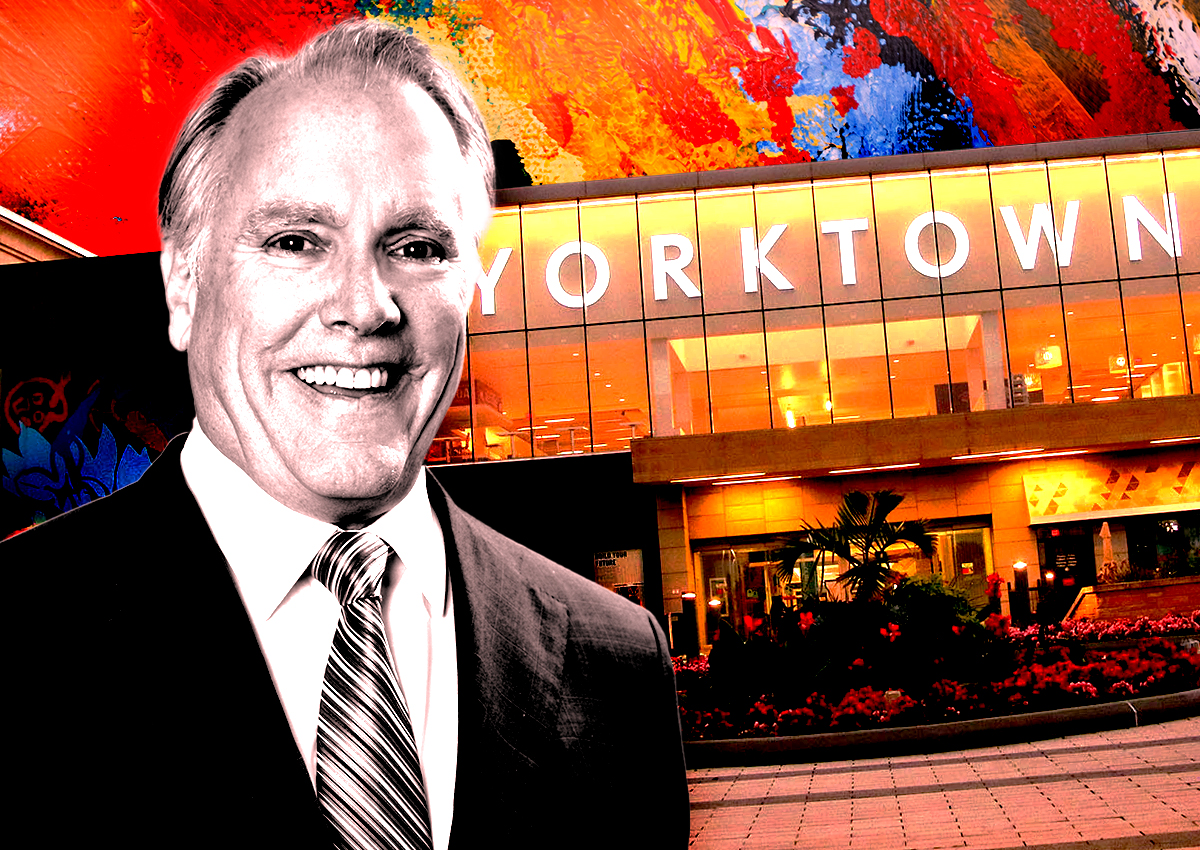

Synergy Construction & Development’s multifamily redevelopment at Yorktown Center shopping mall in Lombard landed a big construction loan.

The Chicago-based firm secured $92 million in financing to start the first phase of Yorktown Reserve, a multifamily development that will eventually include up to 600 apartments, Crain’s reported.

The financing package includes $56 million from CIBC Bank and Republic Bank, $12.5 million from Fidelity Investments, and $23.5 million in equity from BJB Properties. Lombard trustees are also supporting the project with public incentives, including $20 million in tax-increment financing.

Synergy has partnered with Pacific Retail Capital Partners, the mall’s owner and operator, to execute the redevelopment.

“How do you save the more antiquated, inward-facing mall? Well, you open it up and maybe take away some of these boxes and bring true mixed-use development to it,” Synergy principal Phil Dominico told the outlet.

The 175,000-square-foot former Carson’s department store is being demolished for the first phase, to make way for 271 market-rate apartments in a mid-rise, wrap-style structure, complemented by 2 acres of green space.

Construction is already underway, with completion of the first phase anticipated by summer 2026.

Tenants at the Yorktown Center include Dave & Buster’s, Fresh Market, Empire Burger and Ancho & Agave. If the project is successful, the Yorktown redevelopment could become a model for future projects involving aging mall assets, the firm believes.

Inspired by Yorktown Reserve, Synergy is also considering a similar project at Schaumburg’s Woodfield Mall — Illinois’ largest shopping center. Although still in early discussions with mall owner Simon Property Group, the concept would bring residential units to the 2.2 million-square-foot property.

Chicago’s suburban multifamily market is outperforming that of the city in terms of investment sales, due to a multitude of factors, including politics.

— Andrew Terrell

Read more