A large Cook County apartment complex is up for sale for $34 million, joining other recent listings for large multifamily assets in offering an assumable debt package.

A pair of local investors have hired Kiser Group to market the 264-unit Forest Glen Apartments at 1639 Forest Road in suburban La Grange Park. Lee Kiser, Will Cornish and Kyle Sissell have the listing.

The Class C property consisting of several two and three-story buildings is being offered for sale with assumable debt at a 3.3 percent interest rate with nine years remaining on the loan, which was issued for $20.1 million in 2020 by Greystone, according to public records. That’s likely to appeal to investors who may otherwise be chilled by interest rate hikes pushing the cost of obtaining commercial real estate debts to well more than 5 percent of the principal in most cases.

“I don’t think it’s the only part but it is a strong factor on why deals are coming to market, is because these deals work because they have assumable loans,” Cornish told The Real Deal.

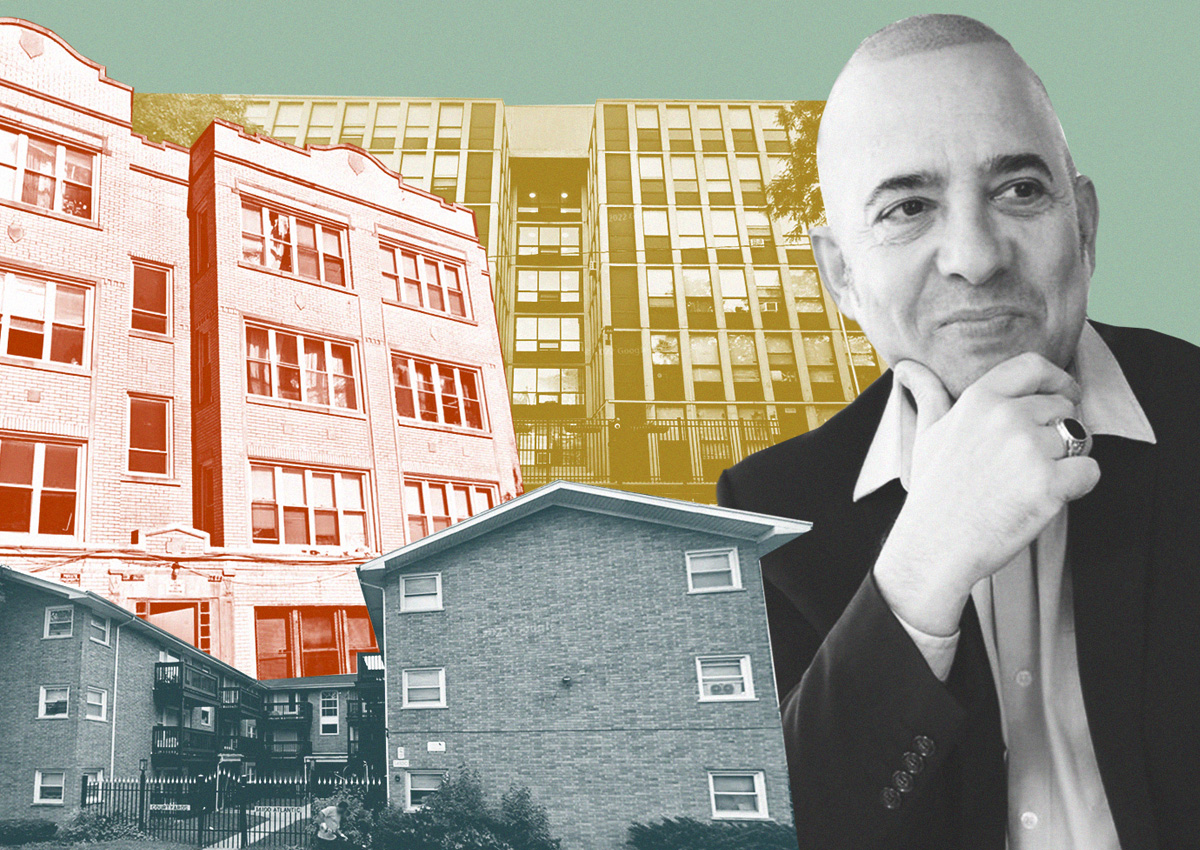

Assumable debt could become a hot commodity in Chicago, with several other options for buyers right now. Also testing investors’ appetite for big apartment complexes with assumable loans are condo deconversion specialist Strategic Properties of North America, which listed the 267-unit K-Square apartments in the city’s Old Town this month, and Goldman Investments’ Hadar Goldman, who listed a 1,700-unit affordable housing portfolio on the city’s South and West Sides last month with hopes to fetch about $200 million.

The heightened cost of borrowing, as well as gaps between buyers and sellers on pricing expectations has slowed multifamily investment sales activity since March 2022, bringing deal flow down about 20 percent across the metro area last quarter compared to the same time last year, according to Marcus & Millichap. Still, the area’s average multifamily cap rate — the net income of a property compared to its purchase price — was 100 basis points higher than any other major metro area over the same time, the report said.

While Cornish declined to identify the La Grange Park property’s owners beyond calling them local investors, the LLC listed as its owner in public records is managed by Vladimir Novakovic, who has a Barrington Hills address and has long run a Chicago-based real estate firm called Terranova Property, according to state documents, a LinkedIn profile and previous news reports. Novakovic’s LLC paid $16.1 million for the property in 2004, records show.

The asset will likely sell to another local investor who knows the suburbs well, Cornish said.

Read more