Hines, Chris Kennedy of a famous American political family and their investment partners in a 60-story skyscraper in Chicago have defied the pandemic-induced downturn for commercial office space.

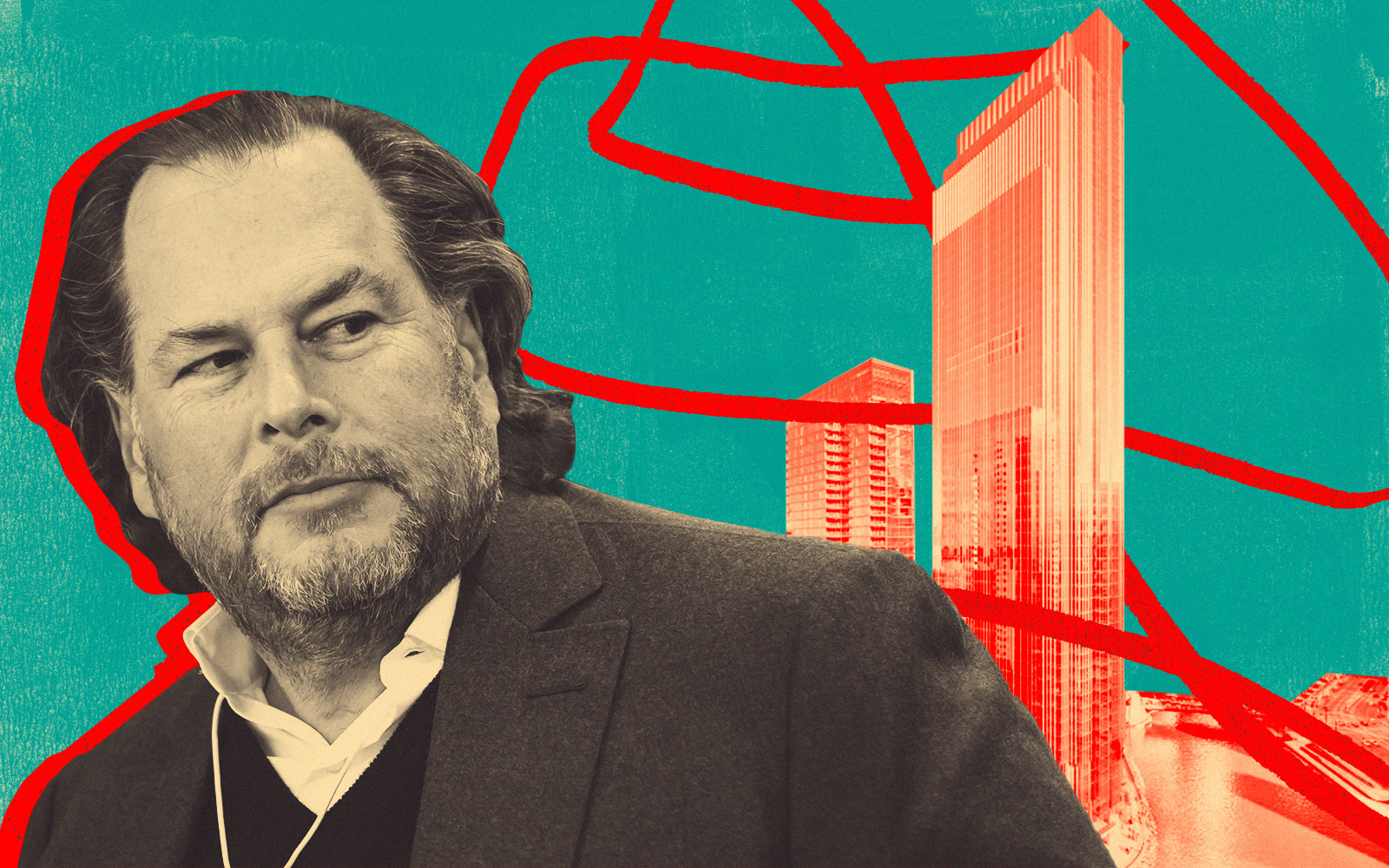

The owners of Salesforce Tower on the bank of the Chicago River are nearing the finalization of a $610 million long-term debt deal, marking a milestone in the aftermath of the pandemic-stricken economy, CoStar News reported. Should the deal close later this month as expected, the property — developed by Hines and the Kennedy family as well as the AFL-CIO’s real estate investment arm — will stand as a contrarian bet that worked out amid economic uncertainty.

The commercial mortgage-backed securities loan reflects the tower’s long-term valuation of $888 million, as appraised by Cushman & Wakefield. Its current valuation of $745 million is expected to rise further following the repayment of tenant-improvement costs and free rent allowances.

The refinancing package, with Wells Fargo, JPMorgan Chase and Goldman Sachs serving as the lenders, will replace the property’s $549 million construction debt and is projected to carry an interest rate of 6.525 percent until its maturity in March 2030.

Conceived during the early days of the pandemic, Salesforce Tower has upended market trends by maintaining high occupancy levels, with leases covering over 95 percent of its 1.2 million square feet. Key tenants include Salesforce, which rents more than 477,000 square feet, and Kirkland & Ellis, which is on a 677,000-square-foot lease; those deals run into the 2040s.

Meanwhile, much of the rest of the Chicago office market is depressed, with record-high vacancy rates of more than 25 percent and massive foreclosure lawsuits against office landlords winding through Cook County court.

For the Salesforce Tower developers and Chicago’s broader office market, scoring the loan is a testament to the investment thesis that the world’s largest companies remain interested in ultra-premium workspace and aren’t afraid to invest heavily in it as a method to attract and retain top talent. Kirkland has poured over $207 million beyond its tenant-improvement allowance to create its ideal workspaces, while Salesforce has put up an additional $78 million for its interior buildout, the Moody’s report cited by the outlet shows.

Moody’s put out a robust outlook on the deal, buoyed by a net operating income projected to reach about $51.2 million by the second year of the loan.

Eastdil Secured arranged the financing package for Salesforce Tower.

Read more