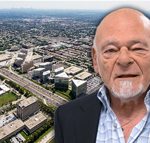

It’s the end of an era for Equity Commonwealth, as the Chicago-based real estate investment trust plans to liquidate its assets and shut down.

After years of accumulating cash, Equity Commonwealth, previously led by the late Sam Zell, intends to liquidate all company assets and dissolve after calls from activist investors to return capital to shareholders, Crain’s reported.

The firm had been looking for a megadeal to deploy its warchest and take it to the next level for years.

“After working through our pipeline, we have been unable to consummate a compelling transaction. As a result, our board of trustees has determined that it’s advisable and in the best interest of our shareholders to proceed with the wind-down of our operations and the liquidation of our assets in order to maximize value for shareholders,” Equity Commonwealth CEO David Helfand said during a conference call with analysts on Wednesday.

The company had already sold most of its office properties before the COVID-19 pandemic, amassing a large cash pile earmarked for real estate acquisitions. A significant deal almost materialized in 2021, when Zell’s firm tried a $3.4 billion takeover bid of Monmouth Real Estate Investment, but it ultimately lost out to Industrial Logistics Property Trust. Zell, who took over Equity Commonwealth with Helfand in 2014, died in May of 2023 at 81, leaving the company without his crucial guidance.

Shareholders became increasingly frustrated, notably San Francisco’s Indaba Capital Management and Stamford, Connecticut’s Land & Buildings, which collectively hold approximately 6 percent of the company.

Extended immobilization of capital and high executive expenses at the company led the two activist investors to amplify their calls for liquidation.

Equity Commonwealth had nearly $2.2 billion in cash on hand at the end of March, regulatory filings show. The company still has four properties in its portfolio. Three are in the process of being sold — two in Austin and one in Washington, D.C. — and the fourth is being marketed in Denver.

The firm plans to distribute sale proceeds to shareholders by June of next year. A preliminary proxy recommending the liquidation plan is expected by mid-September.

The liquidation has been positively received by some shareholders, including New York-based investment firm Irenic Capital Management.

“We commend Equity Commonwealth’s Board and its management team for making the difficult but correct decision to recommend a liquidation. At the risk of being too subtle: we’re pleased,” a statement from Irenic said.

— Andrew Terrell

Read more