Chicago office tenants that want to get into Fulton Market might not have to wait, as a few in the trendy former meatpacking district are cutting back on floorspace.

With a tight inventory in area office buildings, companies on the hunt for large office space in Fulton Market figured they were sidelined until capital markets loosen up, which would allow construction loans to flow to planned neighborhood developments.

But now, they may be able to jump the line, if they take up one of three subleases being tested in high-end office buildings.

The biggest of the offerings comes from British public relations firm WPP, which is looking to shed about 45,000 square feet at Sterling Bay’s 19-story property 333 North Green Street, people familiar with the offering said. WPP anchored the building when it struck a 253,000-square-foot lease ahead of its construction, which was completed in 2020.

Even though WPP is marketing the biggest space, it seems more committed to having a Fulton Market office than fellow area tenants Foxtrot and Hologram, which are looking to shed a combined 47,000 square feet in 167 North Green Street, the 17-story office tower developed by Jeff Shapack and Walton Street Capital that opened in 2020, the people familiar with the offerings said.

Foxtrot, the upscale convenience store company, put its offices in the building in a 25,000 square foot lease. Hologram, which provides networking services for the “internet of things” industry, leased a 22,000-square-foot spot in the building. Each are actively courting firms to come in as subtenants and take as much as their entire office spaces, though they would consider making a deal to sublease portions of the spaces.

None of the three tenants returned requests for comment. But the Fulton Market offerings are attracting strong interest in the only part of Chicago where occupied office square footage increased during the pandemic.

The walkbacks from commercial real estate in Fulton Market also represent a challenge to the notion that the newest properties featuring upscale amenities are immune to the significant challenges currently facing the commercial sector.

Any deals made for the subleases are likely to save WPP, Foxtrot or Hologram much more money on rent with what a secondhand tenant will pay in Fulton Market, compared to the yield tenants of older office buildings in the city can get for their sublease offerings.

With a record-high 8 million square feet of office space being actively marketed for sublease in Chicago, Loop tenants are having a tough time luring takers for their offerings at discounts of as much as 70 percent from what they pay their landlords for their direct leases, brokers have told The Real Deal.

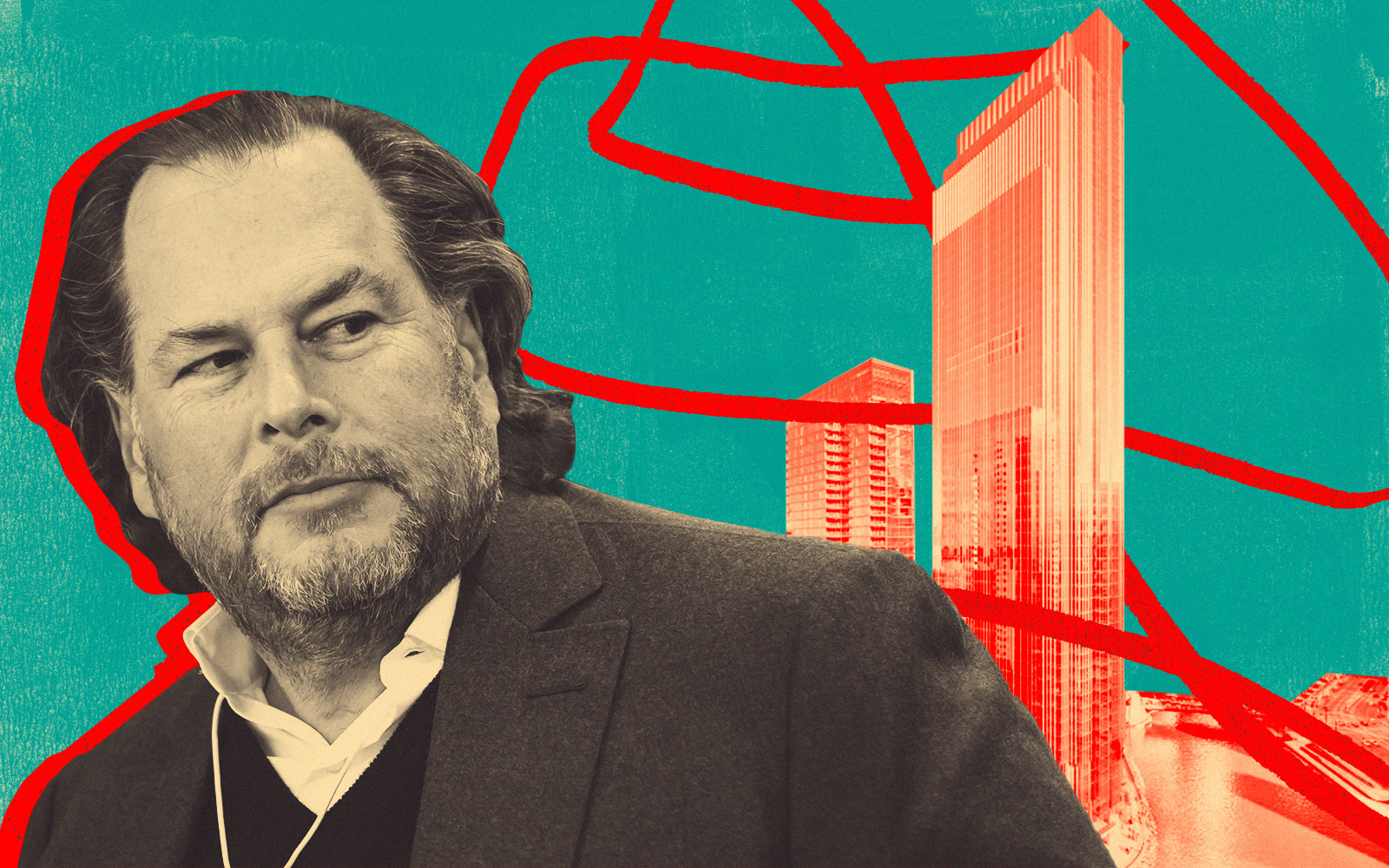

Recovery rates are much higher in newer, highly-amenitized buildings such as the Green Street buildings or the Salesforce Tower at Wolf’s Point — where the namesake tenant is offering 100,000 square feet for sublease out of the 500,000 it committed to leasing from the developer Hines. Subleases in those properties can lure takers with discounts of only as much as 30 percent less than the full rent paid by the original tenant to the building owner.

Read more