Who should fund litigating the case of a worker’s fatal injuries suffered while on a South Side construction site? One insurance company or another, according to lawsuits crawling through Cook County, and that’s a problem.

Deciphering whose lawyer should defend the development and construction teams behind the 43Green housing project in Bronzeville from Rene Martinez’s wrongful death lawsuit is proving to be a tough task.

Illinois has work to do in the hard-knock world of worker’s compensation and workplace liability insurance contracts, even after over a decade of reform meant to save costs for policyholders in risk-prone industries like real estate development and construction.

Recent wrongful death and worker’s compensation complaints involving high-profile Chicago developments have shone a spotlight on Illinois’ subpar ranking in the price of the premiums faced by employers and workers.

The severity of worker’s compensation claims has dropped significantly in Illinois, yet the state’s worker’s comp insurance rate premiums were 19th-highest in the nation as of 2022, a huge drop from 35th-priciest since the state enacted reforms in 2011, according to the biannual industry standard Oregon Workers’ Compensation Premium Rate Ranking; construction and manufacturing account for a considerable portion of the total.

Reforms in 2011 were supposed to lower costs for Illinois employers.

“Instead, the insurance industry has pocketed enormous profits and has not passed any savings along to employers,” the Illinois Trial Lawyers Association declares on its website. “Any further changes in laws should instead look to promote insurance premium transparency and oversight — not further sacrifices by injured workers.”

While some marks of progress have been made, such as a 34 percent decline in the number of worker’s compensation cases filed since 2011, things could be better, as Illinois trails Midwest peers like Indiana, Michigan and Ohio, which all have lower average premium rates.

Further insurance premium rate drops could ease the burden faced by real estate players, as some try to dig Chicago out of its affordable housing crisis via projects such as 43Green.

Some of the responsibility falls to the insurers themselves, to step up and deal with each other in better faith than they have been in some recent cases regarding high-profile Chicago real estate projects, according to state court records.

A common issue that increases rate prices — meaning the premiums paid by employers for protection against wrongful death and worker’s compensation claims — are the frequent fights between insurers about which of them should be on the hook for defending the case.

That’s the situation the developers of 43Green’s second phase are facing.

The developer is a venture of Chicago-based The Habitat Company and Phil Beckham’s P3 Markets, and, along with their general contractor James McHugh Construction, they were all hit by a lawsuit in December accusing their entities of negligence that led to the death of Martinez. He was employed by a subcontractor on the construction job in November 2022, when he had a heart attack on the site. He had another heart attack at the hospital later on and subsequently died, according to court documents.

The complaint accuses the developers and contractor of negligence for failing to keep an AED on the site, as well as forcing Martinez to walk eight flights of stairs while carrying heavy equipment despite his difficulty climbing. The developers and builder deny wrongdoing.

43Green, a product of former Chicago mayor Lori Lightfoot’s Invest South/West initiative aimed at revitalizing underserved neighborhoods, has been hailed as a crucial transit-oriented development for accelerating Bronzeille’s rise by bringing 80 affordable apartments to the area.

The developers and their contractor have been begging an insurer to step up to its defense.

State Farm has failed to hold up its end of its deal with the developers and contractor for serving as its insurer during the project, according to a lawsuit McHugh and the developers filed last week in response to the Martinez case.

They claim State Farm has wrongly refused to come to the development’s defense, which would minimize the potential financial damage posed by the complaint. It has so far cost James McHugh and its separate self-funded insurance policy money out of their pockets to defend. The parties all either declined to comment or didn’t respond to The Real Deal.

