Trophy office landlord Beacon Capital Partners is booting fellow real estate player Enlivant from its Chicago headquarters amid the tenant’s layoffs of hundreds of corporate employees.

An affiliate of Beacon that owns the 52-story, 1.2-million-square-foot AMA Plaza at 330 North Wabash Avenue filed an eviction lawsuit last month against Enlivant, a struggling senior housing provider that owns and operates properties in 27 states, some of which have buckled under challenging market conditions.

Enlivant announced plans this summer to cut 284 workers before the end of the year, amid concerns about the company’s rising expenses being driven in part by surging debt costs.

Enlivant informed Beacon of its plans to shutter its roughly 32,000-square-foot office space starting Sept. 1 in a letter sent the day before, according to an exhibit filed in the lawsuit, which is playing out in Cook County court.

Neither Enlivant, Beacon nor attorneys for the respective companies returned requests for comment.

Enlivant’s lease for the space on the 37th floor ran through November 2025, at which time it was scheduled to pay Beacon nearly $34 per square foot in base rent, and more than $851,000 total for the year, the lawsuit claims. The lease began in 2014 at $25 per square foot in base rent, before taxes and other costs normally borne by tenants.

Beacon’s lawsuit seeks to remove Enlivant from the building and force it to cough up more than $150,000 in back rent the landlord says it’s owed for a missed September payment, plus future rent payment it says it would have paid had the lease remained intact, and attorneys fees and court costs.

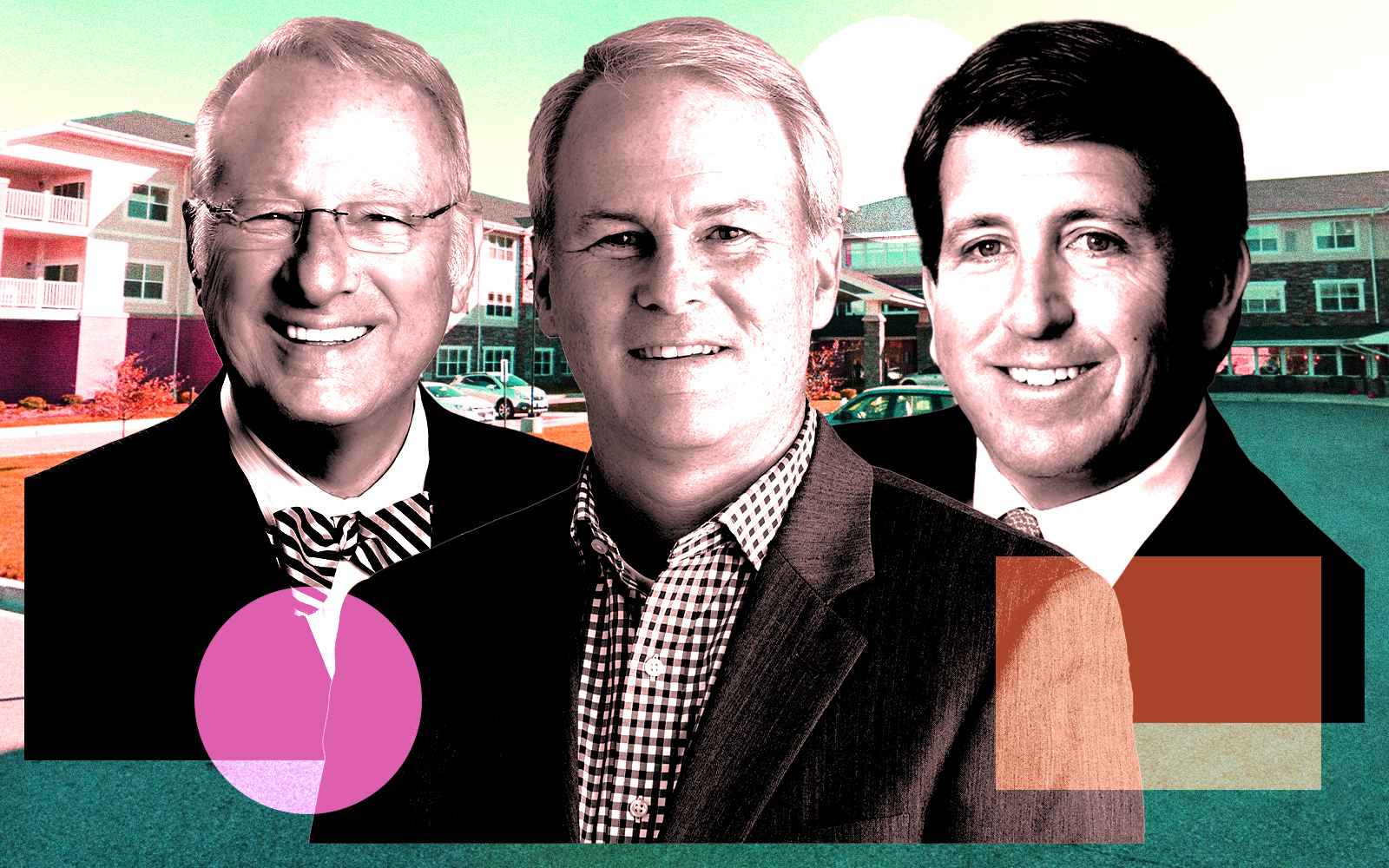

A portfolio of more than 150 senior living communities operated by Enlivant and owned by a joint venture of TPG Real Estate and the publicly traded Sabra Health Care REIT faced severe financial trouble earlier this year. In March, Sabra said in SEC filings there was “substantial doubt” about the ability of the joint venture to continue as a going concern, industry publication Senior Housing News reported.

The joint venture was said to be facing growing expenses and lost revenue as a result of the pandemic, and that Enlivant as of June would need “additional liquidity to continue its operations over the next 12 months,” according to the outlet.

During the spring the joint venture fell behind payments on loans from Freddie Mac, Fannie Mae and Keybank. Many of the communities have since been taken over by the lenders and transitioned to new property management, the publication reported in June.

Read more