When three progressive politicians met with a senior executive at the Blackstone Group in February, the fate of 6,200 Manhattan apartments hung in the balance.

New York State Assembly member Harvey Epstein, state Sen. Brad Hoylman and City Council member Keith Powers requested the meeting, concerned that Blackstone, which has $545 billion in assets under management, would plow ahead with a plan to deregulate the Stuyvesant Town-Peter Cooper Village apartments under a complex tax incentive program known as J-51.

As it turned out, the politicians were intermediaries sent to the investment giant’s Park Avenue headquarters in Midtown by four residents of Stuy Town. The tenants, who later filed a lawsuit against Blackstone, were concerned after hearing, indirectly, that their landlord was digging in its heels following Albany’s rent law overhaul last summer.

Blackstone and silent partner Ivanhoé Cambridge purchased the 11,200-unit housing complex out of default for $5.3 billion in 2015. And Stuy Town — which made history following a record sale and monumental fiasco years prior — became the stage for another drama after the city and Blackstone struck a deal over a $220 million financing package.

The agreement was that the investment firm would keep 5,000 units below market rate for a 20-year period, renting out the remaining units under whichever housing laws apply. At the time, that meant the deregulation of apartments would begin this year.

“Blackstone indicated to our elected representatives they would follow the terms of the regulatory agreement, and that means 6,200 units are slated to be deregulated,” said Susan Steinberg, president of the Stuyvesant Town-Peter Cooper Village Tenants Association and a plaintiff in the lawsuit.

Driven by the promise of double-digit returns the firm made to investors, Blackstone has every incentive to stick to its business plan, according to Steinberg and others familiar with the matter.

“We welcome the court’s involvement, but to be clear, no tenant subject to the J-51 program has seen an increase in rents above those legally allowed under rent stabilization,” a Blackstone spokesperson told The Real Deal in a statement.

But the Stuy Town tenants argue that the state’s 2019 rent law overrules the one-time regulatory agreement, and that it should prevent Blackstone from carrying out the deregulation.

At the same time, the plaintiffs are targeting a legal gray area that could permanently lock other New York apartments into rent regulation if their claim holds up in court.

The J-51 incentive program — which provides the city’s landlords with a tax break for making building-wide improvements — keeps those units rent-stabilized for as long as the benefits are being received.

What happens to some of the apartments after the benefits expire is now being called into question by the Stuy Town lawsuit, which could block the city-negotiated agreement and have even wider impacts on New York’s multifamily market.

What happens to some of the apartments after the benefits expire is now being called into question by the Stuy Town lawsuit, which could block the city-negotiated agreement and have even wider impacts on New York’s multifamily market.

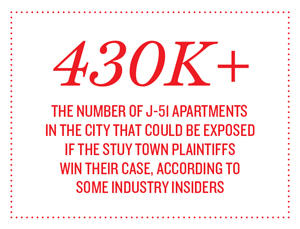

Some industry observers say hundreds of thousands of apartments covered under the J-51 program could be affected, including units owned by other major landlords.

And with a public health crisis upending everything from housing court trials to bank financing, the results of the Stuy Town court case — which now faces months of potential delays — could turn the J-51 program, which many thought was left unscathed by last year’s rent reforms, into a liability.

“The rules have changed,” said Alicia Glen, the former city housing czar who negotiated the Stuy Town agreement.

“Blackstone didn’t foresee that the changes would be so dramatic last year, and they are under pressure to deliver returns to their investors,” she added. “Now they are going to have trouble making their numbers.”

Locked and loaded

To deal with the politicians, Blackstone sent a trusted negotiator: Bill Mulrow, a prominent figure in both New York state politics and the real estate industry.

Mulrow — Gov. Andrew Cuomo’s former chief aide, campaign manager and fundraiser — now works as a senior advisory director at Blackstone. He was hired by the investment firm in 2017, soon after Cuomo lauded him for being part of the “tremendous team” that put together Vornado’s $1.6 billion deal to redevelop the Farley Post Office building.

“From Blackstone’s perspective, having the governor’s guy be your negotiator seems like a good idea,” said Glen. “He’s the guy to talk people off the ledge.”

This time, however, Mulrow’s negotiation efforts fell short, sources say, and the legislators left the meeting convinced that their dispute with the world’s largest commercial landlord could only be settled in New York Supreme Court.

Blackstone declined to comment on the negotiations between Mulrow and the politicians.

“They have economic interests that are different from our belief system and political system in New York,” said Epstein, who represents parts of Manhattan’s Lower East Side, East Village and Midtown East. “When we came out of that meeting, we were at a crossroads.”

