The past year was bustling for Long Island’s residential and commercial real estate markets, with high demand for homes, consistent office rents, relatively low retail vacancies and continued demand for industrial space. Consumer confidence, meanwhile, was only higher in 1999 and 2000, said Ann Conroy, president of Douglas Elliman Real Estate’s Long Island Division.

“People trust in the economy on Long Island, people are buying houses. They still know it’s the best place you could put your money…and they believe in the region,” Conroy explained.

But with the stock market’s recent volatility, Conroy can readily recall the haunting aftermath of the financial crisis that swept across the globe in 2008. “The minute Lehman went under, it was almost like the lights went out,” Conroy said. “It was 2008 when we really saw drastic change in activity — it almost came to a halt.”

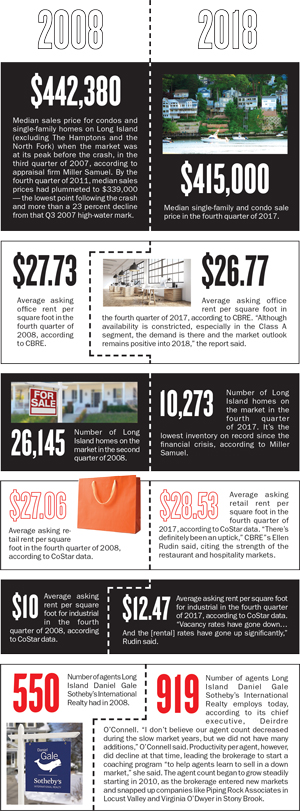

The impact was immediate. The fourth quarter of 2008 saw condo and single-family home sales on the island fall to 4,427 — a drop from third quarter sales of 5,292 — and by the first quarter of 2009, that number had plummeted to 2,872, a low point that it has never hit since, according to data compiled by appraisal firm Miller Samuel for Douglas Elliman. The Elliman report and CBRE market reports quoted in this piece exclude the Hamptons and the North Fork in their data sets. CoStar’s numbers include the entire East End.

By the fourth quarter of 2011, the median sales price for a home on Long Island hit the lowest point it would reach in the downturn, at $339,000 — a nearly 25 percent drop from the third quarter of 2007.

“People couldn’t sell their houses for what they bought them for…People were losing their homes. It was probably the most depressing time in real estate,” Conroy said.

And while 2017 was an active year for the residential market, it still hasn’t reached the heights it hit pre-crash, Conroy noted. “We’re almost there — we’re not there yet.” The median price on Long Island was up 6.6. percent from the year-ago quarter at $415,000 in Q4 2017, according to Douglas Elliman.

Overall, the commercial market didn’t experience the significant downturn that neighboring areas like Manhattan saw, according to Ellen Rudin, the managing director of CBRE’s Long Island and New York City Outer Boroughs offices. Nonetheless, it’s notable that today’s average office rent is down by about a dollar, from where it stood at the fourth quarter of 2008: $27.73, according to CBRE.

“The beauty of Long Island, if you will, is we have not overdeveloped — we didn’t have the lows that many regions had because we’re a very consistent market,” Rudin said.

While places like Manhattan go through phases where rents skyrocket and then pull back, Long Island doesn’t see those “huge swings,” she said. Rents on the office front today, for example, haven’t changed dramatically between now and the time of the crash, she noted.

A decade after the crash, The Real Deal looked at some of the numbers in the residential and commercial markets to gauge the success of Long Island’s recovery.