A Los Angeles-based investment firm has expanded its Chicago area holdings with a suburban multifamily acquisition.

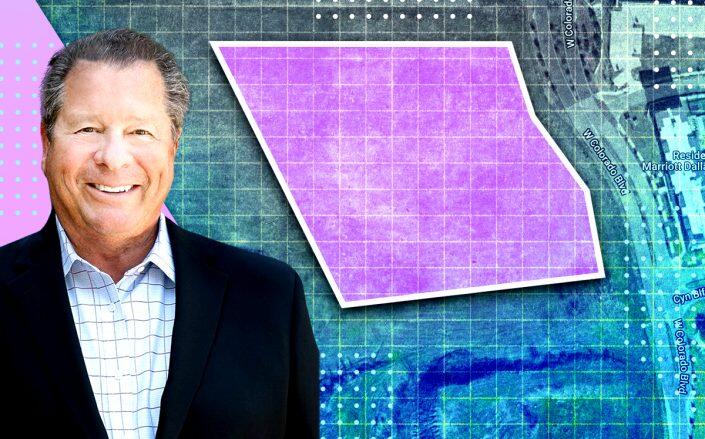

JRK Property Holdings bought the 288-unit Brook on Janes apartment complex in Bolingbrook for $69.3 million, Crain’s reported. The price is $240,600 per unit.

The property, at 401 Janes Avenue, was purchased from Quarterra, the multifamily investment and development arm of homebuilder Lennar. The deal was brokered by Jones Lang LaSalle, with financing provided through a $48.5 million loan from Freddie Mac that matures in September 2034.

Quarterra built the apartment complex in 2017, financing construction with a $29.7 million loan. The three-story complex is 97 percent occupied and commands an average effective rent of $2,126 per month, according to MSCI Real Assets.

JRK’s acquisition expands the firm’s Chicago-area portfolio — which includes other significant properties in Arlington Heights and Lombard — and it highlights the growing opportunities surrounding the multifamily sector, JRK President Daniel Lippman said.

“We’re finally seeing seller capitulation on pricing expectations, which has allowed us to significantly ramp up our acquisition activity,” Lippman said.

JRK is planning to invest $1.5 to $2 billion over the next 12 to 18 months in similar acquisitions, and it is not the only buyer eyeing multifamily properties. Investor activity in apartment buildings has seen a sharp increase, with national transaction volumes up 20 percent year-over-year in the second quarter.

The firm recently listed a 1970s apartment complex in Arlington Heights that it bought for $93,000 per unit in 2014.

The suburban Chicago apartment market is experiencing rent growth. Median net rent in the Will County submarket, which includes Bolingbrook, increased by 1.5 percent year-over-year, rising to $1.99 per square foot in the first quarter.

Quarterra recently sold 18 properties totaling more than 5,200 units in coastal and Sun Belt markets to global investment firm KKR. The firm also sold the 270-unit Emerson apartments in Oak Park for more than $60 million in July.

— Andrew Terrell

Read more