Baum’s $88M theater redevelopment hits roadblock

Baum’s $88M theater redevelopment hits roadblock

Trending

Baum’s Congress Theater redevelopment seeks a lifeline

Ald. La Spatta pursuing three-year extension of TIF district to keep project afloat

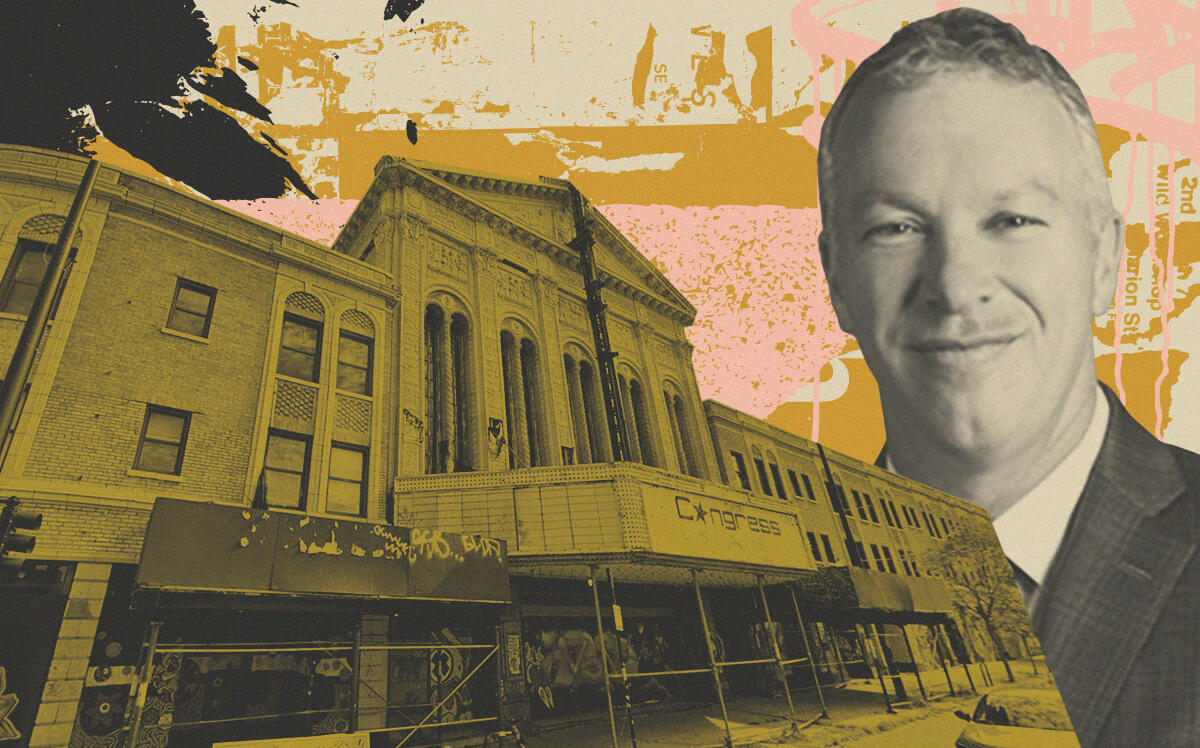

Alderman Daniel La Spata and Baum Revision’s David Baum with the Congress Theater (The 1st Ward, Baum Revision, Google Maps, Getty)

The long-awaited redevelopment of the Congress Theater in Logan Square faces another major setback, with the developer at risk of losing millions in crucial city funding.

Developer Baum Revision has requested $27 million in tax-increment financing from the city to restore the historic theater at 2135 North Milwaukee Avenue, along with surrounding retail shops and apartments. But the project is now in jeopardy as the Fullerton/Milwaukee TIF district —the source of the money — is set to expire next year, Block Club reported.

Tax increment financing districts capture new property tax growth within a designated area, redirecting it to fund projects aimed at spurring economic development and eliminating blight. Under the current TIF terms, all projects using those dollars would need to wrap up by the end of 2024.

Alderman Daniel La Spata hopes to salvage the project by extending the terms of the Logan Square district for an additional three years, despite the Illinois General Assembly recently approving a 12-year extension.

“It is not hyperbolic to say that the Congress Theater development does not happen without the extension of the TIF,” La Spata told the outlet.

Baum needs more time to complete its redevelopment, which calls for restoring the 2,900-seat theater, while adding roughly 5,400 square feet of retail and restaurant space, 16 apartment and office space.

The developer has faced several setbacks since taking over the property in 2021, including labor disputes and escalating costs. High interest rates, compounded by the theater’s worsening condition, increased the project’s estimated cost from $70 million to $88 million.

“It’s been a bit of a game of whack-a-mole. Every time we think we’ve figured it out, pricing goes up,” David Baum, principal of Baum Revisions, previously told the outlet.

La Spata’s handling of the expiring TIF district has drawn criticism from some city officials, saying the alderman should have been more collaborative with the community and transparent in his decision making. La Spata pledged, however, that residents will get a chance to weigh in on how any additional dollars captured by the special taxing district should be spent.

—Quinn Donoghue

Read more

Baum’s $88M theater redevelopment hits roadblock

Baum’s $88M theater redevelopment hits roadblock

Congress Theater revamp costs rise to $88M, council pushes project hearing

Congress Theater revamp costs rise to $88M, council pushes project hearing

After Inland takeover, Logan Square apartments near completion

After Inland takeover, Logan Square apartments near completion