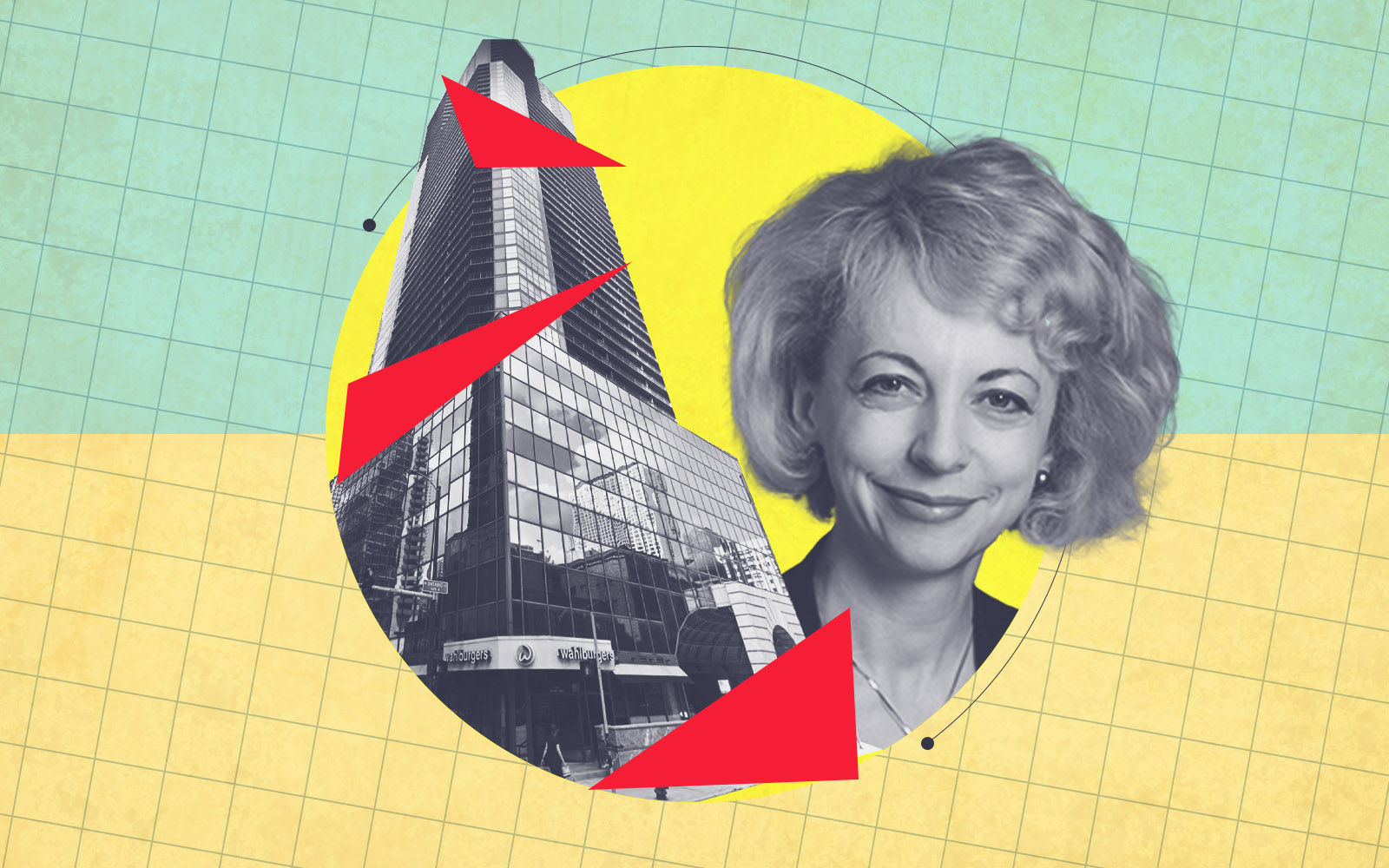

The $190 million deal to convert the Ontario Place condos into apartments has been squashed, The Real Deal has learned. Negotiations fell apart at the eleventh hour, signaling the end to a three-year saga where the buyer, Strategic Properties, struggled to get financing for the ambitious deconversion.

Strategic, which already owned dozens of apartments in the the 467-unit tower at 10 East Ontario Street in River North, had until 5 p.m. Tuesday to put up $700,000 as a show of good faith to the sellers, or the deal was off, sources told TRD.

If executed, the Ontario Place deconversion would have been the priciest condo-to-rentals bulk buyout in the city to date.

Strategic requested multiple extensions and was expected to close back in February. Negotiations began in 2020 and endured many false starts, as the property’s condo association board grew increasingly restless and concerned as to whether the deal would ever materialize.

The $700,000 would have added to Strategic’s $1.7 million non-refundable deposit, according to the sellers. The lender and an attorney for the buyer did not respond to requests for comment.

It’s unclear whether the board will pursue another buyer or move away from the deconversion strategy altogether. Market conditions have significantly worsened since the now-defunct deal was struck, making it more challenging for a buyer to get financing.

Since entities with ties to Strategic still own dozens of units within the building, the firm could potentially make another push to convince a critical mass of fellow condo owners to consider a bulk sale in the future.

Strategic had become a specialist in deconversions, which are generally messy deals that involve multiple players and some resistance from holdout condo owners, despite intense pressure from condo board members. This was true at Ontario Place, where its board already fended off multiple lawsuits from unit owners who didn’t want to enter the deal.

Even with those complaints out of the way, drama erupted within the building after Strategic balked on closing in the middle of February, when unit owners were instructed to leave their keys on their counters only to be told hours later the buyer didn’t have the funds yet to close.

Sellers and their attorneys elected to halt communications with the buyer, and instead correspond directly with its lender, Fairchild. The collapse of Credit Suisse and the attention it drew from Swiss regulators figured into further delaying the closing in March, according to a letter from Fairchild principals Mark Kelley and Karen Kahn that was shared with TRD in March.

The botched deal had previously forced sellers to make tough choices, with some having to sell other assets to pay for the contingent purchase of another home, while others are losing out on rental income because they expected the units to be sold by now.

“I am relieved this fiasco has finally come to an end,” unit owner Elizabeth Sima, who opposed the sale, said. “It has been hell for the past three years.”

Read more