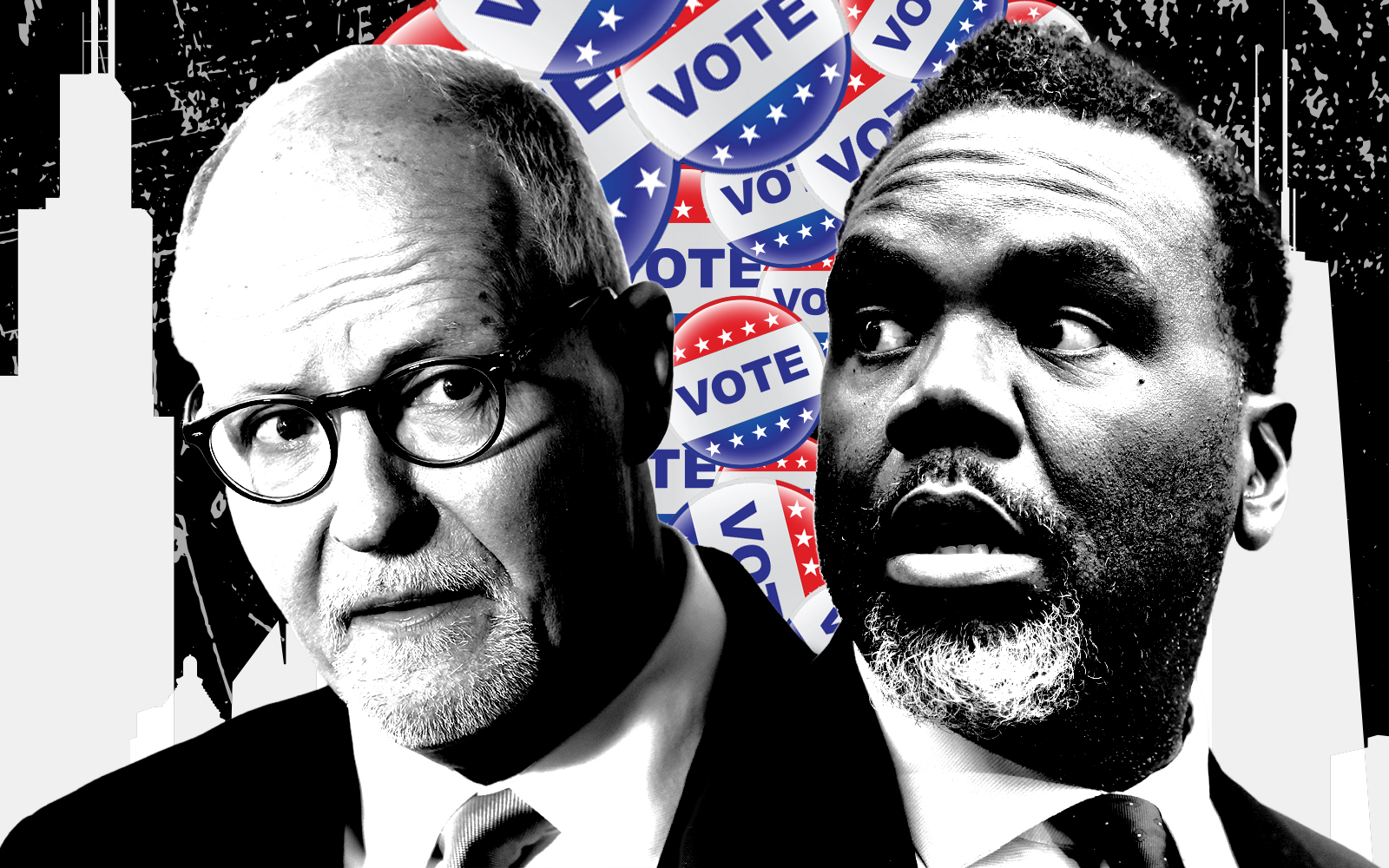

While the tax hike itself isn’t on the ballot, Johnson’s support of it and Paul Vallas’ opposition have renewed real estate players railing against the idea as the mayoral runoff enters its final hours, with polls set to close at 7 p.m Tuesday.

Some have narrowed in on the fact it would hammer not only luxe pads in Lincoln Park and penthouses in condo towers, but commercial real estate, too, including relatively small industrial and multifamily buildings along with office and apartment high rises.

The proposal would increase the city’s current real estate transfer tax from 0.75 percent to 2.6 percent of a purchase price and earmark the increase to fund services to combat homelessness — and come on top of transfer taxes imposed by Cook County and the state.

Advocates behind the proposal, a coalition known as Bring Chicago Home, say it would generate an additional $163 million annually, based on the average yearly revenues from transfer taxes from the last 10 years, according to Doug Schenkelberg, Executive Director of Chicago Coalition for the Homeless, one of the organizations behind Bring Chicago Home.

Read more

That figure includes sales of both residential and commercial assets, according to the group. And it’s clear a substantial portion of the new tax proposal, if imposed, would be derived from commercial property even as it’s been advertised as a tax on a limited pool of wealthy homeowners.

While Bring Chicago Home hasn’t provided a breakdown of the total amount of tax that would be extracted from commercial versus residential sales, The Real Deal conducted an analysis of all deed transfers within Chicago from March 1, 2022 through last month and found large commercial properties would account about 20 percent of the new revenue. The analysis showed, without carving out exemptions to real estate transfer taxes, the tax hike would have added roughly $170 million into city coffers during the time period, on par with Bring Chicago Home’s estimate.

Of the nearly 3,000 real estate deals for $1 million or more recorded during the period, the priciest 50 — all commercial properties ranging from $170 million to $18.5 million — would have accounted for about 20 percent of the additional tax revenue. Commercial real estate’s total tab would be substantially more than that under the proposal, considering the smaller and less expensive retail, industrial and office properties sold for between $1 million and $18.5 million.

Outside of explaining its data analysis, Bring Chicago Home hasn’t fulfilled requests for an interview on why the proposal has been designed to tax commercial property in addition to high-end homes. Johnson’s campaign didn’t return requests for comment.

It’s unclear whether the tax could stifle an already struggling commercial real estate market, especially as interest rates continue to climb and both attendance and leasing at downtown office buildings stays muted compared to pre-pandemic norms.

The measure is similar to one in Los Angeles, where the impact on commercial assets of a new tax hike on properties traded for $5 million or more was overlooked before getting approved by voters last year, sending market players scrambling to complete deals before the law took effect this month.

It remains to be seen whether the proposal has the support needed in city council should Johnson win, while a Vallas victory would slim its chances of becoming law.