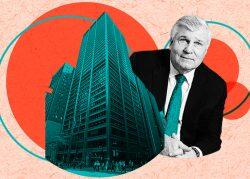

One of Chicago’s most celebrated real estate developments is caught in the crossfire of a legal dispute between the Prime Group’s Mike Reschke and one of his early business partners.

Investor and orthodontist Edward John claims in a lawsuit filed last month that The Prime Group owes him $45 million stemming from two loans the company issued to him in exchange for some of his shares.

John claims that the highly anticipated redevelopment of the Loop’s Thompson Center into Google’s Midwest headquarters, led by a joint venture of Prime and Quintin Primo’s Capri Investment Group, indicates that Prime is capable of paying back those notes.

The dispute dates back to 2007, when Prime bought some of John’s shares, according to the legal filing. Reschke signed off on the paperwork in his capacity as CEO and Chairman of the company. Rather than paying for those shares up front, Prime issued John a $16 million note with a 2010 maturity date. In 2017, Prime bought additional shares via another note worth $1.1 million. The maturity dates on the loan notes, which both carry an 8 percent interest rate, have been extended multiple times, John claims.

Since selling off the shares, John has maintained a minority stake in Prime, which Reschke has ridden through multiple rises and falls over decades of the firm’s involvement in major Chicago real estate developments.

Now, John claims that the repayments on the loans are past due and with interest and penalties, the debt totals $45 million. He issued notices of default to Prime last year, and when Prime didn’t repay the loans, John filed a lawsuit in Cook County circuit court.

“Contrary to his self-perpetuated image as a civic-minded dealmaker, Reschke has proved himself a bum creditor and unfaithful fiduciary,” the filing states.

While Reschke has a history of battling financiers, Prime denies those claims.

“The plaintiff has not contributed capital to the Prime Group or its affiliates in over four decades. The allegations are baseless, substantially false and legally without merit,” a statement from Prime said.

John claims Reschke stands to earn $100 million in profit from the Thompson Center redevelopment plan, although it’s unclear in the filing how the investor arrived at that figure.

Reschke struck a deal with the state of Illinois to buy the Thompson Center for $70 million in 2021 with plans to renovate the Helmut Jahn-designed, postmodern-style building and maintain its use as an office tower.

That changed when Capri’s Primo played a key role in securing an offer from Google to take over the building. Google tapped a joint venture of Prime and Capri to lead a $300 million revamp of the building while allowing the developers to collect a fee on the project. Construction began last year.

To make the deal happen, Reschke had to re-work his agreement with the state because his original plan included space for some of the state employees previously working out of the Thompson Center. In the restructured deal between Prime, Capri and Google, the state was paid another $30 million for the Thompson Center, and a Reschke-led venture gave the state an office building at 115 South LaSalle Street, which was estimated to be worth $75 million at the time.

John claims the deal was structured in a way that allowed Reschke to “keep the lucrative Google opportunity to himself.”

In addition to requesting that Prime him back, John’s lawsuit requests that a judge order “the removal of Reschke and his family members from any director or officer positions at Prime Group and its affiliates.”

Prime, however, stated that the filing concerns “decades-old financial arrangements and internal governance disputes that bear no relevance to the company’s current day-to-day operations,” and that it is a “private, civil matter.”

“The lawsuit does not affect our leadership, our work, or any ongoing development, construction or property management activities,” the statement from Prime read.

An attorney for John and representatives of Google and Primo’s firm Capri did not respond to requests for comment.

A court date for John’s suit is scheduled for August 5; Prime and Reschke have yet to file a formal response.

Editor’s note: this post was updated to correct the structure of the promissory notes issued by The Prime Group and to properly reflect that Mike Reschke did not issue the notes personally but rather in his capacity as CEO and Chairman of The Prime Group.

Read more