A Loop apartment tower just sold for far less than when it last changed hands, reflecting the sluggish market’s ripple effect on falling prices.

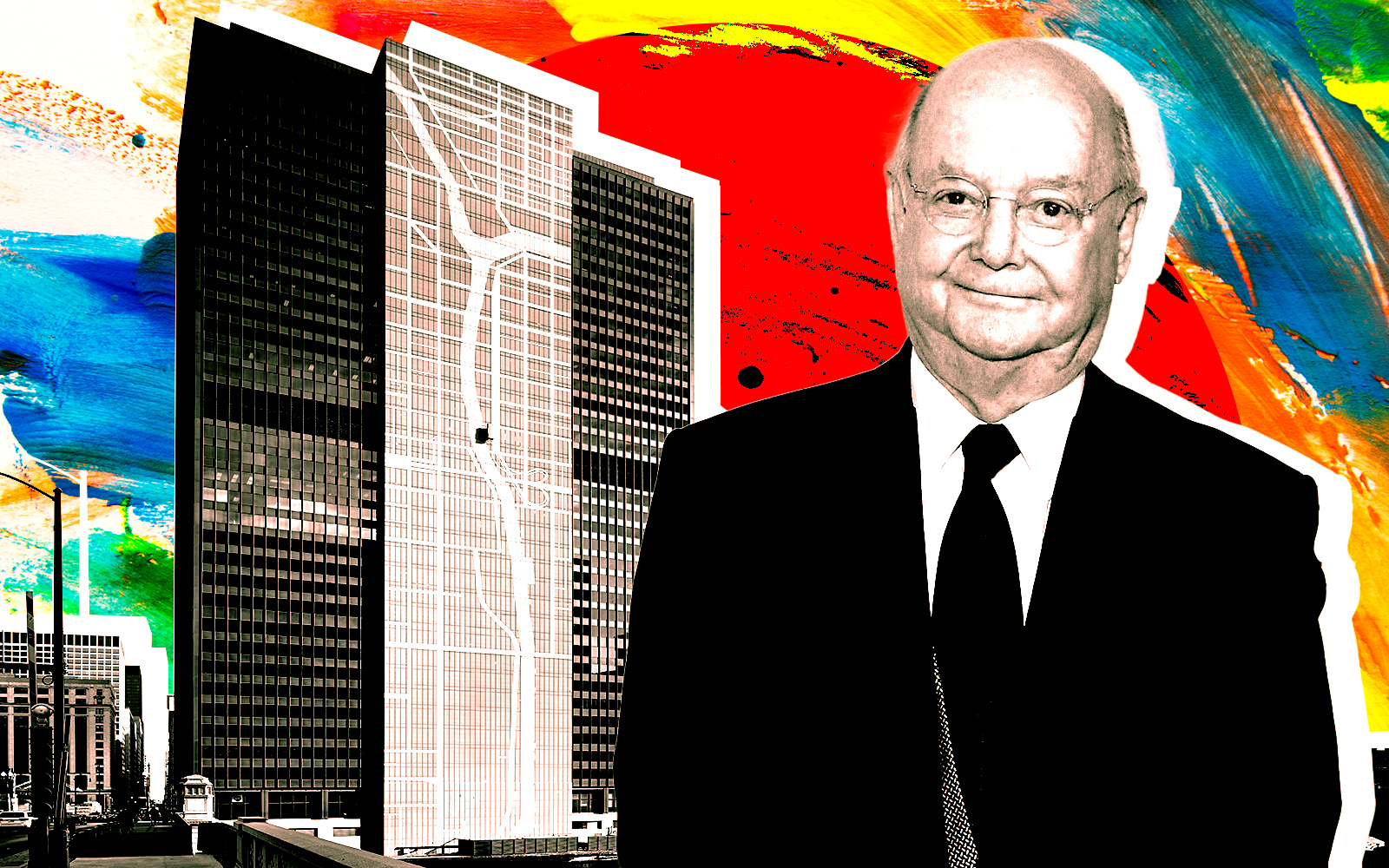

Green Cities just purchased the 329-unit Lake & Wells building at 210 North Wells Street from a joint venture consisting of developer Jay Javors and a subsidiary of the National Electrical Benefit Fund, Crain’s reported.

CBRE, which brokered the sale, didn’t reveal the official closing price, but sources familiar with the deal said Green Cities paid $98 million for the building. That’s 20 percent less than the $123 million Javors and National Electrical invested in the site when they developed it in 2008.

While the multifamily sector continues to perform better than the city’s office and retail sectors, Lake & Wells’ steep drop in value points to a number of issues within the overall market. Climbing interest rates, a strict lending climate and recession worries, compounded by local crime, have gradually depressed property values since the market peaked around last summer.

Last year, while multifamily was booming, American Landmark Properties and Evergreen Residential paid $180 million for the 496-unit Alta Roosevelt at 801 South Financial Place amounting to roughly $363,000 per unit.

Now, however, building sales closer to $100 million have become the norm. Green Cities, led by managing partners Molly Bordonaro, Brent Gaulke, Kelly Saito and Patrick Wilde, sold the 240-unit Xavier Apartments for $81 million at the end of March, for example.

The developer is hoping to raise rents by adding several upgrades to the site, which should yield a solid return on investment.

“This property represents one of the most significant value-add opportunities in Chicago in a high barrier-to-entry market,” CBRE’s John Jaeger said in a statement. “There are no planned developments or properties in lease-up within an eight-block radius of Lake & Wells, which drove interest even higher.”

—Quinn Donoghue

Read more