DMG Capital bought a foothold in Chicago’s River West multifamily market to extend the firm’s shopping spree, staying bullish enough to pull in new financing in spite of the commercial real estate downturn.

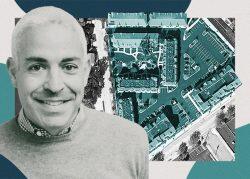

The Chicago-based firm snagged the 47-unit luxury building called Linkt Apartments at 830 North Milwaukee Avenue for $14.2 million in a deal announced Tuesday. The purchase of the property completed in 2017 marked the third acquisition by DMG Capital in the last six months for a total of $40 million in new assets, the company said.

“We’re definitely buyers and out looking for opportunities,” DMG co-founder Roger Daniel said. “We’ll continue operating where our footprint currently exists — Chicago city and suburbs, first and foremost.”

DMG looked into the River West building, known as Linkt Apartments, a few times in the past but did not pursue it until the price recently dropped to $14.2 million as the seller, a venture of developer Rajen Shastri’s firm Akara Partners, was coming due on its loan. The seller “needed to solve for lower loan proceeds coming their way,” Daniel said.

“We’re an interesting part of the market where there’s a lot of these loans coming due, so I think it presents opportunities for people that are in a position to take advantage of them,” he said. “That’s what we’ll be focused on for the next 12 to 18 months.”

Akara couldn’t be reached for comment.

DMG’s deal follows its December purchase in partnership with JDI Realty and the Wolcott Group of Roselle Luxury Apartments, a 72-unit multifamily building in the northwest suburb of Roselle for $19.7 million. And last month, a DMG venture paid nearly $4 million for 4179 West Belmont, a 17-unit apartment community in Avondale.

Debt financing on the acquisition of the River West building was provided by Freddie Mac and arranged by Philip Galligan and Danny Kaufman of JLL Capital Markets. DMG signed on for a five-year loan with a rate of just more than six percent and two years of interest-only payments, according to Daniel.

Greenberg Traurig’s Meredith Katz and Ariel Murray represented DMG Capital in the acquisition. Interra Realty’s Craig Martin was the buyer’s broker on the deal and Joe Smazal, also with Interra, represented the seller.

The building has tenants on long-term leases in both of its two retail spaces – a Wing Stop and a barbershop. Its residential units — a mix of studios to three-bedroom apartments — are 95 percent leased. The new ownership is planning some upgrades for the building’s units, common spaces and amenities in order to raise rents to “meet the market,” Daniel said.

“You’ve got upward pressure on rents from Fulton Market and the West Loop,” Daniel said. “We’re planning on rents going up everywhere, but I think there’s some additional pressure being so close to those locations.”

Read more