A major player in Chicago real estate is undergoing a leadership shakeup.

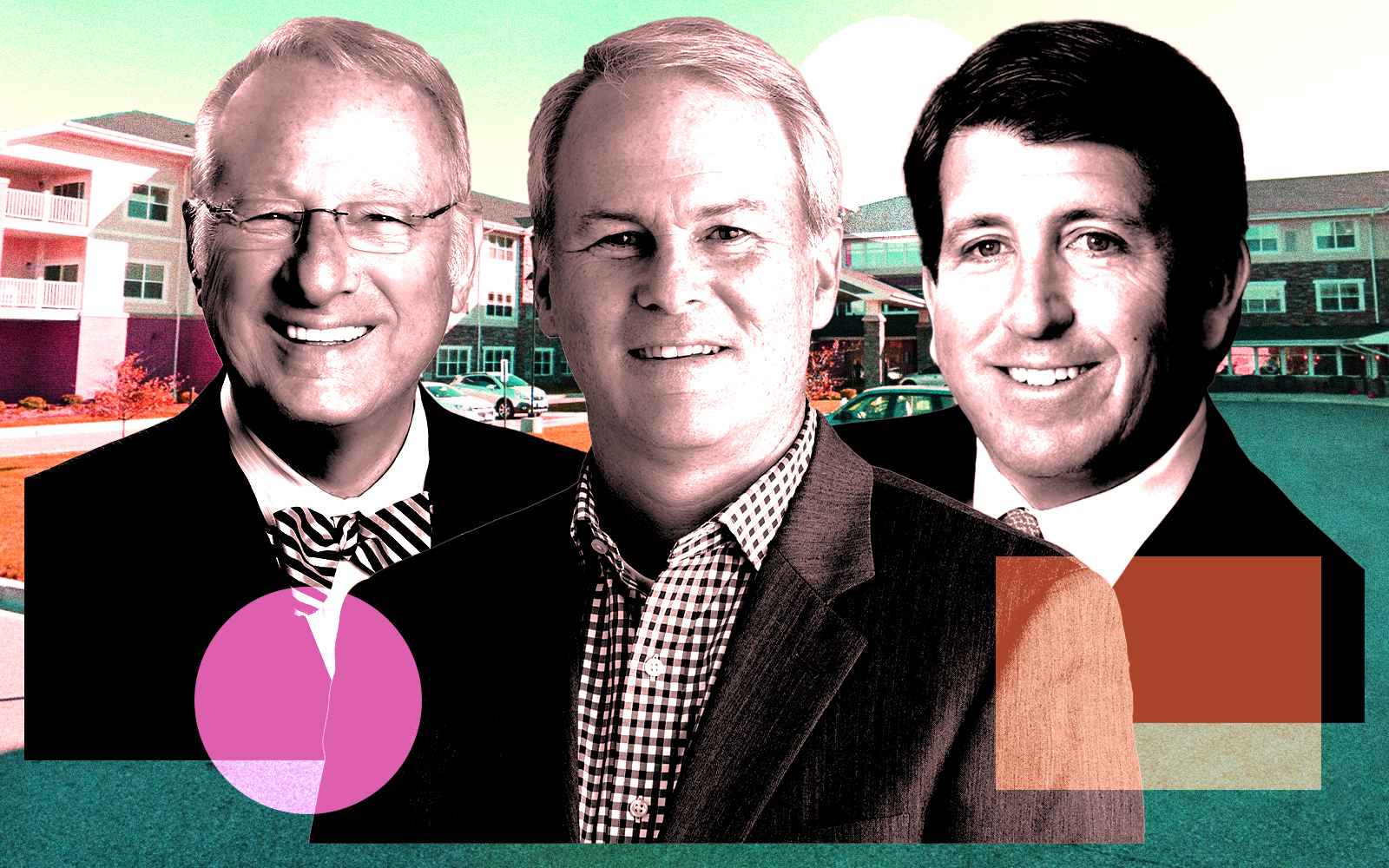

Keith Lampi has been appointed president and CEO of Oakbrook-based Inland Real Estate Investment Corporation, replacing Mitchell Sabshon, who is retiring, REjournals reported. The change is effective Feb. 1.

Sabshon will retain his positions at two publicly registered real estate investment trusts sponsored by the company: InPoint Commercial Real Estate Income and Inland Real Estate Income Trust. Sabshon will assist with Lampi’s transition in the coming weeks and after his retirement.

Inland’s succession plan has been in the works to ensure that there are no hiccups in the firm’s operation. Sabshon is retiring to spend more time with family and focus on passions outside of work.

Lampi brings over 20 years of experience to the role, having started as an intern in 2001 and rising through the ranks to become president and CEO of Inland Private Capital, roles he will continue. Under his leadership, Inland Private Capital became a market leader in the private real estate securities industry, managing assets exceeding $12 billion. Lampi also will continue his role as CEO of the IPC Alternative Real Estate Income Trust.

Founded in 1967, Inland has maintained a large presence in the Chicago area. New York-based DRA Advisors acquired a huge Inland business line in 2016, when it assumed the firm’s 132-property, $2.3 billion real estate portfolio concentrated on Midwest shopping centers, which operated under the IRC Retail Centers banner. DRA put 24 retail centers, stemming from the Inland acquisition, up for sale in May 2023.

DRA is shedding the Midwest portfolio, worth an estimated $540 million, and buyers have gobbled up about $31 million of that recently. Ohio-based REIT Phillips Edison spent $23 million in December to buy a grocery-anchored shopping center at 885 East Belvidere Road in the northern suburb Grayslake.

—Quinn Donoghue

Editor’s note: This story was updated to correct the nature of DRA Advisors’ acquisition of Inland assets.

Read more