It’s a mixed bag when it comes to Long Island’s commercial real estate market. On the one hand, there’s notable action with Class A office properties, including the 233,000-square-foot $112-million headquarters of software company Dealertrack, due for completion this summer.

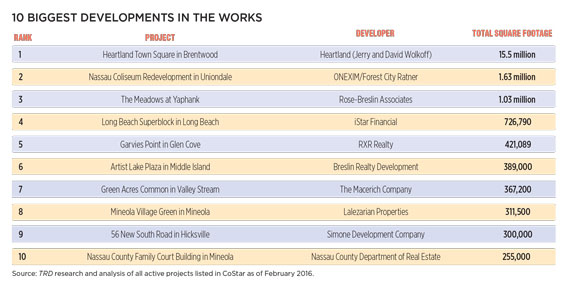

And then there’s the $260-million redevelopment of Nassau Coliseum in Uniondale and the upcoming $4-billion, 452-acre mixed-use Heartland Town Square project in Islip, which will house more than 9,000 rental apartments and condominiums, 1 million square feet of retail, 3 million square feet of office and one or more hotels.

But the market also faces its share of challenges. Population growth has become stagnant as empty nesters leave the area and millennials opt for higher-density urban areas with more multifamily options, said David Pennetta, executive director of Cushman & Wakefield’s Long Island office. Many employers, in turn, are reluctant to move to Long Island because the supply of younger employees is dwindling, he noted. Meanwhile approvals of most real estate projects are slow, thanks to the microscopic scrutiny resulting from the area’s 175 zoning and building districts.

Office

Despite the latest demographic shifts, demand for office space on Long Island has been on an upswing recently. Vacancy rates fell to 8.1 percent in the fourth quarter of 2015 from 15.7 percent the previous year, while the average asking price rose to $33.23 per square foot from $31.60 in the same period.

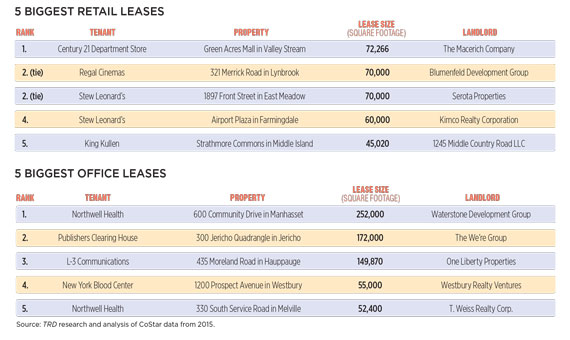

The expansion of health care systems has played a key role in local office market activity. One of the largest examples is Northwell Health’s $113.7 million 30-year lease-to-own agreement with Waterstone Development Group at 1111 Marcus Avenue in Lake Success, involving the purchase of a 940,000-square-foot office condominium.

At the end of the lease term in 2045, Northwell, the largest non-government employer on Long Island, will be gifted all 1.4 million square feet of the complex. The company also recently leased 252,000 square feet at 600 Community Drive in Manhasset and 52,400 square feet at 330 South Service Road in Melville.

Among the other major lease deals last year, Publishers Clearing House inked 172,000 square feet at 300 Jericho Quadrangle from the We’re Group and L-3 Communications took 149,870 square feet at 435 Moreland Road in Hauppauge from One Liberty Properties.

A lot of the action on the development side has been in Class A buildings. “We see a flight to quality,” said Martin Lomazow, a senior vice president in CBRE’s Long Island office. With new developments, there’s a growing interest in projects that exceed 50,000 square feet, he added.

C&W’s Pennetta told The Real Deal that “Class A office space in blocks that large are hard to come by in this area, so construction in that sector has come to life.”

One of the biggest new office developments in the works is the 233,000-square-foot, four- story building in North Hills, which is set to become Dealertrack’s new headquarters later this year. Setauket-based TRITEC Real Estate and Manhasset-based Castagna Realty, the project’s sponsors, began construction on the office building in late 2014.

Meanwhile, Long Island office sales transactions totaled roughly 2.5 million square feet in 2015, according to CBRE. Notable deals last year included Philips International’s $34 million acquisition of the 107,000-square-foot 60 Cuttermill Road in Great Neck and The Feil Organization’s $27 million purchase of 1305 Walt Whitman Road, an office building in Melville comprised of 165,310 square feet.

Retail

Retail space is hard to find on Long Island and demand is high. Vacancy rates declined to 4.9 percent in the fourth quarter of 2015 from 8.1 percent in the fourth quarter of 2014, while rents have steadily increased over the past five years, said Gregg Carlin, a senior vice president in CBRE’s Long Island office. “There’s been very little product available,” he said.

Dealtracker HQ

In fact, Long Island has the fifth lowest retail space vacancy rate in the nation, and the second lowest in the Northeast, according to the National Association of Realtors.

Among the most talked about projects is the Roosevelt Field mall expansion. Simon Property Group is in the middle of a $200 million expansion of the Garden City retail property, including a 50,000-square-foot dining district, which opened in January, and a 100,000-square-foot Neiman Marcus, which opened in February.

While most of the activity has been in the redevelopment of existing retail properties, there are also new ground-up construction projects in the works. The Macerich Company is building Green Acres Commons, a 20-acre outdoor shopping center next door to Green Acres Mall, and Flushing, Queens-based MVC Properties is constructing a new 82,000-square-foot strip mall at 1707 Middle Country Road in Suffolk County’s Centereach.

Likewise, several shopping center sales have taken place in the past year. Among those transactions, First Washington Realty and an unnamed joint venture partner bought the 187,000-square-foot Sunset Plaza Shopping Center in North Babylon for $63 million in December 2015.