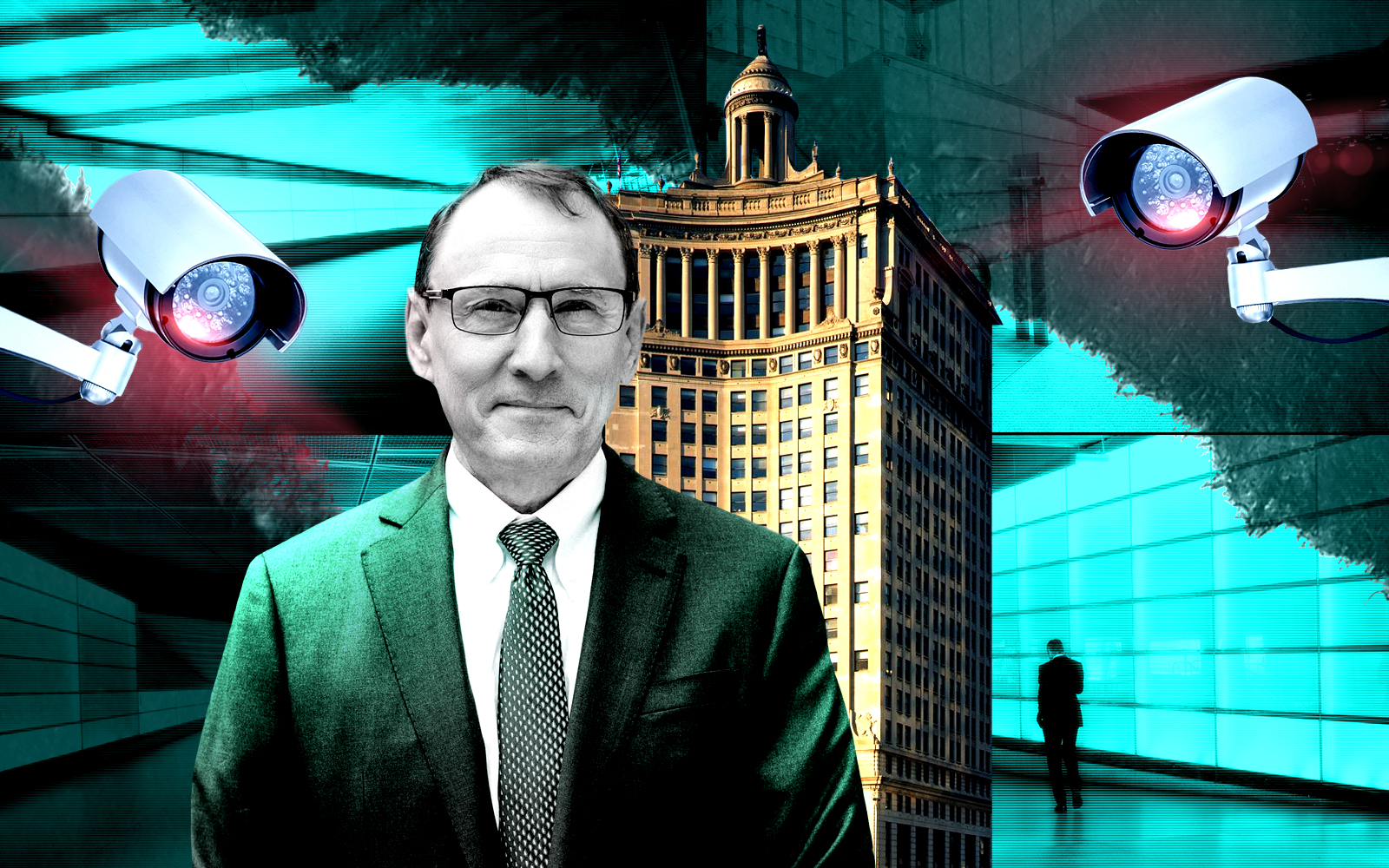

It’s far from the only contentious fight over serious injuries or deaths on a Chicago construction site to spawn one or more additional lawsuits. Hundreds of lawsuits in which one insurance company alleges another is responsible for funding a claim or a policyholder’s legal defense litter the Cook County court docket. Multiple lawsuits are set to get underway after one worker died and another was critically injured on June 6 at a University of Chicago construction site where they fell from scaffolding.

No fewer than four lawsuits have been filed in response to a worker getting seriously hurt in a fall during the conversion of a landmark Wacker Drive building from offices into the LondonHouse Hotel. The initial suit was filed more than six years ago, yet several of the subsequent complaints are still winding through court as insurance companies joust over which one is responsible for funding a claim that’s been complicated by the failure of one party — MBRE, the brokerage and property management firm acquired by Transwestern in 2022 — to come forward with video evidence of the incident.

Of course, it’s the insurance companies’ job to protect their policyholders from funding claims so they can keep their premiums down. That often means they’ll calculate that the costs of duking it out in court are worth incurring.

But with disputes like these often proliferating more and more lawsuits, each one denoting an insurer trying to pass the buck to a different insurance company, and each usually taking a year or more to get to a resolution — all the while dragging out pain and uncertainty for both those employees and their families who deserve payouts — it seems like this is an area ripe for cleaning up.

Read more

Getting to resolutions with less fighting, less time, and more efficiency should save everyone money, and, without knowing or predicting whether any of the parties mentioned here are legally obligated to do what their opponents in court want, such an improvement would would require insurers to agree to actually provide coverage rather than consistently looking to pass on responsibility.

And if that happens, real estate players and their contractors should enjoy the benefits — and so should their tenants and buyers.