The family that owns a popular tequila brand just showcased some liquid courage by buying a Wacker Drive office tower despite a struggling commercial real estate market in downtown Chicago.

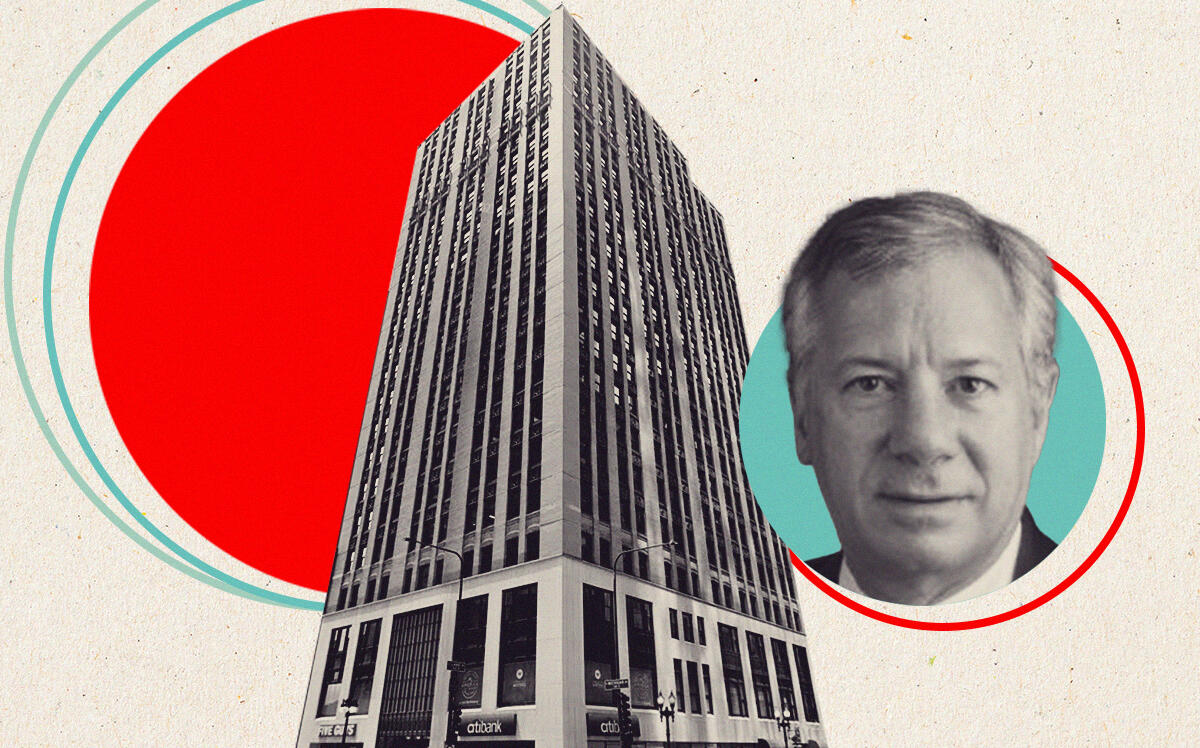

Miami-based Agave Holdings, which serves as the real estate investment firm of Jose Cuervo’s Beckmann family, is acquiring the 35-story, 535,000-square-foot building at 300 South Wacker Drive from the joint venture of Chicago-based Golub and Boston-based Alcion Ventures, Crain’s reported.

Terms of the deal have not yet been disclosed, but it’s valued at around $96.5 million, a person familiar with the deal told the outlet.

It will likely deal a painful blow to Golub and Alcion, whose venture paid $155 million for the asset in 2017, plus put an extra $10 million into renovations. The sale affirms values of downtown office towers are plummeting, as the sector has yet to rebound from remote-work trends set in motion by the pandemic.

The price is close to the same amount as the debt tied to the building. The mortgage is held by lender Deutsche Bank, which is providing new financing to Agave as part of the agreement.

The move allowed Golub and Alcion to get a deal done without risking foreclosure or making prolonged debt payments. Rather than trying to land a buyer who might struggle to attain adequate financing, Deutsche Bank simply provided a new loan, expediting the sale process while also reclaiming most or all of the mortgage. This type of arrangement usually leads to lower interest rates as well, allowing buyers to pay more.

Read more

The Wacker Drive building is currently 75 percent leased, slightly less than the city average of 78 percent. Its largest tenant is law firm McDonnell Boehnen Hulbert & Berghoff, which has 53,000 square feet at the site.

Buying any office tower is a risk in today’s market, but the property is in close proximity to recently upgraded or newly built office towers like Old Post Office, Willis Tower and BMO Tower. Willis Tower last year unveiled a $500 million renovation, while BMO Tower only recently opened. Such buildings are generally performing better than older, outdated ones, as they’re more likely to lure employees back to the office with fresh amenities.

— Quinn Donoghue