Multifamily

The average asking rent per unit in Long Island rose slightly to $1,998 in the fourth quarter of 2015 from $1,954 in the fourth quarter of 2014.Vacancy rates ticked up slightly, from 1.2 percent to 1.7 percent in the same period.

Those figures, however, don’t tell the whole story. Many real estate experts say the supply of multifamily housing is too small to meet the needs of the area. There are about 26,000 multifamily units currently proposed or under construction, according to a report by HR&A Advisors and the nonprofit Regional Plan Association. But most of those units are in the proposal stage, according to Brian Lee, an executive managing director in Newmark Grubb Knight Frank’s Long Island office. As a result, millennials are increasingly eschewing Long Island in favor of higher-density urban areas with public transportation, as are many empty nesters, he said.

The most ambitious efforts to capitalize on this latent demand for multifamily housing are mixed–use developments that aim to build what Lee calls “mini cities.” The biggest project in the works is the planned 15.5-million-square-foot Heartland Town Square on the site of the former Pilgrim State Hospital in Islip. Jerry and David Wolkoff are the developers behind the massive project, which is scheduled to begin in 2017, according to a representative for Heartland.

Other projects are transit-oriented developments in downtown areas near Long Island Rail Road stations that aim to create vibrant high-density communities attractive to younger people.

Among them is the $500 million Wyandanch Village project in Babylon, a public-private partnership with the Albanese Organization as the master developer. The first phase opened with 91 units in November 2015, while the second phase opened with 86 units this January. The development, once fully completed, will also contain 40,000 square feet of retail and 90,000 square feet of office space.

On the multifamily sales front, the Dallas-based private equity firm Lone Star Funds acquired several multifamily properties in Bayport, Sayville, New Hyde Park, Hauppauge and other Long Island towns when it purchased Rochester, N.Y.-based Home Properties for about $7.6 billion in June 2015.

Industrial

With a vacancy rate of about 4 percent, Long Island’s industrial real estate market is exceedingly tight. That’s largely due to a shortage of land, especially in Nassau County.

“We’re on an island and there’s little room to expand,” said C&W’s Pennetta.

There’s also a chicken-and-egg situation. Despite the paltry supply and high demand, developers are hesitant to build because rents haven’t gone up enough. While they’re in the “low teens” in Nassau County, the highest on record, according to Pennetta, that’s still not enough to encourage development.

Heartland Town Square

“It’s too expensive to put up a building because they can’t make it back in rent,” said CBRE’s Lomazow. He recently represented a company looking for about 500,000 square feet of space for a distribution center, but, after a long search, they gave up and the client looked elsewhere, he said.

Some companies are responding by buying buildings and raising the roof height. One pending transaction is a contract involving Stellae International’s purchase of 50 Marcus Drive in Melville, now in negotiations. At about 160,000 square feet, the office building, which started out as industrial space, would be converted to industrial property again, according to one person who asked not to be named because the deal has not been finalized.

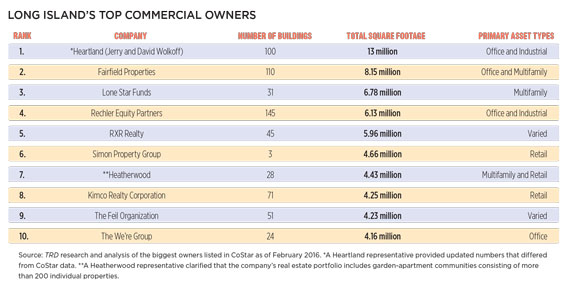

The largest industrial owners in Long Island are the Wolkoffs, with 13 million square feet divided among 100 or so office and industrial buildings, followed by Rechler Equity Partners, with 6.3 million square feet among 145 buildings, including both industrial and office.

Lodging

Long Island is seeing select hotel activity, while average daily room rates and revenue per available room are on the upswing. The average daily room rate in Suffolk County rose to $127.15 in the fourth quarter of 2015 from $122.25 the previous year, while RevPAR jumped to $84.02 from $75.41 in the same period. The average daily room rate in Nassau County grew to $141.17 in 2015 from $139.26 in 2014, while RevPAR climbed to $109.36 from $99.75.

The 165-room Hilton Garden Inn under development at 3 Harbor Drive in Port Washington is scheduled for completion in early 2017, while construction on the 60-room Huntington Hotel in Huntington Village is due to commence this spring.

In Melville, OTO Development, the developer of the proposed 160-room, four-story Hyatt Place, is in the midst of trying to persuade the town’s zoning board to pave the way for the property at 500 Broad Hollow Road, according to C&W’s Penetta.

Additionally, the massive Heartland Town Square plan includes hotel space for an estimated 250 rooms.

One of last year’s biggest hotel sales was the 10-acre Panoramic View Resort & Residences at 272 Old Montauk Highway in Montauk. Lloyd Goldman’s BLDG Management and George Filopoulos’ Metrovest Equities acquired the property, which includes 50 hotel rooms, 12 townhouses and three beach cottages, for $70 million in December. The buyers are also owners of Gurney’s Montauk Resort & Seawater Spa, which is right next door.

On the downside, plans for the $260 million redevelopment of the 77-acre Nassau Coliseum site in Uniondale originally included a hotel, but those plans were later scraped.

Now, the first phase of the 416,000-square-foot Nassau Coliseum arena renovation and development of 188,000 square feet of surrounding property — which is being led by ONEXIM Sports & Entertainment and Forest City Ratner Companies — includes a movie theater, restaurants and additional unspecified entertainment venues, as well as parking garages.