INVESTMENT SALES IN MANHATTAN AND BROOKLYN

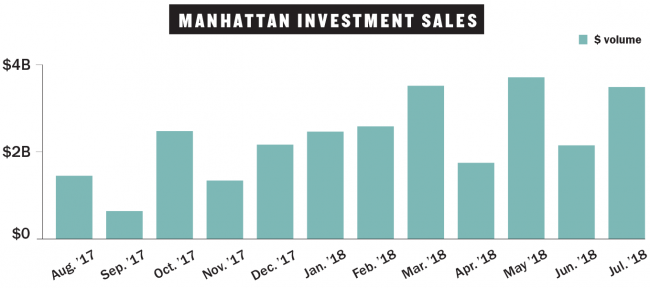

Manhattan investment sales rose in July, fueled by two deals involving the Walt Disney Company. In the first, the firm sold its office space on West 66th Street to Silverstein Properties for $1.15 billion. In the second, which happened almost simultaneously, the company paid $650 million to Trinity Church Real Estate for a parcel in Hudson Square.

Source: TRData analysis of news reports and NYC Dept. of Finance records in July

Top Manhattan Investment Sales Recorded

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 77 West 66th Street,n47 West 66th Streetnand others (office) | $1.15 billion | Silverstein Properties /nWalt Disney Company | EastdilnSecured |

| 4 Hudson Squaren(development site) | $650 million | Walt Disney Company /nTrinity Church Real Estate | CBRE |

| Plaza Hotel at 1 CentralnPark South (hotel) | $600 million | Qataru2019s Katara Hospitality /nSahara Group, Ashkenazy Acquisition,nSaudi Prince al-Waleed bin Talal | N/A |

| 635 Madison Avenuen(office) | $153 million | L&L Holdings / SL Green Realty | Cushman &nWakefield |

Source: TRData analysis of news reports and NYC Dept. of Finance records in July

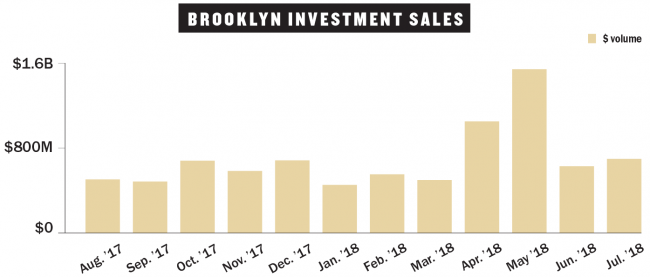

Buyers recorded $3.4 billion in sales in July, up 51 percent compared with the 12-month average. In Brooklyn, the most expensive deal was All Year Management’s purchase of several buildings, including 450 Union Street, for $61 million. Overall, buyers in the borough recorded $692 million in transactions, which was the same as the 12-month average.

Source: TRData analysis of news reports and NYC Dept. of Finance records in July

Top Brooklyn Investment Sales Recorded

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 450 Union Streetnand othersn(commercial) | $61 million | All Year Management /nestate of the investornDaniel Tinneny | N/A |

| The Edgen22 North 6th Streetn(retail) | $47.3 million | Gazit-Globe /nMadison Marquette | HFF |

| 542 Atlantic Avenuen(commercial) | $27.5 million | Sterling Town Equities /nJames Pappas and others | N/A |

| 90-94 4th Avenuen(development site) | $22.9 million | Level One Holdings /n94 4TH LLC | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in July

INVESTMENT SALES IN QUEENS AND THE BRONX

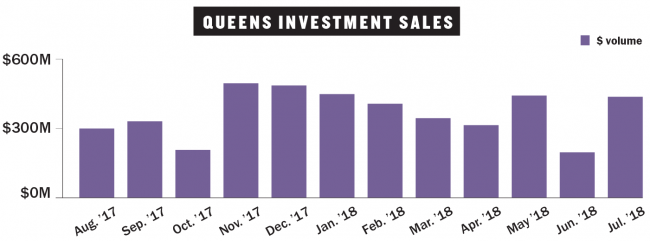

In Queens, investment sales rose in July compared with June, topping $422 million. That figure was about 19 percent higher than the 12-month average. It was also more than double the prior month. The borough’s top sale in July was A&E Real Estate Holdings’ $127.5 million purchase of a portfolio of buildings, which included 41-40 Denman Street.

Source: TRData analysis of news reports and NYC Dept. of Finance records in July

Top Queens Investment Sales Recorded

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 41-40 Denman Streetnand othersn(residential) | $127.5 million | A&E Real Estate Holdings /nTreetop Development | RosewoodnRealty Group |

| 144-10 135th Streetn(hotel) | $39.7 million | ASAP Holdings/nMagna Hospitality Group | N/A |

| 82-46 and 83-15nLefferts Boulevardn(apartment) | $36 million | Cammebyu2019s International Group /nLefferts Houses Enterprises,nKew Gardens Enterprises | N/A |

| 37-02 10th Streetn(development site) | $11.5 million | Dun Zhang /n10th Street Realty LLC | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in July

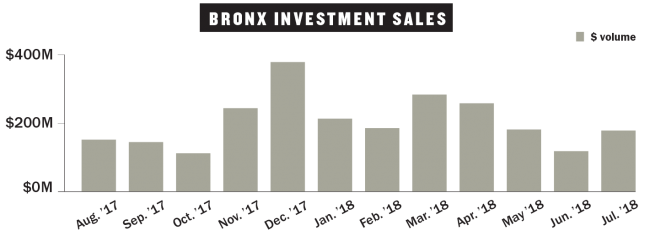

The seller was Treetop Development. Meanwhile, in the Bronx, buyers recorded $176 million in transactions in total. That was about 13 percent below the 12-month average. The top sale was the purchase of a parcel at 1932 Bryant Avenue for $19.3 million by the Association of New York Catholic Homes.

Source: TRData analysis of news reports and NYC Dept. of Finance records in July

Top Bronx Investment Sales Recorded

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 1932 Bryant Avenuen(development site) | $19.3 million | Association of New York CatholicnHomes / Second Farms Neighbor-nhood Housing Development Fund | N/A |

| 2718 and 2719 MorrisnAvenue (apartment) | $16.7 million | Prana Investments /nBilynn Realty III, LLC | N/A |

| 1459 Wythe Placen(apartment) | $14 million | 1459 Wythe A LLC /nRidge Holding Corp. | N/A |

| 1888 WestchesternAvenuen(commercial) | $12.3 million | Westchester 1888 Owner /n188 West LLC | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in July