There are several reasons why taking Brookfield Property Partners private might be a bad deal. The company’s investors lose a lucrative dividend, hundreds of millions of dollars worth of fees to its parent Brookfield Asset Management go by the wayside and the Brookfield empire gives up an established line to the public markets.

But privatization gives Brookfield something more valuable than money: time.

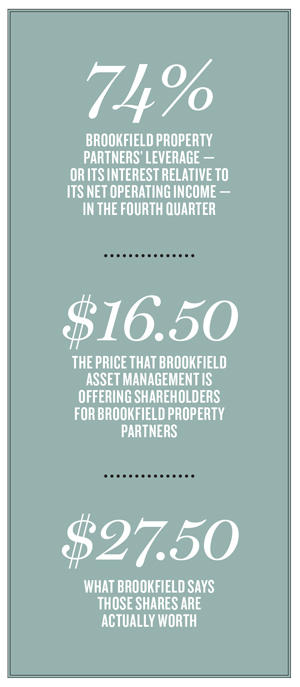

It allows the company, one of the world’s largest commercial real estate investors, a chance to reconfigure its extensive mall portfolio, which has been walloped by the pandemic. It also lets Brookfield Asset Management buy its real estate subsidiary’s outstanding shares at $16.50 per share, a steep discount from the $27.50 the company claims they are worth.

But it’ll be far from a seamless process. If the $5.9 billion deal is approved, Brookfield Property Partners’ problems become Brookfield Asset Management’s problems. Both companies declined to comment for this story.

The parent company will inherit a firm that accumulated $2 billion in losses in 2020 and one that is heavily leveraged, with operating income just about covering its interest expenses. Not to mention a firm whose asset valuations and accounting practices have attracted the scrutiny of short sellers who say the company is hiding its true distress. Privatization will mean that Brookfield will no longer have to answer to those pesky outsiders.

“Life is not going to get any easier on the property markets in the next three to five years,” said John Heldman, a partner at Triad Investment Management, which has a significant stake in Brookfield Property Partners. “It’s better to do the rehabbing in private rather than in public.”

Playing defense

Bruce Flatt, who took the helm at Brookfield Asset Management in 2002, has long argued that the company is not just another real estate investor.

Brookfield does not just own office buildings; it owns the best office buildings, from glistening skyscrapers on Manhattan’s Far West Side to big chunks of London’s Canary Wharf and Downtown Los Angeles. The company talks up its mall portfolio similarly, pointing to trophy properties like the Ala Moana Center in Honolulu, Hawaii, and the Shops at Merrick Park outside of Miami.

The market never quite bought this. Since it went public in 2013, Brookfield Property Partners’ stock (BPY) has consistently traded below the firm’s book value, or the value that the company assigns to its assets. Some of Brookfield’s rivals are in a similar predicament, according to data from Green Street Advisors shared with the Wall Street Journal, which shows that shares for public mall and office landlords were trading this January at average discounts of 20 percent and 32 percent, respectively, to their net asset values.

The market never quite bought this. Since it went public in 2013, Brookfield Property Partners’ stock (BPY) has consistently traded below the firm’s book value, or the value that the company assigns to its assets. Some of Brookfield’s rivals are in a similar predicament, according to data from Green Street Advisors shared with the Wall Street Journal, which shows that shares for public mall and office landlords were trading this January at average discounts of 20 percent and 32 percent, respectively, to their net asset values.

“We’ve been at this for seven years,” Brian Kingston, the CEO of Brookfield Property Partners, told the real estate investment publication PERE last month. “We’ve done everything we feel we can, and it seems unlikely that we will be trading at NAV [net asset value] anytime soon.”

Brookfield’s financial statements offer some more insight to this statement.

The company is facing a number of financial challenges, but perhaps none more pressing than its debt. Its leverage — measured as a percentage of its interest expenses to net operating income — stood at 74 percent in the fourth quarter of 2020, filings show. Its closest mall competitor, Simon Property Group, had leverage of 27 percent in the same period.

With the pandemic gutting retail cash flow, Brookfield Property Partners’s business is just about able to meet its debt payments. But while some companies may be able to operate with such a thin cushion, Brookfield’s setup makes that very difficult. The company pays a high dividend to shareholders. In the first nine months of 2020, Brookfield Property Partners paid $932 million in dividends to unitholders, according to its third quarter earnings report.

The burden of this dividend stymies growth, according to some analysts and investors.

“The structure [of Brookfield] leads to a lack of free cash flow that limits the opportunities to grow,” said James Sullivan, a REIT analyst at BTIG.

Privatization gives the company another benefit: Brookfield Property Partners would have fewer questions to answer about its accounting. Both Brookfield Asset Management and Brookfield Property Partners report under IFRS, which allows companies to use internal assessments for property values. (Al Rosen, a Toronto-based forensic accountant, said in October that using IFRS was akin to letting an 8-year-old prepare their own report card.)

