The road to Westchester’s future is lined with sprawling biotechnology campuses — at least in the eyes of commercial developers and local government officials. Given the massive projects in the pipeline that will house modern labs and high-tech facilities for what are called “life sciences” companies, that seems to be an accurate assessment.

Westchester now has 31.7 million square feet of commercial office space; biotech companies occupy upwards of 6 percent of the total, with more than 2 million square feet, according to Jones Lang LaSalle. While the industry’s footprint is not as large as in some metro areas housing university-funded spaces — MIT’s East Cambridge, Massachusetts., neighborhood has 7.81 million square feet of lab stock — the county is considered a thriving biotech hub due to the rapid growth of the sector in recent years.

Biotech is best known for research that produces drugs or technology to fight diseases. Its labs require unique spaces and must be fitted with refrigerators, freezers and other equipment that researchers use to try and develop new treatments. The shortage of ready-to-use lab space has slowed the industry’s overall growth to some extent, but county officials have declared biotech expansion a major driver in Westchester’s economic engine.

“The biotech industry really, through one or two specific companies, has been exploding in Westchester,” said Chris O’Callaghan, a managing director at JLL who oversees the Westchester region. That growth is in contrast to demand for general office space in Westchester, which remains flat, partly because several major companies have scaled back their footprints. IBM, for example, just sold its 723-acre campus in Somers. The vacancy rate for Class A office space in Westchester is 20.2 percent, according to JLL.

O’Callaghan said there are several reasons the county has a reputation for being a budding biotech hub, and that a large part of the credit goes to its economic development office.

O’Callaghan said there are several reasons the county has a reputation for being a budding biotech hub, and that a large part of the credit goes to its economic development office.

Five years ago the office declared that Westchester was ready to welcome biotech companies and coined the phrase “Biohud Valley,” offering financial incentives, including waiving or reducing sales tax on items such as construction materials and equipment as well as exemptions on mortgage recording taxes. Some municipalities offer a PILOT program, or payment in lieu of taxes, to encourage companies to stay or expand.

County officials say biotech executives cite access to a talented workforce as the top reason for moving to Westchester. The myriad transportation options offering easy access to New York City, as well as a high quality of life in the county, are attractive to potential employees.

The county’s proximity to universities also helps to supply the kind of talent that the industry wants. Patricia Ardigo, a vice president with CBRE’s Westchester/Fairfield office and a founder of the firm’s Life Sciences Group, said biotech companies generally gravitate toward research hospitals and colleges so they can build partnerships, find qualified interns and hire graduates. County officials say 47 percent of Westchester’s residents 25 or older have at least a bachelor’s degree.

“Businesses are coming here because we have the highly skilled and talented workforce that businesses want to employ and need,” said William Mooney III, director of Westchester’s Office of Economic Development.

Brokers and analysts say the synergies between the county and the industry also includes the fact that major biotech companies pay relatively well, which means their workers can afford to live in upscale towns nearby. The firms are also willing to accept Westchester’s notoriously high taxes.

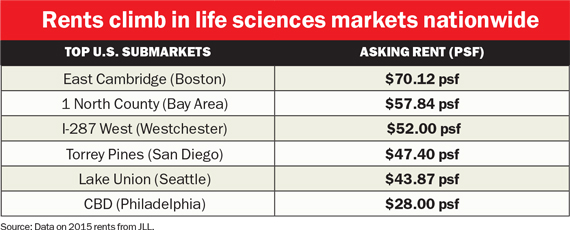

While real estate industry reports show that Westchester has a long way to go when compared to major biotech clusters such as Boston, San Francisco and San Diego, there are very promising signposts. In JLL’s third-quarter report on Westchester, the county ranked third in office-space asking rents among U.S. life sciences clusters, at $52 per square foot. East Cambridge had the highest rent, at $70.12 per square foot, and coming in second was the Bay Area, at $57.84.

The county made the list in another JLL 2016 report: Westchester ranked No. 9 in the U.S. on the broader “life sciences” cluster list that includes biotech. The ranking weighed several factors, such as the size of the biosciences workforce versus overall private employment, biotech concentration, number of companies and the amount of venture capital funding.

