One of Chicagoland’s most active retail developers is taking on the world’s largest commercial real estate brokerage in court, claiming its agents are improperly seeking commission on a 200,000-square-foot medical office deal that came close to getting done but ultimately fell apart.

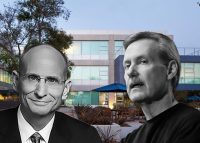

Affiliates of Shai Wolkwicki and Mitch Goltz’s development firm GW Properties filed lawsuits naming CBRE as a defendant after two of its brokers requested a $6 million commission, even though the deal they were working on fell apart, according to the complaints filed in Cook County and Will County courts.

“Unfortunately, this is the result of the actions of a few overzealous individuals who chose to put their own desires to get paid a commission on two non-binding leases that were terminated above what’s right and in their client’s best interests,” Goltz said in a statement. “In these difficult market conditions and with the various headwinds out there, particularly in the office sector, it’s sad to see and I think clients deserve better.”

To demand payment, brokers Jonathan Springer and Kevin McLennan filed liens against vacant lots in the southwest suburbs of Joliet and Orland Park that GW owns and was targeting for development while a health care group considered leasing the space. GW planned to build a 100,000-square-foot building at each property — 2000 West Jefferson Street in Joliet, and 7420 West 159th Street in Orland Park — that Duly Health Care was set to lease, and had hired Springer and McLennan to negotiate the deal.

Despite coming to an initial agreement in 2021 with Duly Health, the prospective tenant and GW terminated their deal because Duly’s plans would have cost $20 million more than was initially budgeted by the developer for the project, according to the suit. Duly declined to comment.

GW is suing in hopes the judge will order the removal of the liens against their property.

The deal disintegrated even as medical office tenants have expanded more rapidly in the Chicago area, compared to the rest of the nation. The metropolitan area’s medical office market expanded nearly 18 percent between 2012 and 2022, adding more than 4.3 million square feet, while the nation’s top 25 medical office markets had the asset class grow by 13 percent during the same period. Conversion of retail storefronts into versions of medical office space, sometimes referred to as “medtail,” have become popular in the area as shopping habits shift.

Duly was set to pay $37 per square foot in base rent for its leases of the buildings, had it occupied them, according to the initial lease agreements. That rate would be due on top of utility, property tax and property maintenance costs borne by the tenant. CBRE was set to get paid $1.50 per rentable square foot per lease year for the initial 20-year term of the proposed lease.

CBRE disagrees with GW, and defends its brokers filing liens. The brokerage believes the parties in the deal waived contingencies — events that are required to occur for a commission to be paid out, such as the negotiation and finalization of the initial budget between the prospective tenant and landlord and the project’s development schedule.

The brokerage said that because the contingencies were waived, the commission should be paid even though the tenant and landlord decided not to move forward on the project.

“Our people worked incredibly hard to bring the parties together to execute a transaction,” a CBRE spokesperson said. “The failure of the plaintiff to accomplish the development does not take away from the fact that all contingencies were waived and the commissions became due. As a result, we will be seeking to enforce the commission agreement and compel payment of the monies owed to us.”

GW has been busy making other deals as of late. In March, it sold the Waukegan Plaza shopping center in the north suburbs for $17 million after putting capital into upgrading the property. And the developer in November also cashed out of another medical office project in Chicago, selling a two-story building leased by Advocate Medical Group in Portage Park for $16 million to an affiliate of Oak Brook-based Inland Real Estate Group.

Read more