A California investment firm acquired its first asset in Chicago, attracted by what it considers a post-peak multifamily market.

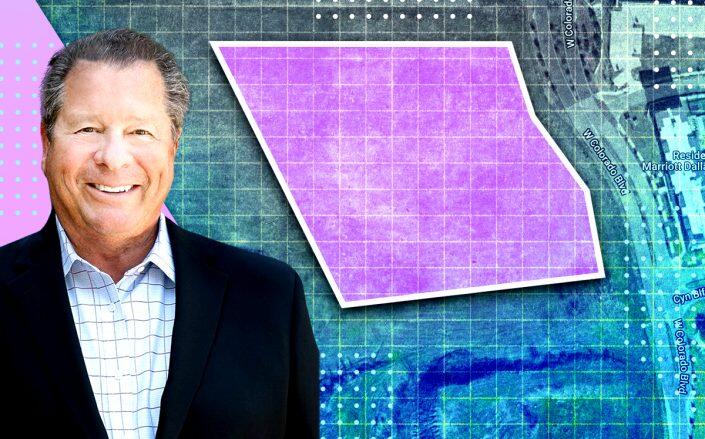

Virtú Investments bought The Marlowe, a 176-unit apartment building at 169 West Huron Street in River North, Crain’s reported. The transaction adds to Virtú’s portfolio of more than two dozen apartment buildings primarily situated on the West Coast.

The sale price was not disclosed, but anonymous sources told the outlet that it ranged between $60 million and $70 million ($340,900 to $397,700 per unit).

The acquisition was financed through a Fannie Mae loan, which covered 60 percent of the purchase price. The reported price would be a loss for Marlowe’s seller and developer, Charlotte, North Carolina-based Quarterra — the multifamily arm of national homebuilder Lennar — delivered it in 2018 with $43.4 million in construction financing and about $30 million in equity.

Chicago is projected to face an undersupply of downtown apartments next year, as the development pipeline dries up, resulting in a spike in rental prices, market conditions that inspired the investment, CEO Michael Green said.

“You’ve got markets in the Sun Belt that everyone’s really excited about, Phoenix and Austin,” he said. “Their supply pipelines are now peaking, whereas I think Chicago’s peaked two years ago.”

Despite the challenges facing the Chicago market, Green is confident in the long-term potential of the city.

“It was a perfect opportunity to go in at a lower basis and get a piece of Chicago when we think it has several good years in front of it,” he said.

Virtú plans to maintain ownership of The Marlowe for the foreseeable future.

Quarterra also recently sold a 288-unit apartment complex in suburban Bolingbrook to JRK Property Holdings for $69.3 million, or $240,600 per unit.

— Andrew Terrell

Read more