Santefort pushed forward without a loan and plans to take on debt post-closing to pull off one more suburban Chicago multifamily deal before the end of 2024.

GSP Development sold its 181-unit apartment complex in Lombard to Westmont-based Santefort Real Estate Group in a $46 million deal closed at the end of last year, public records show.

Santefort purchased the building outright using “internal financing,” but is currently shopping around for a mortgage to finance the property, the firm’s Chief Operating and Financial Officer Brian Gallagher said.

This – coupled with the fact that Santefort will continue working with the building’s current property manager, RMK Management Corporation – made for a quick closing, Gallagher said. Other big apartment listings have lingered on the market or struggled to fetch prices attractive to their sellers due to the elevated costs of financing since the Federal Reserve’s campaign of interest rate hikes began in 2022.

“That was part of our attractiveness to the seller – that we could get this done quickly,” he said. “We’re going to prepare to finance it, but we’re going to keep an eye on where rates are heading first.”

The firm is looking for a mortgage with the help of Maverick Commercial Mortgage’s Ben Kadish, Gallagher said.

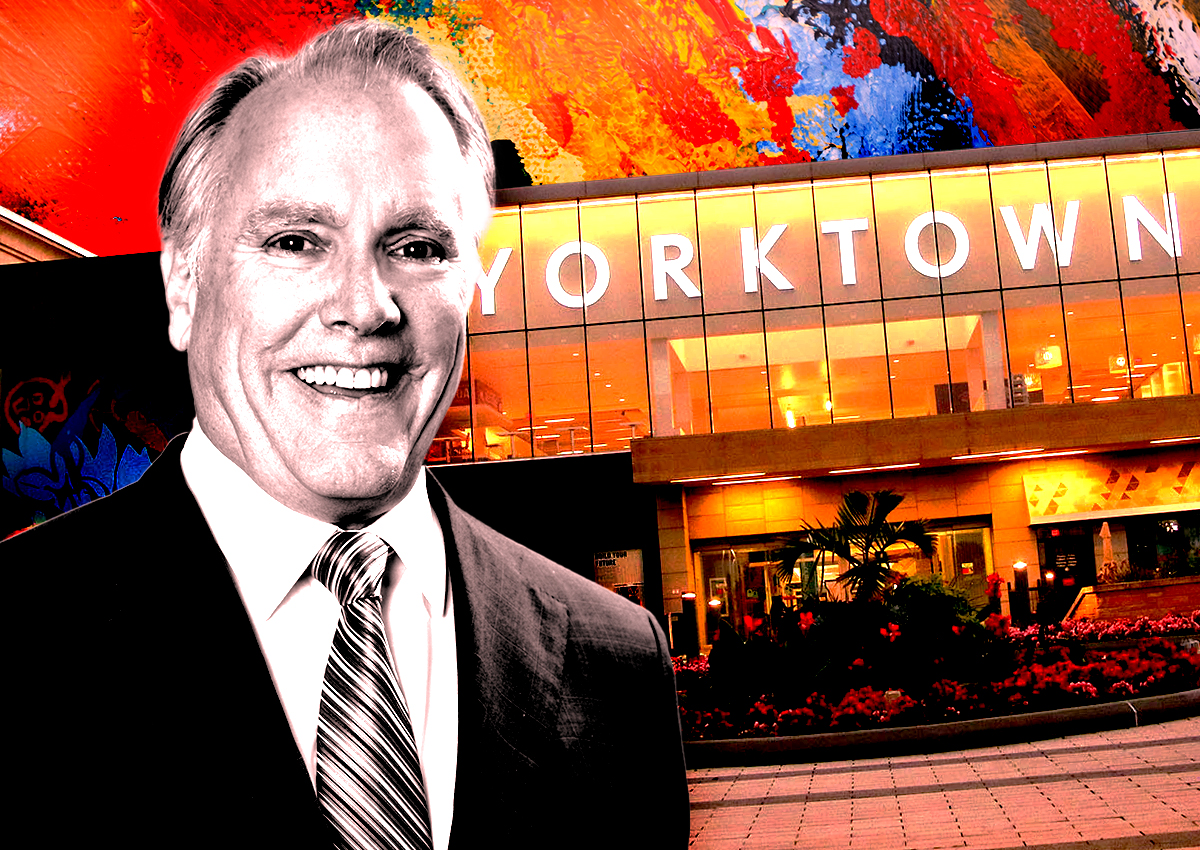

Des Plaines-based GSP finished construction on the apartment complex, known as ‘Apex 41,’ in March 2017. The building located at 2760 South Highland Avenue in Lombard near the Yorktown Center mall is five stories and sits atop a heated parking garage.

Apex 41 was owned and sold by an LLC managed by GSP President and Founder Larry Debb, who could not immediately be reached for comment Thursday. Debb first purchased the 3-acre site in 2015 and took out a $32.4 million construction loan with PNC Bank shortly thereafter.

In the summer of 2019, GSP secured a $33.1 million senior loan to refinance the building through PCCP LLC, a New York-based lender and investment manager. The loan was taken out to repay the preexisting construction loan and to allow for more time to get the property stabilized and fully leased up.

The Apex 41 complex is part of a larger, 60-acre mixed-use development by GSP that includes a 150,000-square-foot Sears Great Indoors and “120,000 square feet of multi-tenant retail,” according to the developer’s website.

Gallagher called Apex 41 an “outstanding asset” in the group’s area of interest that will serve as a great long-term investment for the company. Today, Apex 41 is “well over” 90 percent occupied and has no outstanding collections on the building, making it a stable asset in a strong residential market for commuters, he said.

“We think it’s a great market. …It’s probably only 25 minutes in good traffic to Chicago, and yet, it’s also great for going west to other location centers,” Gallagher said. “It’s just a great property, well built, and we’re very excited to get it.”

Read more