With several Atlantic City hotels shuttering between 2014 and last year, it seemed as if the only hotel news coming out of New Jersey was negative. But statistics and a look at a hotel growth spurt in the northern half of the state tell a different story.

Overall, state occupancy and room rates are on the rise, according to hotel analytics company STR. Occupancy ticked up nearly a full percentage point to 63.4 percent in 2016. Over a five-year period, from the end of 2011, it’s jumped 6.4 percent.

The state has also enjoyed an increase in RevPAR, the hotel industry metric that measures revenue per available room by multiplying a hotel’s average daily room rate by its occupancy rate. From 2011 to 2016, the New Jersey RevPAR grew 22.9 percent, to $77.39.

“The national occupancy average was 64.3 percent. [New Jersey’s] is just below that, but it’s still a pretty healthy number,” said Jan Freitag, senior vice president of lodging insights at STR. “Because hoteliers saw that increase in occupancy, they felt comfortable increasing room rates.”

Average daily rates rose 15.4 percent between 2011 and 2016, to $122.01, with increases every year, per the STR data.

With demand outpacing supply, owners had the leeway to jack up rates. Demand increased 2.2 percent in 2016, but supply grew just 0.7 percent, “implying few hotels were built,” said Freitag. But that is changing.

Northern New Jersey

With a residential and commercial construction boom happening in northern New Jersey, developers have begun to build new hotels, either as part of mixed-use projects or as stand-alone properties. Hudson County leads the state with 2,517 rooms spanning 15 projects in the pipeline, according to STR. Six are already under construction. In addition, two hotels recently opened in the county: the 152-suite Residence Inn by Marriott in Jersey City in April — across from the Grove Street PATH station — and the 102-room Best Western Premier NYC Gateway Hotel in North Bergen in March.

“There’s a changing landscape and skyline, with increased business and commercial development along the waterfront,” said Peggy Kelly, director of tourism marketing for the Hudson County Office of Cultural and Heritage Affairs. “Many corporations are moving their headquarters here, which in turn will prompt new hotels and visitors to the area.”

That process is already underway. Hotel demand in the county grew 5.4 percent from the first quarter of 2016 to the first quarter of 2017, according to STR. Additional hotels will help meet the increasing demand. A second new Jersey City hotel, the 258-room Hyatt House located next to the Exchange Place Light Rail station and across from a PATH station, will debut on July 25.

In April, the Hoboken City Council approved a redevelopment plan for the Hoboken Post Office that will feature a 24-story, 238-room hotel to be built by KMS Development Partners, according to the Hudson Reporter. The proposed manager of the property is Hilton.

Other Hudson County hotels under construction include the 100-room Fairfield Inn & Suites in North Bergen, a 172-room Aloft in Secaucus, a 75-room Holiday Inn Express & Suites in Jersey City and two Marriott-connected properties in Weehawken as part of the Port Imperial waterfront mixed-use project — a 210-room Renaissance and a 164-room Residence Inn. A representative from developer Mack-Cali said the two projects are scheduled to open the first quarter of 2018.

Next door in Essex County, developers broke ground on the 150-room MC Hotel in Montclair in July 2016. When finished, it will be the first new premium hotel in the town since 1938, according to NJ.com. Though it will be a Marriott-branded hotel, the property will be managed by the Aparium Hotel Group. The hotel is slated to open in spring 2018.

To the north in Bergen County, Alfred Sanzari Enterprises will soon finish construction on a 350-room dual-branded hotel in Teaneck as part of the mixed-use Glenpointe complex. The site will have 190 Hampton Inn & Suites rooms and 160 Homewood Suites rooms, per NJbiz.com, when it opens this year.

Hotels are also going up in Middlesex County, where four projects for a total of 442 rooms are in the final planning stages, according to STR. Those hotels will meet a growing demand, which jumped 10 percent the first quarter of 2017 compared to last year, according to STR data, while available supply remained even.

Southern New Jersey

At the other end of the state, Atlantic City is seeing more redevelopment than new development in the hotel market.

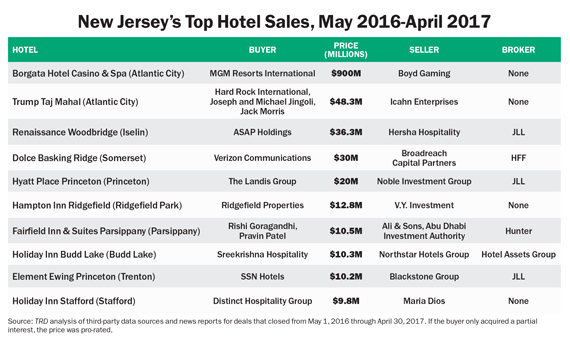

This spring, Hard Rock Hotels and Casinos announced that it would take over the Trump Taj Mahal, which closed in October 2016. Rebranded as the Hard Rock Hotel and Casino Atlantic City, the property will get a $375 million makeover, with a new 400-seat Hard Rock Cafe, full-service spa, 2,400 slot machines and 130 table games. The property is scheduled to reopen by summer 2018.

There was also talk of reopening the glitzy 1,399-room Revel — which opened in 2012 and closed in 2014 — as a facility named TEN sometime this year. Glenn Straub’s Polo North Country Club bought the property for $82 million in 2015. However, the company continues to have problems getting proper casino licensing.

In the meantime, other properties are adding meeting spaces in an effort to boost midweek business, say local experts, and that will be a goal for the Hard Rock, too. It started with Harrah’s adding its Waterfront Conference Center, with more than 125,000 square feet, in late 2015, said Jim Wood, president and CEO of MeetAC. Since then, the Claridge has added 15,000 square feet of meeting space, and Resorts Atlantic City added 12,000 square feet. The Borgata, now owned by MGM, has repurposed a nightclub into an 18,000-square-foot conference center opening this season.

Overall occupancy for Atlantic City averages about 80 percent, said Wood, but for midweek business, last year it averaged 82 percent and is on track for 88 percent this year.

“If we increase demand and drive into the marketplace, you hit a certain delta and new development sees that and wants a piece of the action,” said Wood, adding that while a significant amount of that business comes from New Jersey, more is beginning to come from the larger regional market.

“We hope to grow demand and see additional development into the city,” he said.

—Harunobu Coryne provided research for this article