The longtime owner of a Wacker Drive landmark is treading water in a sea of debt tied to the asset, and its only life line may be selling to a developer that could convert it from offices into housing.

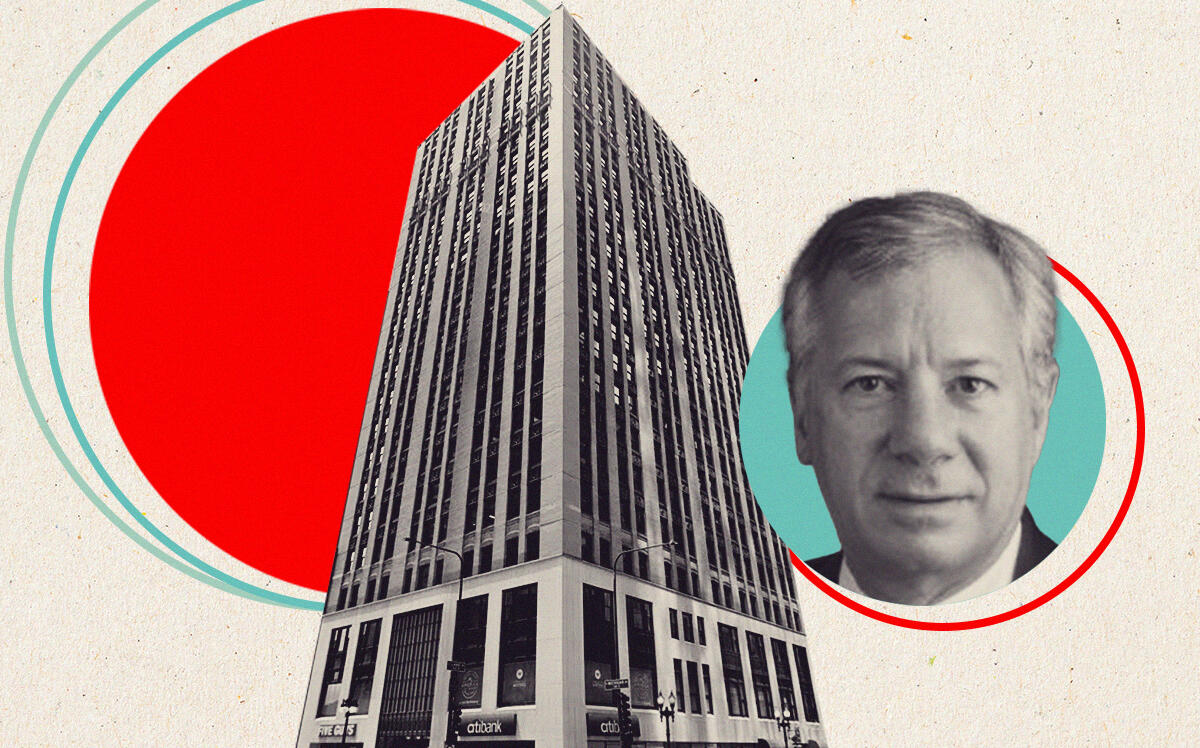

Toronto-based Dorchester has hired Draper & Kramer to market the 40-story Jewelers Building at 35 East Wacker Drive, and is playing up the asset as prime for redevelopment into a residential use, Crain’s reported.

An official asking price hasn’t been revealed, but Dorchester aims to land a deal that will allow it to pay off a $51 million mortgage that’s due to mature this summer. The lender is a venture of Boston-based John Hancock Life Insurance. Dorchester, whose CEO is Morris Shohet, has owned the 560,000-square-foot building for 40 years.

Dorchester joins a growing list of office landlords that have been forced to explore sales as debt maturities approach. Big losses of value on a few buildings have elicited some acknowledgement that Chicago’s office market is likely to keep struggling as demand remains depressed while hybrid work schedules linger. The rise of remote working has led to a slew of company layoffs and office downsizings, contributing to a record-high downtown office vacancy rate last quarter.

One way that developers have been acclimating to the change is through office-to-apartments conversions. Demand for rental housing is high in Chicago, and rising rents make investing in multifamily a safer play. Draper & Kramer’s Scott Ward, who’s marketing 35 East Wacker, believes the Jewelers Building is suited for this approach.

“The highest and best use of this building in this market, with the way that the pandemic has shifted people to a hybrid work mode, is probably as a residential building,” Ward told the outlet.

As part of former mayor Lori Lightfoot’s LaSalle Street Reimagined initiative, the city is considering putting more than $300 million in tax increment financing for office-to-resi conversions along and near LaSalle Street through the Loop. Lightfoot initiated this plan to help revive the downtown area, but also because such conversions are extremely expensive and require public financing. However, Mayor Brandon Johnson’s outlook on the plans, and the amount of political capital he’s willing to spend to get them approved by the city council remains uncertain.

— Quinn Donoghue

Read more