Two downtown apartment buildings are up for grabs, testing investor demand for Chicago multifamily while dealmakers face challenges including less office action in the Loop and tightening lending standards.

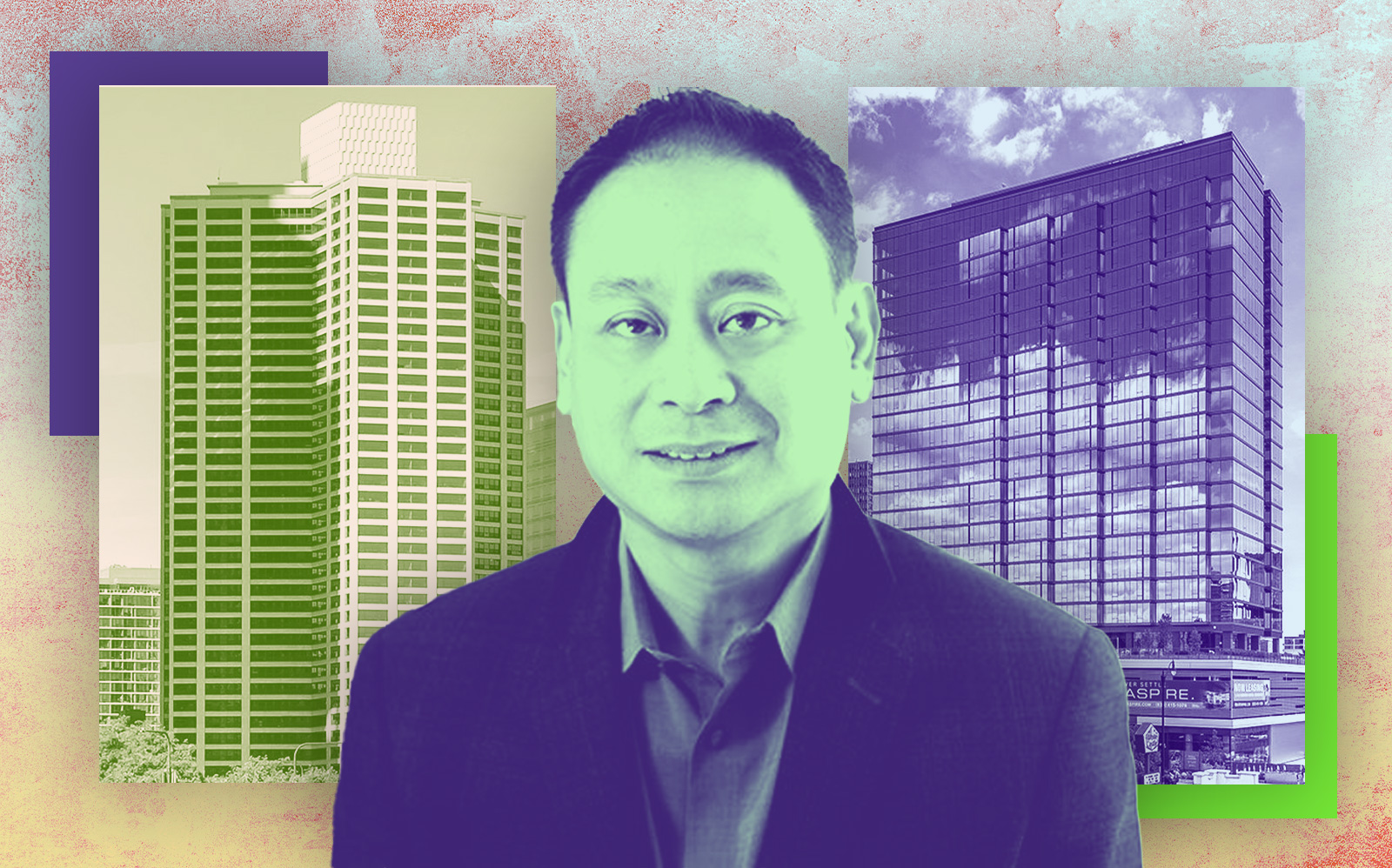

LG Development is offloading the Jax, a 166-unit property at 1220 West Jackson Boulevard in the West Loop, and a joint venture between D2 Realty and Wood Partners is selling the Alta Grand Central, a 346-unit building at 221 West Harrison Street, Crain’s reported. Brokers at Newmark are marketing both properties.

The Jax is expected to attract bids of more than $50 million, as it’s located in one of Chicago’s hottest areas for new developments and investment opportunities. It’s unclear how much Alta Grand Central might sell for, though. Sky-high vacancies in downtown office buildings have hampered real estate activity in the Central Loop since the pandemic, making Alta Grand Central a potentially riskier investment.

Overall, the Windy City’s multifamily sector is performing well. Most apartment buildings have healthy occupancy rates, and the city has seen a surge in rent growth since last year. However, rising interest rates have counteracted apartment values, while driving borrowing costs up.

“That’s the dichotomy of the market,” LG Development’s Daniel Haughney told the outlet. “The underlying fundamentals are as strong as ever, and the capital markets are as weak as we’ve seen them.”

LG completed construction of the Jax in April 2020, shortly after the pandemic struck. The firm financed the project with a $28.3 million construction loan. The building has an occupancy rate of about 93 percent, and average rent amounts to roughly $3.80 per square foot. Haughney is confident that it will attract a buyer with deep pockets.

The D2-Wood venture took out a $65.7 million construction loan from Compass Bank to finance Alta Grand Central, which also opened in 2020. They refinanced the property with a $64 million mortgage from Santander Bank in September 2021.

The 14-story, two tower complex’s gross income has risen 22 percent over the past 12 months, while maintaining a 93 percent occupancy rate.

— Quinn Donoghue

Read more