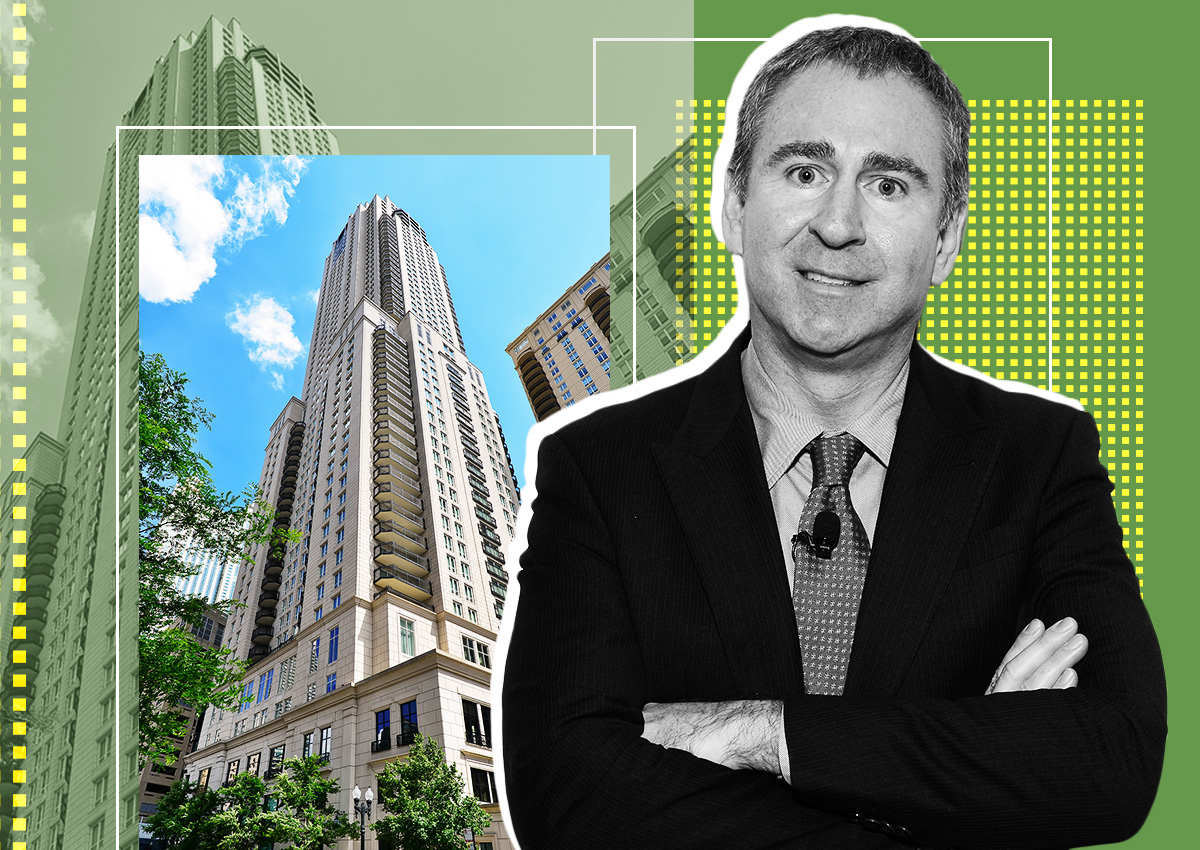

Ken Griffin’s Chicago condos are flying off the shelves.

The billionaire hedge fund manager and Florida transplant took another real estate loss here, selling two unfinished floors at No. 9 Walton in Gold Coast, Crain’s reported.

The two floors sold to an undisclosed buyer for a combined $19 million; the 37th and 38th floors fetched $9 million and $10 million, respectively. The 38th floor has a private rooftop pool and sold for $1,200 per square foot.

The sale comes at a $14.65 million loss for Griffin, who purchased the two floors in 2017 for $33.65 million.

It’s also the priciest residential purchase in Chicago this year, edging out a Lincoln Park mansion that sold in August for $15.25 million. It also brings the number of sales of $4 million and up this year to 75, surpassing last year’s 73 — with over a month to spare.

Nancy Tassone of Jameson Sotheby’s International Realty and Emily Sachs Wong of @properties Christie’s International Real Estate represented Griffin, and Compass’ Katherine Malkin represented the buyer.

Griffin purchased floors 35 and 36 at 9 Walton Street at the same time as the other floors, in a deal totaling over $58 million, and he still holds the two lower floors.

Griffin’s divestment at No. 9 Walton continues a series of luxury residential sales since he moved to Florida a few years ago. Alongside a $3.8 million loss on his 66th floor condo at Park Tower, he has also notched a $1.8 million loss on his 37th-floor condo at the Waldorf Astoria.

Griffin’s cumulative losses exceed $21.5 million. This price depreciation is not isolated to Griffin and his condo holdings. With economic pressures and shifting demand, Chicago’s real estate market, especially in the high-end segment, is seeing a trend of declining valuations.

A downtown Chicago condo recently sold for $900,000, a notable drop from its 1989 sale price of $1.1 million, for example.

Billionaire Michael Krasny reduced the asking price for his 50th floor condo at Park Tower to $6.9 million, down from $9.8 million.

— Andrew Terrell

Read more