Draper & Kramer has relisted a South Loop apartment tower with a twist this time: an assumable low-interest loan.

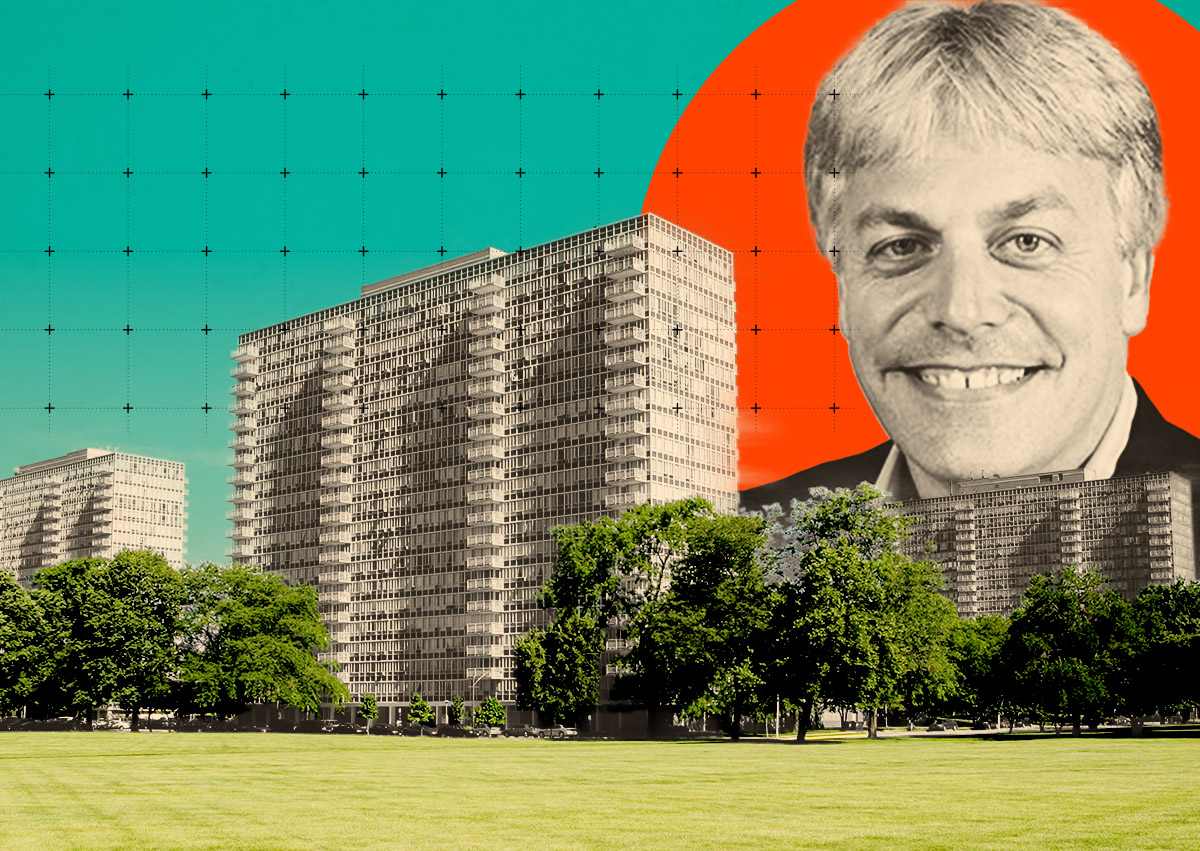

The Chicago-based multifamily developer is seeking a buyer for Eleven Thirty, a 656-unit apartment tower at 1130 South Michigan Avenue, CoStar reported. CBRE’s John Jaeger, Justin Puppi, Jason Zyck, Danny Zeboski and Pete Marino are marketing the property.

The assumable loan from Allianz Life Insurance was issued in 2017 with a 3.7 percent interest rate, well below current market levels. The loan has a remaining balance of $85.8 million ($130,800 per unit) and matures in 2047. Monthly payments for principal and interest are $463,000.

Eleven Thirty has been a mainstay in the South Loop since it was built in 1967. The 43-story tower’s asking rents are $2,306 per unit, or $3.03 per square foot, according to data from CoStar. The building, more than 95 percent leased, features ground-floor retail with tenants such as Yolk Restaurant, Lakeview Market and Hand & Stone Spa.

Although the firm has a long history of holding onto assets, it has been divesting some of its larger properties. In 2022, the developer sold the 1,869-unit Lake Meadows complex on the city’s South Side to Antheus Capital for $161 million ($86,000 per unit). Later that year, the firm sold Aspire Residences, a 275-unit tower in the South Loop, to the same buyer for $59 million ($215,000 per unit).

Draper and Kramer, led by president and CEO Todd Bancroft, initially listed its South Michigan apartment tower with another brokerage last year, but a sale did not materialize.

The assumable loan structure has become an increasingly common way to secure buyers in Chicago’s difficult market. Recent examples include the $17 million sale of Brix on Morse in Rogers Park, the $94 million sale of the Haven on Long Grove in Aurora, and the $31 million sale of the 78-unit MODE Logan Square Apartments.

Though the Federal Reserve recently reduced its baseline interest rate, the loan assumption offers a hedge against potential rate hikes in the future, potentially driving interest from investors looking for stable, long-term returns.

— Andrew Terrell

Read more