High interest rates have midsize multifamily owners holding onto their properties, crushing deals for the asset class to an eight-year low in Chicagoland and forcing brokers to turn to sellers carrying assumable debt.

Deal volume for midmarket multifamily properties, defined as assets sold for less than $30 million, notched its lowest point in the Chicago metro area in the first six months of 2023 since the first half of 2015, according to CoStar data.

Midmarket multifamily deals totaled $731 million in the first six months of 2023, down almost 40 percent from the same time period in 2022. That marks the lowest midyear total since 2015, when sales volume hit $663 million in June.

It’s a slowdown that has Chicago’s leading brokerages in the midmarket space hustling to close ever-scarcer deals.

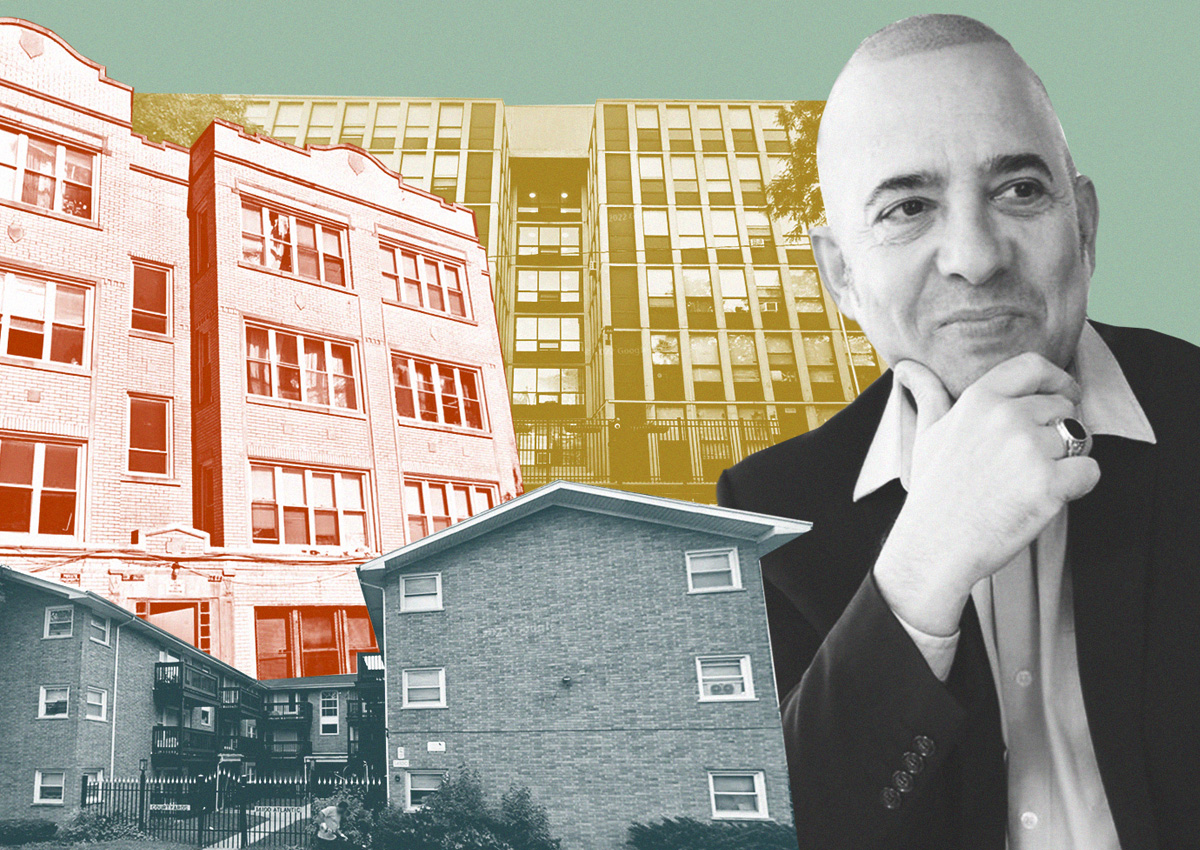

“We all work harder and cry more,” Kiser Group’s Lee Kiser told The Real Deal. “We’re working twice as much for two-thirds of the income.”

Midmarket multifamily sales volume totaled almost $1.2 billion in the first half of 2022, capping off an upward trend that began in 2020.

“We’ve kind of been coming out of a historically high-velocity, high-volume transactional market. In the last several years there’s been kind of a perfect storm of cheap financing and a ton of buyer demand,” Essex Realty Group’s Matt Feo said.

Now, the tables have turned, and as high interest rates have given some sellers pause, it’s also created opportunities for those who can offer assumable debt at a lower rate. Recent Chicago-area listings that include assumable debt in their marketing are a 264-unit apartment complex in La Grange Park and Hadar Goldman’s 1,700-unit affordable housing portfolio across the city’s South and West Sides.

“That’s why all these properties are coming to market. We’ll see if it actually works, we’re doing it ourselves,” Kiser said.

About a quarter of Kiser Group’s $300 million in listings offer assumable debt, “where historically it would be zero,” he said.

Deals with assumable loans can be a nuanced situation, brokers say — the lower rates can help values, but taking on the mortgage means potential buyers need to have more capital ready to go.

Overall, multifamily dealmakers are optimistic the market stabilizes in the second half of the year as rent growth mitigates the higher cost of borrowing.

“I think once everyone accepts where the market is today — better, worse or indifferent — at least there’s going to be a degree of certainty that we haven’t had,” Feo said.

Read more