AmTrust Realty is pouring $50 million into two of its seven downtown Chicago office buildings to attract new tenants at a time when office vacancies are at an all-time high in the Loop.

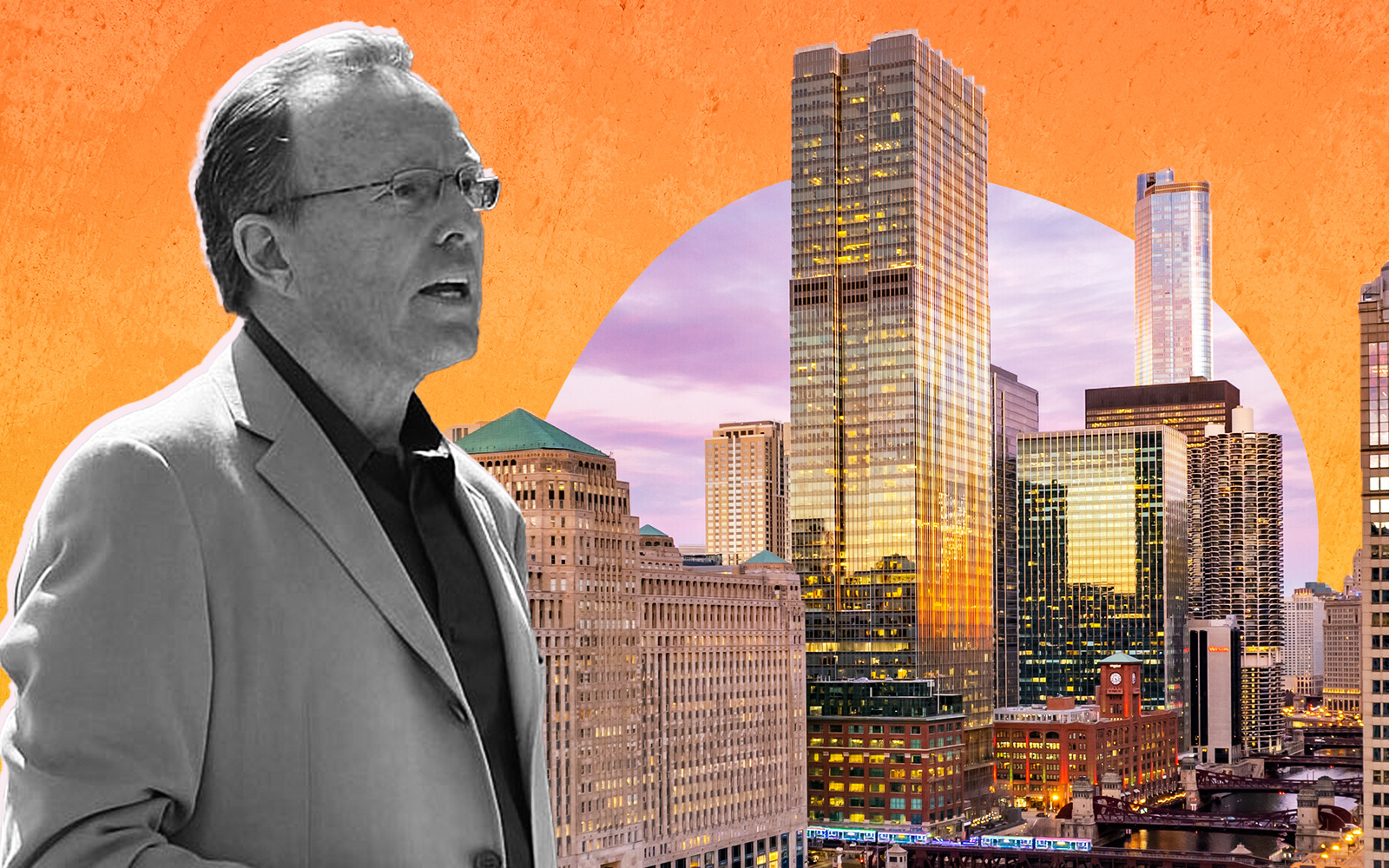

The New York-based firm, led by president Jonathan Bennett, aims to perform renovations at its 41-story office tower at 1 East Wacker Drive and the 25-story building at 33 North Dearborn Street, Crain’s reported.

AmTrust’s investment comes two years after the firm revealed its intentions to spend $100 million to revamp its Chicago office portfolio, which also includes the 900,000-square-foot building at 33 West Monroe Street and the mostly-vacant tower at 135 South LaSalle Street that’s being partially repurposed for residential use.

With half of that amount going into these two buildings, the firm is still formulating where and how to spend the rest, though it already has a good idea of which assets won’t be targets for capital improvements. AmTrust is committed to surrendering the 44-story tower at 30 North LaSalle to its lender, which has an affiliate aiming to convert the property into a residential asset through the city’s LaSalle Street reimagined program, just as AmTrust is looking to do at 135 South LaSalle.

Despite a struggling office sector, plagued by stubborn remote-work trends, hiking interest rates and a tightening lending climate, AmTrust appears to have faith the market will recover. At the very least, the two properties that the firm is investing in “have a reason to exist” and can weather the storm until Chicago’s office market starts to improve, Bennett told the publication.

“We’re trying to be nimble and we’re trying to be smart. We’re fully committed to the portfolio, but we want to make smart decisions on each one of these assets,” Bennett told the outlet.

The renovation strategy aligns with a broader trend in the downtown office market, where businesses have been gravitating towards Class A buildings, either newly built or renovated, to lure employees back to the office. Notably, the vacancy rate for Class A office spaces has only slightly increased from 18 percent to 18.3 percent over the past two years, whereas vacancies for Class B buildings have risen from 19.1 percent to 26.5 percent.

Unlike AmTrust, a number of other office landlords are surrendering their assets to lenders or holding off on major upgrades. Bennett, however, believes there are advantages for landlords who make long-term commitments to their properties.

“I think it’s an opportune time to pick great assets that we think have great bones and great viability and a great future, (and) invest in them when other people are still kind of frozen and sitting on the sidelines,” he told the outlet.

Work is scheduled to commence at 1 East Wacker in the coming weeks, with a focus on renovating the lobby, creating new amenities on the second floor and improving entrances, corridors, restrooms and the top-floor tenant lounge. The planned investment has helped secure a lease extension from Shore Capital Partners, the largest tenant at the site, upping the occupancy rate from 81 percent.

At 33 North Dearborn, AmTrust has already begun upgrades, including the creation of a rooftop deck and doubling the size of the conference center. The building is 83 percent leased.

— Quinn Donoghue

Read more