Regeneron is considered the “800-pound gorilla” in the Westchester biotech industry.

Ardigo says her data show there are about 100 life sciences companies currently operating in Westchester, including biotechs such as Acorda Therapeutics, which occupies 165,000 square feet with 390 workers in its Ardsley facility.

Two major projects announced in 2016 that will more than double the amount of occupied biotech space in Westchester are center stage in the excitement about the industry.

The first is a $1.2 billion bioscience and technology complex planned in Valhalla, a project local officials repeatedly identify as proof that the county is a bona fide biotech hub. The 3 million-square-foot multi-use project will be built on 80 acres of vacant land that sits near the Westchester Medical Center and New York Medical College.

Named the Westchester BioScience & Technology Center, the project will be developed by Fareri Associates, which is owned by John Fareri, an industry veteran with more than 50 years in the region’s development. The Westchester government endorsed the plan and is currently awaiting a vote by the Westchester County Board of Legislators, expected by Dec. 31. The project is then subject to zoning and environmental reviews by the Town of Mount Pleasant.

Officials and brokers say the prospect of annual tax revenues of $9 million, $7 million in rent and 8,000 new jobs means the project stands a high chance of getting approved.

Fareri owns 20 acres of land and is looking to get a 99-year lease on the remaining 60 acres, owned by the county. The project will be built in three phases and when completed will include 2,252,000 square feet of biotech/research space, medical offices, a hotel and retail space, according to county officials. Fareri has agreed to spend $40 million on infrastructure, including roads for the wooded area plus a sanitary waste system and storm water management.

Geoff Thompson, a spokesman for Fareri, says the location is ideal because it’s near multiple public transportation options and close to other biotech companies. “A lot of people have analyzed this, and every study shows that this economic area is the hot area right now and it shows no sign of diminishing,” he says.

The other biotech project is by Regeneron Pharmaceuticals, a science and technology company that develops medicines . The firm was founded in Tarrytown in 1988. Now a global company, it has been expanding its footprint every couple of years, adding jobs by the hundreds. It currently occupies 1.1 million square feet in Tarrytown; half of its 5,000 employees are based there.

“They’ve become by far the fastest-growing and the largest biotech company in New York State,” said William Cuddy Jr., executive vice president in CBRE’s Westchester/Fairfield office.

In September, Regeneron announced an expansion that would double its current space if it wins approval of its plan to develop about 30 of the 100 acres the company bought in 2015.

The company proposed nine buildings that will sit on a parcel along Saw Mill River Road, which is south of the company’s current location, known as the Landmark at Eastview. It’s in proximity to other biotech companies such as Acorda along the 9A corridor between Yonkers and Tarrytown.

“The 800-pound gorilla of the industry is Regeneron,” said Howard Greenberg, owner of Greenberg Properties and a broker in the area for 30 years.

In 2013, the company announced plans to expand the Tarrytown campus by 300,000 square feet. That space was completed and occupied last year. The plan unveiled in September would be the largest expansion to date. And industry insiders said the fact that Regeneron owns more land than it currently has plans to develop is a sign it intends to spread its wings further.

Greenberg praised the firm’s strategy of acquiring more land than it had immediate use for, given that development plans need to pass muster at the county and often also at the town or city level. “Getting approval in Westchester is extremely hard, expensive and long, so this is a very intelligent play by Regeneron,” he said.

Despite the high level of enthusiasm for office space in the biotech space, the industry does grow slowly, mainly because it’s an expensive and long process. The cost of building new labs or retrofitting offices to meet the needs of biotech companies means just a handful are willing to foot the costs to do it, real estate brokers say.

“The biggest problem is availability of product,” said Greenberg. “It’s stifling growth in Westchester because we just don’t have the product.”

However, there’s no lack of enthusiasm about the future of the biotech valley among county officials or real estate professionals who point to what’s happening today.

“The proof is in the pudding,” said Mooney. “The market is responding to our strengths.”