Taking Brookfield private could give the real estate arm more discretion to mark down the value of its assets — or, in Brookfield’s case, not mark them down enough.

“A mistake they made was not writing down the value of their assets in 2020, when it was clear [they] had declined,” said Mark Rothschild, an analyst with Canaccord Genuity. “Many investors are looking at the book value and saying, ‘why would you offer us $16.50 when the book value was so much higher?’”

And then there’s Brookfield Property Partners’ unique relationship with its parent company. In exchange for “management services,” it pays at least $50 million a year to Brookfield Asset Management, which has purchased millions of its shares and now holds about two-thirds of its stock.

Rothschild said that the fee income was something that Brookfield Asset Management undoubtedly did not want to lose.

“This is a transaction that [BAM] had to do,” said Rothschild. “And if they don’t do it, BPY is going to have problems.”

Future proof

Brookfield Asset Management owns telecommunications lines, solar farms, railroads and large nuclear reactor servicers, with assets north of $600 billion. But real estate remains its calling card.

By taking its real estate arm private, Brookfield Asset Management will likely continue its industrial and multifamily push near urban centers, according to analysts. The fate of its office holdings, which as of October spanned at least 27 million square feet in New York City and millions of square feet in prime markets across the U.S., are a bigger point of debate.

Still, even as major finance and technology tenants have announced that they will at least partially adopt remote work long-term, the capital markets seem bullish on a large-scale return to the office. In September, the company was able to score a $1.5 billion CMBS loan on its 67-story One Manhattan West tower close to the Hudson Yards megadevelopment. In November, it scored a $1.3 billion CMBS refinance of its 49-story Grace Building in Midtown Manhattan.

Still, even as major finance and technology tenants have announced that they will at least partially adopt remote work long-term, the capital markets seem bullish on a large-scale return to the office. In September, the company was able to score a $1.5 billion CMBS loan on its 67-story One Manhattan West tower close to the Hudson Yards megadevelopment. In November, it scored a $1.3 billion CMBS refinance of its 49-story Grace Building in Midtown Manhattan.

Talking his own book, Flatt has repeatedly stated that employees will eventually return to the office.

“In business and life there are always problems, and having a personal connection with others helps you work through those situations,” he told the Financial Times in January. “That’s why office spaces are important.”

The company’s retail portfolio, historically a major cash generator, is now its biggest headache. In 2018, Brookfield bought out the remaining share of Chicago-based GGP’s 125 malls for $9.25 billion in cash, making it one of the largest mall owners in the U.S.

Brookfield said it would “future-proof” most of those malls, turning moribund properties into mixed-use “mini-cities.” That strategy hasn’t always panned out.

The firm recently handed over the keys to a 1.3 million-square-foot mall in Georgia to its lender. An analysis by The Real Deal revealed that at least 10 Brookfield malls may be at risk of a similar fate. (In the earnings call, the company said that it was in negotiations with servicers on about 20 malls)

Getting absorbed by Brookfield Asset Management would buy the real estate arm more time to reposition its portfolio for the next generation of retail shopping.

“BAM is pretty well diversified,” said Triad Investment’s Heldman.”If they take a hit on the property side over the next five to seven years, it can be hidden within the overall BAM structure. It’s not going to be a large percentage of BAM’s cash flow.”

Brookfield Asset Management will likely raise money for Brookfield Property Partners through new funds targeting private investors. Kingston told PERE that the company has investors interested in the real estate subsidiary’s assets at its net asset value, well above its publicly traded price of about $17 per share. It’s unclear why said investors would want to pay such a steep premium.

Taking the subsidiary private could also allow Brookfield Asset Management to be more aggressive in a market with falling property values.

“Being a very value-oriented buyer with a particular nose for finding distress … I think they smell blood in the water,” said Brian Madden of Goodreid Investment Counsel, which has a stake in both the parent company and its real estate arm. “They see the prize at the end of bringing this back to book value.”

Of course, Brookfield Asset Management could always restructure its subsidiary’s debt and then go back to the public markets. The computer giant Dell went private in 2013, only to list its shares once again in 2018.

Besides the cash buyout, existing Brookfield Property Partners shareholders also have the option of receiving a portion of Brookfield Asset Management shares or Brookfield Property Partners’ preferred units.

At the least, investors have taken note of the sharp disconnect between Brookfield’s book value and its $16.50 per share offer to existing shareholders. A Feb. 10 report by Unite Here, a union of hospitality workers in the U.S. and Canada, claims that Brookfield Asset Management’s offer undervalues the real estate subsidiary, and states that “BPY should demand a higher buyout price from BAM, in the range of $19.50-$21.00 per unit.”

“We are not happy about it,” said Triad’s Heldman about the privatization plans. “But I wouldn’t say we are jumping up and down feeling bad about it.”