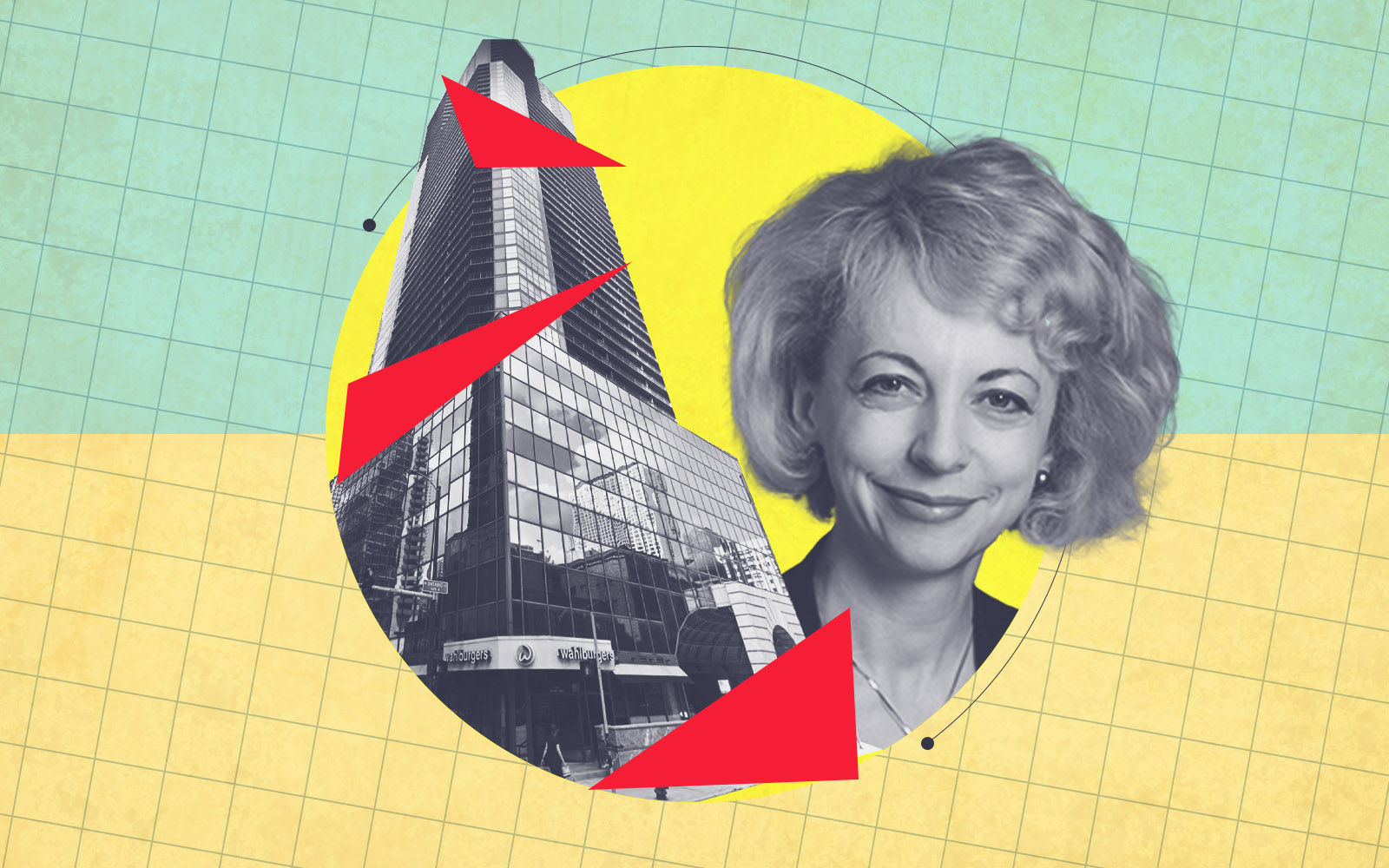

A year after Strategic Properties of North America’s bulk buyout of Chicago’s 467-unit Ontario Place condo highrise fell apart, the firm is still coming up short at the property.

The condo association board at the 51-story building at 10 East Ontario Street in the River North neighborhood filed over $303,000 in liens against 37 units owned by Strategic Properties affiliates for failing to pay their monthly dues to the association, according to Cook County property records.

The units owned by Strategic have been leased out as rentals and are mostly occupied, but the company has not paid its dues in about six months, according to a condo board member who asked to remain anonymous. The company paid $10.2 million for a 35-unit chunk of the building in 2019, and may own some other units in the property, as well.

“They have rent coming in to pay the assessments, they’re choosing not to,” the board member said. “They have some other units that are probably down, units that they may or may not be doing construction on.”

Negotiations between Strategic and the Ontario Place condo association board to deconvert the building and turn the condos into a traditional apartment building began in 2020 and stretched across three turbulent years before the $190 million deal fell through in the eleventh hour when Strategic was unable to secure financing.

Strategic Properties did not respond to requests for comment made by The Real Deal Wednesday.

The board’s decision to file the liens at the end of April had nothing to do with last year’s failed deconversion sale to Strategic, the board member said. The liens were filed against Finchley Investments, an LLC opened by Strategic Properties to purchase the units.

Strategic has put some of the units it owns in the condo building up for sale, the board member said. It’s unclear why the firm hasn’t paid the assessments.

And last month, Strategic fumbled its second attempt at a major condo deconversion in less than a year. The condo association board at 200 North Dearborn Street voted to terminate its agreement to sell the 310-unit Loop building for $95 million after the company failed to secure financing for the deal for more than two years.

Furthermore, the firm and an affiliate have run into financial trouble at other North Side rental complexes bought in bulk buyout deals, with a lender’s seizure having taken place at a Gold Coast property and a foreclosure lawsuit pending at another building.

“They failed at Ontario Place. They failed at 200 North Dearborn,” the Ontario Place board member said. “They’re losing at every project they’ve tried to get, including the ones they did get.”

Read more