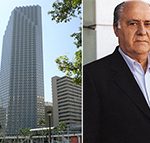

Spanish billionaire Amancio Ortega made a splash in Chicago when word of his family office buying the city’s priciest apartment deal so far this year spread across real estate circles this week. But it’s not the first time the Zara founder’s investment firm has made a sizable bet on the City of Big Shoulders, and on best-in-class properties in other markets.

Ortega’s investment firm, Pontegadea, this month paid almost $232 million for 727 West Madison Street, a 492-unit, 45-story luxury tower in the trendy West Loop whose height and oval shape make it a standout in Chicago’s skyline.

The trophy asset, developed by sellers Ares Management and F&F Realty Partners alongside Fifield Companies, first hit the market in 2020 with JLL assigned to the listing. Fifield CEO Steve Fifield told Crain’s at the time that “727 is THE fortress deal in the West Loop” and was performing well despite the pandemic.

Regardless, it never traded, and the sellers refinanced the property last year with a $177 million loan, their second time borrowing against the property since its construction finished in 2019. An Eastdil Secured team that included Chicago-based Bryan Rosenberg, Donald Kelly and Sam Byczek got the assignment earlier this year, representing the sellers Ares and F&F. Cushman & Wakefield’s Susan Tjarksen represented Pontegadea in the sale.

While it was Cushman’s first time advising Pontegadea on a Chicago purchase, the brokerage has been involved in deals that included the high-profile buyer in other markets, as has Eastdil, according to disclosures by the companies and news reports.

“We were very happy to represent them,” Tjarksen said.

Elsewhere in Chicago, Pontegadea in 2015 paid $176 million, or $3,667 per square foot, for the former Esquire Theater building in the Gold Coast at 58-104 East Oak Street, where its tenants at the time included high-end retailers Christian Louboutin, Tom Ford, Dolce & Gabbana, upscale restaurant Fig & Olive and since-closed steakhouse Del Frisco’s.

But it hasn’t been totally smooth sailing for the firm at some Chicago assets. All those other Oak Street tenants remain in its property, though the wine-focused restaurant chain Cooper’s Hawk — which took over the Del Frisco’s space with a 2019 opening — is closing its doors and leaving the Esquire Theater property, Chicago Eater reported in May.

And Pontegadea also owns the 216-room Eurostars Magnificent Mile hotel in River North, which it bought for $73 million in 2019. The hotel business in 2021 was fined $10,000 by the city after 42nd Ward Ald. Brendan Reilly called it a “hotspot” for crime in the wake of a shooting there, and asked police to crack down on disturbances at and near the hotel.

This winter, however, LM Restaurant Group is poised to open a ground-floor eatery at the hotel, called River North Bistro, and also start operating a top-floor private event space.

Back in 2007, Pontegadea also dropped $350 million to buy a block of Magnificent Mile retail space at 730-750 North Michigan Avenue, where Tiffany & Co. and Ralph Lauren had stores then that remain open, as does Victoria’s Secret today. In 2009, the landlord took out a $200 million loan against that property, and then followed up that deal with a $16 million buyout of a ground lease that encumbered the property stemming from a deal struck back in 1994.

Outside the Windy City, Ortega’s real estate group made its first major entry into the multifamily market last year with the purchase of a rental tower in New York’s Financial District, paying almost $500 million for the 64-story property at 19 Dutch Street.

Before that, Pontegadea was well known in South Florida’s commercial real estate scene for snapping up prime office and retail properties such as downtown Miami’s Southeast Financial Center, the state’s tallest office tower, for $517 million in 2016. That marked a spending spree as it followed the firm’s purchase of an entire block on Miami Beach’s Lincoln Road for $370 million.

Comras Company CEO Michael Comras, who sold the Lincoln Road block to Pontegadea, told The Real Deal in 2016 that Ortega is a known buyer in major markets.

“When you travel around the world and look at the best assets in every gateway city, you will find that he’s the preferred buyer,” Comras said at the time.

Read more