In their case against the investment firm, the Stuy Town tenants claim the thousands of units in the complex should stay in regulation forever. And the politicians backing the lawsuit fully support blocking J-51 deregulation in other rental buildings around the city — a move that some industry insiders see as a unique, and unwanted, possibility.

The outcome now largely depends on the state Supreme Court — which is hearing arguments via Skype, Zoom and conference calls during the coronavirus pandemic, sources said.

More than 430,000 apartments across the five boroughs are covered under the J-51 program as of March 2020, according to the city’s Department of Finance. But a spokesperson for the Department of Housing Preservation and Development, which administers the tax exemption, said it’s unclear how many of those units would be exposed if the plaintiffs win.

Some say the applicability of any ruling to J-51 apartments outside of Stuy Town is uncertain because of the 2015 regulatory agreement and two pivotal settlements governing the complex.

Several legal experts told TRD that the recent case against Blackstone could affect all apartments in the city receiving the tax benefits, but assessing the risk is no easy task.

The lawsuit could “certainly impact other owners with J-51 tax abatements,” said Sherwin Belkin, an attorney at Belkin Burden Goldman. “Ultimately, I think it will come down to more generic J-51 and rent-stabilization issues that could affect many other apartments,” he noted.

But Belkin said he believes Blackstone’s deregulation plan will actually be upheld due to the deal with the city and the two prior settlements.

In the first settlement with Stuy Town’s previous owner in 2009, the court found that Tishman Speyer could not deregulate apartments while receiving J-51 benefits — which led to a slew of rent overcharge challenges. A settlement over the Roberts v. Tishman case in 2012, however, ultimately allowed for more units to be deregulated.

The parties in the 2012 settlement “specifically agreed that the affected apartments would be exempt from rent stabilization after June 2020, which I believe will be reaffirmed in this case,” Belkin said.

Nonetheless, the one-time deal between Blackstone and the city can’t overrule a change to general law, said Manhattan attorney Tim Collins, who is representing the plaintiffs in their suit.

“The regulatory agreement was made in good faith, but any claim that [it] trumps future legislation would mean that some agreement made in the past would immunize a building or group of tenants from general law going forward,” Collins argued. “And that makes no sense at all.”

Systematic deregulation

The J-51 program — which started in 1955 and has since gone through several iterations — has declined in popularity in recent years, due to requirements that apartments remain rent-regulated under the benefit.

That has led pro-business advocates like Kathryn Wylde to call for a “resurrection” of the tax break, which is scheduled to lapse in June if it’s not renewed.

“The lack of a viable J-51 meant that tenants were entirely responsible for paying for building maintenance upgrades,” Wylde told TRD. “So a lot of the pressure for rent reform in 2019 came because there was nothing else to help absorb the cost of improvements.”

“The lack of a viable J-51 meant that tenants were entirely responsible for paying for building maintenance upgrades,” Wylde told TRD. “So a lot of the pressure for rent reform in 2019 came because there was nothing else to help absorb the cost of improvements.”

But several landlords have been able to use the tax break to their advantage over the years.

The Scharfman Organization, which owns about 4,000 rental units citywide, received $6.4 million from the program across more than two dozen buildings from 2002 to 2018, tax filings show.

Mark Scharfman, the company’s founder, declined to comment on his portfolio’s exposure to potential changes to the J-51 program.

Close behind is Charles Bronstein, whose firm owns more than 100 rental buildings across the city. Bronstein Properties received $4.3 million in tax benefits from the J-51 program across 44 buildings in the same period, according to tax fillings.

A 2018 investigation by TRD and WNBC found that Bronstein and a handful of other New York City landlords were accused of overcharging tenants through the Individual Apartment Improvements program, which was wiped out by the new rent law.

Bronstein did not respond to a request for comment for this story.

At the same time, the J-51 program has also been a key tool for the city in negotiating affordability agreements, including at Co-Op City, which has received nearly $60 million in tax breaks since 2003.

“Originally, the whole point of J-51 was not to be an affordable housing tool, but a mechanism to get owners to upgrade their housing stock,” said Glen. “It evolved over time and got more and more bells and whistles, but the original point of the program was to get landlords to improve their buildings.”

Paving the way

Many rent-stabilized units in Stuy Town had previously been deregulated under more landlord-friendly rent laws prior to last June.

Between 1994 and 2019, according to a 2019 report from the Rent Guidelines Board. more than 6,000 apartments in the city — most of them in Manhattan — were converted to market rate through the former luxury decontrol provision, which allowed apartments to leave rent regulation after they passed a high-rent, high-income threshold.

