The “It” buildings in each of The Real Deal’s markets are condo developments that typify the moment in their regions, according to brokers, insiders and our reporters’ carefully honed instincts. You can read the full series here.

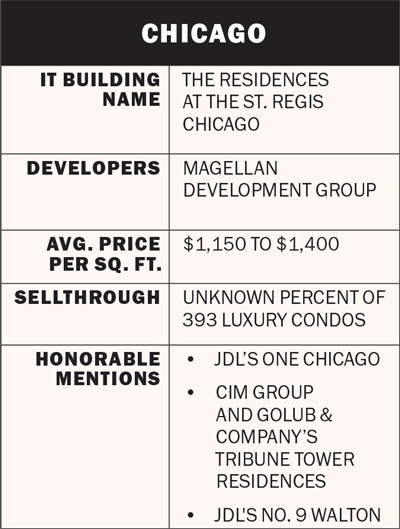

The St. Regis has mirrored the ups and downs of Chicago’s downtown condo market since local developer Magellan brought its 393 luxury residences for sale. The tower at 363 East Wacker Drive is connected to a 192-room St. Regis hotel tower in a sleek, tiered Jeanne Gang-designed building whose color and waved exterior evoke Lake Michigan.

The $1 billion hotel and condo megadevelopment broke ground in 2016 and was originally named the Wanda Vista Tower after the Chinese multinational conglomerate, Dalian Wanda Group, that funded the development. Magellan Development Group bought out Dalian Wanda Group’s 90 percent stake in the project in the fall of 2020 and struck a deal with St. Regis Hotels & Resorts.

The building opened shortly thereafter. But downtown Chicago was a whole new world from the one in which the project had been planned and built. Homebuyers were now leaving downtown condos in search of roomier homes farther from the city center.

Almost five years later, Chicago’s condo market has not returned to pre-pandemic health, though a rebound in sales hints at a recent thaw. At the St. Regis, developers are still working to sell remaining available units.

The Residences at St. Regis notched 26 sales last year — an average of 2.16 per month — excluding a recent bulk sale, according to MLS data. This put the project on the same slow pace as other recently opened luxury buildings downtown and marked an improvement over a slow 2023 selling season at the St. Regis and within the broader downtown condo market.

But buzz might be building again. There were three multi-million dollar sales at the St. Regis in early January, two of which were over $6 million — a strong start to the new year. A 76th-floor unit went for $8.3 million in November, making it the most expensive sale at the 101-story skyscraper since a Mexican mining executive purchased the 71st and 72nd penthouse floors for $20.6 million in a much healthier condo market back in 2022.

The second wind comes with some sacrifice.

In 2023, when selling downtown condos was like “crickets,” as one broker put it, developer Magellan decided to take out a $150 million loan against unsold condo units at the building. Condo inventory loans like these are typically used to allow for more time to sell, in the hopes of achieving higher prices.

Then, in November, Magellan sold 84 units to GD Holdings for $117 million, or almost $1.4 million per unit, in a bulk sale. Denver-based GD Holdings previously purchased the hotel portion of the property in a nine-figure deal.

Now, the building’s original investor, Dalian Wanda Group, is gearing up for another bulk sale to offload 37 condo units — the remainder of its stake in the property, according to CoStar.

Bulk sales like these can be a knock on a project, sparking concern about a building’s financial health, particularly if it’s been on the market for a while, according to David Wolf, local broker and CEO of Wolf Development Strategies.

But bulk sales don’t always signal deeper distress, Wolf said. Much of the St. Regis’ remaining units are pricier, making them hard to sell at a time when luxury buyers seem to seek a lower price point.

A media representative for Magellan declined to respond to questions from The Real Deal about the bulk sale, or recent discounted sales.

Carrie McCormick, a top broker with @properties Christie’s International Real Estate, said she never lost confidence in the building as a good investment opportunity because of its location, management and the strength of the brand.

“The prices did dip a little bit over there,” she said. “To me, that’s a good buying opportunity, very similar to a stock. Something that’s a good brand, but they went through a tough time, and it’s buying low and selling high.”

Luxury brokers like McCormick still vie for listings in the St. Regis, with McCormick prepping to list a 32nd-floor unit in May, because, at an asking price around $2 million, even the building’s smaller sales are sizable for the Chicago market.

Leila Zammatta, senior vice president of sales with Magellan Development, is still heading sales at the St. Regis.

A media representative for Magellan declined to respond to questions about the pace of sales at the building or the number of vacant units that remain available, but said that “sales are on track with our expectations in 2025.”