Last year’s rent reforms eradicated the 1993 luxury decontrol law, which Collins called an “aberration engineered by the real estate industry.”

The rent law that passed last spring was enacted largely at the behest of a coalition of groups representing lower-income tenants on limited budgets, enabled by a series of state election upsets in 2018 that unseated more moderate Democrats in favor of progressives and also ousted some Republican state senators.

And the thought that a dramatic change in state law could potentially undo a regulatory agreement does not sit well with some industry observers.

Mayor Bill de Blasio at a press conference at Stuy Town in October 2015, announcing the deal between the city and Blackstone

“Maybe Blackstone shouldn’t have signed the regulatory agreement unless the state legislature joined and promised to never make legislation that would take away [the ability to deregulate],” said Joshua Stein, a real estate finance attorney.

The investment giant maintains it will prevail because the courts will abide by the prior settlements.

“We are confident that the court will reaffirm the 2012 Roberts settlement, which explicitly stated that these J-51 units should no longer be subject to rent regulation as of June 2020,” a spokesperson for Blackstone said.

Some argue that the tenants of the sprawling East Side complex, once a haven for the middle class, are far more well-heeled than the average rent-regulated tenant in New York City. The median household income within Stuy Town is nearly $100,000, while the median income in neighboring Peter Cooper Village is $123,563, according to the latest American Community Survey estimates from the Census Bureau.

The attorney for the plaintiffs argued that the point is irrelevant.

“The question is what is a fair rent, regardless of whether you’re rich or poor,” Collins said. “The whole process of high-income deregulation only caused [tenants] to lose apartments so that even higher-income people could make money off the apartments.”

The Stuy Town units not covered by the 2015 agreement with the city have average rents of about $4,000 a month, and the average tenant income in those units is $262,000, based on self-reported data from tenants, according to Blackstone.

But Steinberg, of the Stuy Town tenant group, claimed those income numbers are flawed.

“That does not seem accurate whatsoever to me,” she argued. “If you came and walked the complex and started talking to people, you wouldn’t find anyone’s income that comes near that.”

Many apartments, according to Steinberg, are shared by several tenants — and recently, rents in some apartments have reached much loftier levels.

“Four thousand dollars per month? Blackstone isn’t talking about the $6,000 or $9,000 or even $14,000-a-month rents,” she said.

Market headwinds

High-rent, high-income deregulation was used extensively in Stuy Town just prior to the 2008 financial crisis, as Tishman Speyer sought to repay highly leveraged loans financed by public pension and sovereign wealth funds by moving market-rate tenants in and low-income tenants out.

The strategy failed, and Tishman defaulted. But rents at the complex remained high.

With the city’s multifamily industry now facing a different kind of crisis, Stuy Town has once again become a major focal point. The tenant lawsuit would add to an “already chilled business climate around housing,” Belkin argued. But as to the number of units under the J-51 program that could be impacted by the lawsuit, he said it’s beyond his ability to guess.

“If Roberts v. Tishman was World War I, Stuy Town v. Blackstone could mark the beginning of World War II,” said Aaron Carr, executive director of Housing Rights Initiative, which has brought numerous J-51 overcharge cases against landlords over the years.

An unfavorable decision for the real estate industry would likely be challenged and brought to the Court of Appeals, which is deliberating a separate batch of J-51 cases, sources said. But due to the pandemic, all of those cases are now up in the air.

“The courts are in a state of flux now,” said Nativ Winiarsky, an attorney at Kucker Marino Winiarsky & Bittens, who noted that the Court of Appeals is not totally frozen.

“They’re still deciding cases, which makes sense — because they don’t need peoples’ appearances to render a decision,” Winiarsky added.

Alan Wiener, head of Wells Fargo’s multifamily lending arm, which provided the $2.7 billion mortgage for Blackstone’s Stuy Town purchase, told TRD in early March that the uncertainty around the 2015 regulatory agreement raises questions for Blackstone and other investors in the city’s multifamily market.

That comes in light of a flood of new progressive legislation and a statement from the de Blasio administration last month in support of the plaintiffs, Weiner noted.

The mayor’s office declined to comment further.

“One could make an absolutely reasonable argument that the new law supersedes the regulatory agreement,” one political insider said on the condition of anonymity. “It puts the mayor in a terrible position.”

The city’s initial decision to support the Stuy Town plaintiffs underscores the perils of doing a deal that can later be influenced by the politics of the day, according to several observers. The politics can change, and with it, the risk for investors.

“From our point of view, as the lender with Fannie Mae, this is an extremely secure loan,” Wiener said. “But people may want to think twice about what signing an agreement with the city means.”